Residential Status is to be determined for the taxability of income of a person. This term is coined under the Income Tax Act and has nothing to do with the nationality or citizenship of a person. The residential status of the assessee is to be determined each year with reference to the ‘previous year'. A person may be a resident in one previous year and non- resident in other. Residential status of assessment year is not important.

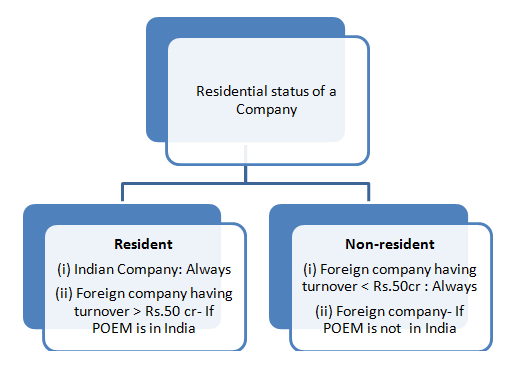

The residential status of a company is to be determined on the basis of its registration. Section 6(3) provides the following conditions in this connection.

Resident [Section 6(3)]

A company shall be said to be resident in India, in any previous year, if

(a) it is an Indian company; OR

(b) its place of effective management, at any time in that year, is in India.

Now let us understand the meaning of 'Place of Effective Management'. For this purpose, the expression "place of effective management” shall mean a place where key management and commercial decisions that are necessary for the conduct of the business of an entity as a whole are, in substance made.

'Place of effective management' (POEM) is internationally used as a condition for determination of residence of a company incorporated in a foreign jurisdiction. Almost all the tax treaties entered into by India recognises the concept of 'place of effective management for determination of residence of a company as a tie-breaker rule for avoidance of double taxation. Determination of the POEM will depend upon the facts and circumstances of a particular case. Moreover, an entity may have more than one places of management, but it can have only one place of effective management at any point of time. Since "residential status" is to be determined for each year, POEM will also be required to be determined on year to year basis. The process of determination of POEM would be primarily based on the fact as to whether or not the company is engaged in active business outside India.

Guiding Principles for determination of Place of Effective Management (POEM) of Company issued by CBDT [Circular No. 6/2017 dated 24-01-2017]

To provide a comprehensive and clear understanding of the concept of POEM for a company, the CBDT has released a set of guiding principles in the form of a circular dated 24-01-2017 [Circular No. 06 of 2017]

POEM guidelines not-applicable to certain foreign companies

The Place of effective management' guidelines issued by CBDT via Circular No. 6/2017, dated 24-01-2017 are not applicable to a foreign company having turnover or gross receipts of Rs. 50 crores or less in a financial year.

Not Ordinarily Resident

A company cannot have this status. It can either be resident or non-resident.

Non-resident [Section 2(30)]

A company shall be considered as a 'non-resident' if it is not resident in India during the relevant accounting year. It implies that, a non-Indian company whose place of effective management is not in India at any time during the financial year, shall be a non-resident of India for that previous year. Similarly, non Indian company having turnover or gross receipts of 50 crores or less in a financial year shall also be a non-resident of India because of non-applicability of POEM guidelines (issued by CBDT) to such companies.

CAclubindia

CAclubindia