Refund refers to an amount that is due or refundable to the payer from the tax administration or department. Like any other taxation law, under GST regime also, there can be no. of cases wherein amount is due or refundable from the department like

Case 1) Refund of tax paid on Zero rated Supplies of goods or services or both

Case 2) Refund of tax paid on input or input services used in making such Zero rated Supplies.

Case 3) Refund of tax on the Supplies of goods regarded as deemed exports

Case 4) Refund of Unutilized Input Tax Credit as provided under sub section 3 of section 54. Refund of Unutilized Input tax Credit permissible in following two situations

|

A) Zero rated Supplies without payment of tax |

B) Rate of tax on Inputs is higher i.e. Inverted duty structure |

|

Except: • Supplier avail duty drawback of CGST • Goods exported subject to export duty • Supplier avail refund of IGST paid on such supplies |

Except: • Notified goods or Services (Refer Annexure) • No Refund in Input Services & Capital Goods • Output Supplies exclude nil rated or fully exempt supplies of goods or services |

|

Include: • Supplies made to merchant exporter under concessional rate of 0.1% under notification 40/2017-Central Tax(Rate) dated 23.10.2017 or 41/2017-Integrated Tax(Rate) dated 23.10.2017 or both |

In this article we will discuss the Case 4B in detailed manner;

No Refund of accumulated ITC of Input Services and Capital Goods arising on account of inverted duty structure

As per Circular No. 79/53/2018-GST dated 31.12.2018 under Section 54(3) clearly mentioned that Credit accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies (Other than nil rated or fully exempt supplies)

Further as per Section 2(59) of CGST Act Inputs as any goods other than Capital goods used or intended to be used by a supplier in the course or furtherance of business. Thus Inputs do not Include Services or Capital goods.

Further as per notification no. 26/2018-Central tax dated 13.06.2018 Net ITC, as used in the formula for calculating maximum amount of refund shall mean input tax credit availed on inputs.

In View of above Refund of Input Services and Capital Goods not available on account of inverted duty structure

Calculation of eligible amount of refund on inerted duty structure

As Per rule 89(5) of CGST Rule Calculation of amount of claim eligible for refund is provided as per following formula

Maximum refund amount = {[Turnover of Inverted rated Supply of goods & services * Net ITC]/Adjusted Total Turnover}- tax payable on such inverted rated supply of goods & services

Net ITC: Input tax credit availed in inputs during the relent period other than the input tax credit availed for which refund is claimed under sub rule 4(A) or 4(B) or both (i.e. related to export & deemed export)

As per Circular No. 79/53/2018-GST dated 31.12.2018 where there are multiple inputs attracting different rates of tax; in the formula provided in rule 89(5) of CGST rule, the term Net ITC covers the ITC availed on all inputs in the relevant period irrespective of their rate of tax.

Adjusted Total Turnover: The Sum Total of Amount

|

The turnover in a state or a union territory as defined under clause (112) of section 2 of CGST Act, excluding turnover of services |

*********** |

|

Add: The turnover of Zero rated supply of services determined in terms of clause D above and non-zero rated supply of services |

************ |

|

Excluding - |

|

|

The Value of Exempt Supplies other than Zero rated Supplies; and |

************ |

|

The turnover of Supplies in respect of which refund is claimed under sub rule 4A or sub rule 4B or both, if any |

************ |

during the relevant period

Relevant period: Period for which the claim has been filed

Example:

Particulars Amount (INR) Tax Amount (INR)

|

Raw Material (Inward Supplies) @12 % |

100.00 |

12.00 |

|

Outward Supplies@ 5% |

150.00 |

7.50 |

|

CA Services @18% (Other Inward Supplies) |

10.00 |

1.80 |

Maximum Refund Amount = {[150*12]/150}-7.5 = 4.5 No Refund of Input Service available.

Time Period for filing of Refund

Any Person Claiming Refund of any tax and interest, if any paid on such tax may make an application before the expiry of 2 years from the relevant date in the form and manner prescribed

Relevant Date:

Relevant date in case of Unutilized Input Tax Credit under sub-sec (3) 'clause (ii) of first proviso to sub-sec (3)” vide clause 23(b)(ii) of CGST Amendment Act, 2018 w.e.f. 01.02.2019 is The end of financial year due date of furnishing of return under section 39 for the period vide clause 23(b)(ii) of CGST Amendment Act, 2018, w.e.f. 01.02.2019.

Form and Manner of filing Refund Claim:

As per Circular no. 17/17/2017-GST dated 15.11.2017 further clarified vide circular no. 24/24/2017-GST dated 21.12.2017 registered person need to file the refund claim with the jurisdictional tax authority to which the taxpayer has been assigned as per the administrative order issued by Chief Commissioner of Central tax and Commissioner of State Tax.

