It is a very common mistake at the time of submitting the TDS return that the PAN of the applicant entered wrongly, now this will make your TDS return defective and the applicant has to revise the same. TDS department will send the notice if they found PAN was wrong in the submitted return or the late fees was not paid. So when they send the notice following points shall be taken at the time of filing of revised return;

1. First open the Notice as received from the department and if the reasons were not properly disclose than generate justification report from traces. To generate the justification report log in to the traces and you will get the option of Request For Justification Report Download in the defaults Tab. After entering the details as open the request for justification report will be done. Now to see the status of file click on REQUESTED DOWNLOAD in the Download Tab and there you will see the status of justification Report.

2. Now to open the Justification report password is 'JR_

e.g., JR_AAAAA1235A_24Q_Q3_2010-11. This file is in text format. Convert this text file to an excel file to make it readable. This conversion is done using TRACES Justification Report Generation Utility. The user can download this utility from TRACES login.

Firstly, Go to Requested Downloads under Downloads

Here click on Click here to download the utility

Click on TRACES Justification Report Generation Utility v2.2.

3.After finding the detailed reasons in the justification report than go to request for console file option in the statement tab. Console file is the last return file submitted by you, after generating the same download the same from the download section. Now the Password for Conso File is 'TAN_' (e.g. ABCD12345E_67890). Request Number should be of the request submitted for Conso File.

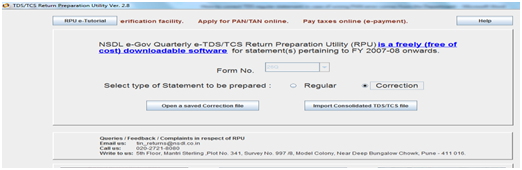

4. Now after download the console file. Download the latest RPU utility from TIN NSDL and download the utility and open the console file in that utility in the correction section and import the consol file as downloaded from the traces and make the correction in the file when it opens.

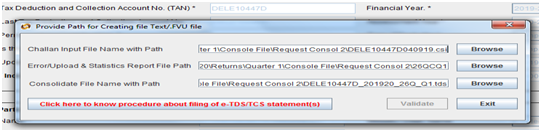

5. After updating the PAN details in the RPU utility click on save button and after saving the details click on create file and the following window will come.

Now in the first column enter the .csi file, You can generate the .csi file from oltas online by clicking on the said link https://tin.tin.nsdl.com/oltas/ and save the same.

In the second tab enter the path where you want to save the file; and

In the third tab browse the console file in the name of .TDS which you have saved from RPU utility

After browsing all these 3 files validate the same and FVU file and form 27A will generate.

Now both the file (i.e. FVU and form 27A) can be submitted to authorized TDS vendor and they will file your return accordingly on your behalf.

The author can also be reached at sdeepak.cs@gmail.com.

Disclaimer:

This article is for the purpose of information and shall not be treated as solicitation in any manner and for any other purpose whatsoever. It shall not be used as legal opinion and not to be used for rendering any professional advice

Click here to enroll Certification Course on TDS by CA Arinjay Kumar Jain

CAclubindia

CAclubindia