Applicable Section:- Section 140(2) of Companies Act, 2013

Applicable Rule: - Rule 8 of Companies (Audit and Auditors) Rules, 2014

Forms required to be filed with ROC:-

- ADT-3:-by Auditor within 30days from the date of resignation.

- MGT-14:- within 30days from the date of EGM in which resignation of auditor was accepted, by the Company

- ADT-1:- within 15 days from the appointment of new auditor by the company.

Legal Provisions:- ( Read Section 140 (2) along with Section 139(8)(i))

Section 140 (2) of Companies Act, 2013:- The auditor who has resigned from the company shall file within a period of thirty days from the date of resignation, a statement in prescribed form with the company and the Registrar, and in case of Companies referred to in sub-section (5) of Section 139, the auditor shall file such statement with the Comptroller and Auditor-General of India, indicating the reasons and other facts as may be relevant with regard to his resignation.

Section 140 (3) if the auditor does not comply with subsection (2), he or it shall be punishable with file which shall not be less than fifty thousand rupees but which may extend to five lakh rupees.

Section 139(8) The Casual Vacancy in the office of an Auditor shall-

I. In case of a Company other than a company whose accounts are subject to audit by an auditor appointed by the Comptroller and Auditor-General of India, be filled by the Board of Directors within 30 days, but if such casual vacancy is as a result of the resignation of an auditor, such appointment shall also be approved by the Company at a General meeting convened within 3 months of the recommendation of the Board and he shall hold the office till the conclusion of the next Annual General Meeting.

II. In case of a Company whose accounts are subject to audit by an auditor appointed by the Comptroller and Auditor-General of India, be filled by the Comptroller and Auditor-General of India within 30 days.

(If Comptroller and Auditor-General of India dose not fill the vacancy within the said period, the Board of Directors shall fill the vacancy within next thirty days)

Rule 8 of Companies (Audit and Auditors) Rules, 2014:- Rule 8:

Resignation of auditor —for the purposes of sub-section (2) of section 140, when an auditor has resigned from the company, he shall file a statement in Form ADT-3.

Crux:-Auditor resigning from the Company shall file within a period of 30days from the date of resignation, a statement in Form ADT-3 with the Registrar of Companies.

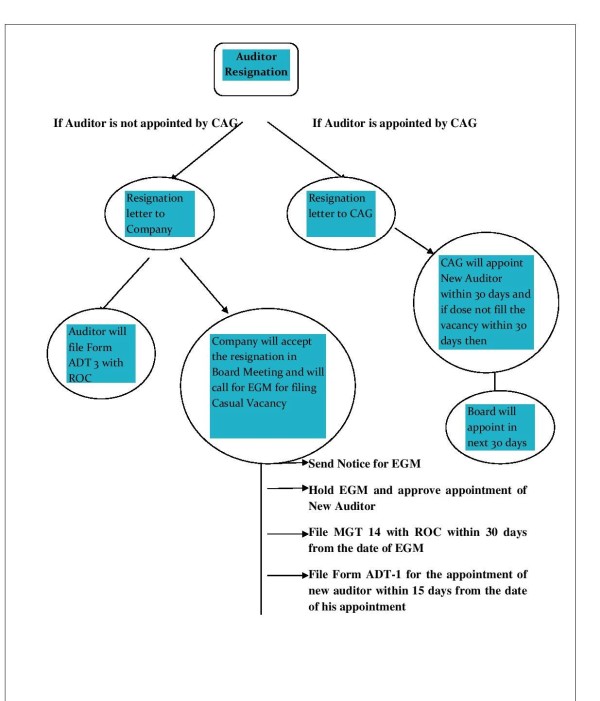

Sequence of event for Resignation of Auditor of the Company:-

- The Auditor shall sent to the Company his/her Resignation Letter along with form ADT-3 (as file by him/her with the Registrar of the Companies)

- The Company will thereafter call a Board Meeting to accept the resignation of the Auditor.

- The Company shall than fill the casual vacancy as arise by the resignation of the auditor and will approve the Notice of the Extra-Ordinary Meeting of the Company, either in above mentioned meeting itself or it will call another Board Meeting

- Hold EGM and approve Appointment of New Auditor.

- File Form MGT-14 with the ROC within 30 days from the Date of EGM

- File Form ADT-1 for the appointment of new auditor within 15 days from the date of his appointment.

The fee for filing ADT-3 depends on the nominal share capital of the Company: -

The Companies (Registration offices and Fees) Rules, 2014

Nominal Share Capital Fee applicable:- For Companies having Share Capital

|

Less than 1,00,000 |

Rupees 200 |

|

1,00,000 to 4,99,999 |

Rupees 300 |

|

5,00,000 to 24,99,999 |

Rupees 400 |

|

25,00,000 to 99,99,999 |

Rupees 500 |

|

1,00,00,000 or more |

Rupees 600 |

Fee (in case of Company not having share capital) - Rupees 200

Fee (in case of Foreign Company) - Rupees 6000

Additional Fees

|

Period of delays |

All Forms |

|

Up to 30 days |

2 times of normal fees |

|

More than 30 days and up to 60 days |

4 times of normal fees |

|

More than 60 days and up to 90 days |

6 times of normal fees |

|

More than 90 days and up to 180 days |

10 times of normal fees |

|

More than 180 days |

12 times of normal fees |

Offence and Penalty

If Auditor fails to comply with Section 140(2) then he shall be punishable with fine:

|

Minimum Fine Rs.50,000 |

Maximum Fine Rs.5,00,000 |

On the Letterhead of the Auditor

To,

Date:-

The Board of Directors,

(Name of the Company)

(Address of the company)

Sub:- Resignation from the post of Statutory Auditor of the Company

Dear Sir,

This is to inform you that my pre-occupation in other assignments, I am not in the position to devote my time to the affairs of the Company. Accordingly, I am submitting my resignation as the Statutory Auditor of the Company with immediate effect.

I therefore, request you consider this letter as my formal resignation from the Statutory Auditor of the Company.

Thanking You

Yours Faithfully

For___________

Chartered Accountant

(Membership No.)

Signature

Date:

Place:

CERTIFIED TRUE COPY OF THE RESOLUTION PASSED IN THE MEETING OF THE BOARD OF DIRECTORS OF XYZ PRIVATE LIMITED COMPANY ON ___DAY OF ___(month), 2016 AT THE REGISTERED OFFICE OF THE COMPANY AT___________ (address of registered office of the company) AT 11.00 A.M.

The Chairman informed the Board that M/s _____________(Name of the auditors firm) vide his letter dated __________(date of letter) has resigned from the Statutory Auditors of the Company. Thereafter, he placed the resignation letter of M/s _____________(statutory auditors firm) before the Board for its consideration. The Board discussed the matter and passed the following resolution unanimously:

“RESOLVED THAT the resignation of M/s ____________(name of Auditors firm) from the Statutory Auditors of the Company be and is hereby accepted with immediate effect.”

RESOLVED FURTHER THAT the Board places on record its appreciation for the assistance and guidance provided M/s ________(auditors) during his tenure as Statutory Auditor of the Company”.

FURTHER RESOLVED THAT pursuant to the provisions of sub section (8) of Section 139 of Companies Act, 2013 and all the applicable rules made thereunder (and subject to any enactment, re-enactment or amendment thereof) and subject to the approval of Members in General Meeting of the Company, M/s. ___________ having Membership No./ FRN________, Chartered Accountants, be and is hereby appointed as the Statutory Auditor in casual vacancy, of the Company, to hold office as such from this date until the conclusion of ensuing Annual General Meeting of shareholders of the Company at remuneration to be mutually agreed upon decided by the Board of Directors and such Auditor.

RESOLVED FURTHER THAT the Extra-Ordinary General Meeting of the Company scheduled to be convened on Monday, ______ day of _________(Month), 2016 at _______(Time) at the registered office of the Company situated at __________Address of the Registered Office of the Company.

FURTHER RESOLVED THAT any of the Board of Directors, be and is, hereby empowered and authorized to take such steps, in relation to the above and to do all such acts, deeds, matters and things as may be necessary, proper, expedient or incidental for giving effect to this resolution and to file necessary E Forms with Registrar of Companies.”

FOR XYZ PRIVATE LIMITED

Mr. ABC

(Director)

DIN:-

Address:-

CERTIFIED TRUE COPY OF THE RESOLUTION PASSED IN EXTRA ORDINARY MEETING OF THE MEMBERS OF XYZ PRIVATE LIMITED ON ____________DAY OF (month), 2016 AT THE REGISTERED OFFICE OF THE COMPANY AT ________ ___________________(address of registered office) AT 11.00 A.M

The Chairman informed that Mr. __________. of M/s. OLD AUDITOR FIRM, Chartered Accountants, ……City has resigned from the post of Statutory Auditor of the Company on 01/08/2015. Hence, as per Section 139(8), the company intends to appoint the Auditor of the company. Chairman apprised the members that the Board has proposed the name of Mr…..of M/s. NEW AUDITOR FIRM, Chartered Accountants, _________City for appointment as Statutory Auditor of the Company. The members considered the same and passed the following resolution as special resolution:

“RESOLVED THAT pursuant to the provisions of Section 139 (8) of the Companies Act, 2013 and other applicable provisions of the Act, if any, including any statutory modifications, amendments or re-enactments thereof, consent of the Company be and is hereby accorded to appoint M/s. NEW AUDITOR FIRM, Chartered Accountants, ……City as an auditor of the company who shall hold the office as statutory auditor till the conclusion of ensuing General Meeting on such remuneration as may be decided by the Board.

FURTHER RESOLVED THAT any of the Board of Directors, be and is, hereby empowered and authorized to take such steps, in relation to the above and to do all such acts, deeds, matters and things as may be necessary, proper, expedient or incidental for giving effect to this resolution and to file necessary E Forms with Registrar of Companies.”

CERTIFIED TRUE COPY OF RESOLUTION

FOR XYZ PRIVATE LIMITED

Mr. ABC

(Director)

DIN:-

Address:-

Date:

Place:

Read the amendment made by SEBI on the Resignation of Statutory Auditors here

CAclubindia

CAclubindia