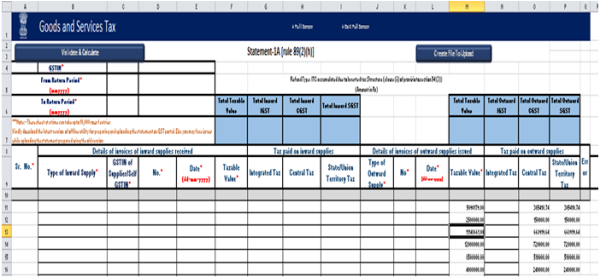

Furthermore, in case of refund claim arising due to inverted duty structure, the prescribed statements- Statement 1 and Statement 1A of Form RFD-01A have to be filled

Statement 1 [rule 89(5)]

|

Turnover of Inverted rated supply of goods & Services |

Tax Payable on such Inverted rated supply of goods & Services |

Adjusted Total Turnover |

Net Input Tax Credit |

Maximum Refund amount to be claimed [(1*4/3)-2] |

Statement-1A [Rule 89(2)(h)]

Some Practical Aspects in respect of Statement-1A:

1) Data Related to Input should be filled in Statement 1A not Input Service or Capital goods in respect of Inward Supplies.

2) Inward Supply Data must be available in GSTR-2A as System reconcile the data with GSTR-2A before filling application

3) Date Should be stored in Text format as per recent utility

4) Amount and Date Should be exactly matched with GSTR-2A.

Annexure:

Notified Goods or Services where refund of unutilized input tax credit on account of inverted duty structure is not permissible

A) Notified Goods:

As Per notification no. 05/2017- central tax (rate) dated 28.06.2017 following goods has been notified in respect of which no refund of unutilized input tax credit shall be allowed:

|

S.No. |

Tariff item, heading, sub- heading or Chapter |

Description of Goods |

Amendment |

|

1. |

5007 |

Woven fabric of Silk or of Silk Waste |

Upto 31.07.2018 |

|

2. |

5111 to 5113 |

Woven fabric of wool or of animal hair |

Upto 31.07.2018 |

|

3. |

5208 to 5212 |

Woven fabric of Cotton |

Upto 31.07.2018 |

|

4. |

5309 to 5311 |

Woven fabric of Other Vegetable Textile fibres, Paper yarn |

Upto 31.07.2018 |

|

5. |

5407, 5408 |

Woven fabric of manmade staple fibres |

Upto 31.07.2018 |

|

6. |

5512 to 5516 |

Corduroy fabrics |

Upto 31.07.2018 |

|

6A. |

5801 |

Knotted netting of twine, cordage or rope; made up fishing nets and other made up nets, of textile materials |

Upto 31.07.2018 |

|

6B. |

5608 |

Corduroy fabrics |

Upto 31.07.2018 |

|

6C. |

5806 |

Narrow woven fabrics, other than goods of heading 5807, narrow fabric consisting of warp without weft assembled by means of an adhesive (bolducs) |

Upto 31.07.2018 |

|

7. |

60 |

Knitted or crocheted fabrics(All goods) |

Upto 31.07.2018 |

|

8. |

8601 |

Rail locomotives powered from an external source of electricity or by electric accumulators |

|

|

9. |

8602 |

Other rail locomotives, locomotives tenders; such as Diesel-electric locomotives, Steam locomotives and tenders thereof |

|

|

10. |

8603 |

Self-propelled railway or tramway coaches, vans and trucks, other than those of heading 8604 |

|

|

11. |

8604 |

Railway or tramway maintenance or service vehicles, whether or not self-propelled (for example, workshops, cranes, ballast tampers, track liners, testing coaches and track inspection vehicles) |

|

|

12. |

8605 |

Railway or tramway passenger coaches, not self- propelled; luggage vans, post office coaches and other special purpose railway or tramway coaches, not self-propelled(excluding those of heading 8604) |

|

|

13. |

8606 |

Railway or tramway goods vans and wagons, not self-propelled |

|

|

14. |

8607 |

Parts of railway or tramway locomotives or rolling-stock; such as Bogies, bissel-bogies, axles and wheels, and parts thereof |

|

|

15. |

8608 |

Railway or tramway track fixtures and fittings; mechanical (including electro-mechanical) signaling, safety or traffic control equipment for railways, tramways, roads, inland waterways, parking facilities, port installation or airfields; parts of the foregoing |

B) Notified Services:

As per notification no. 15/2017-central tax(rate) dated 28.06.2017 no refund of unutilized input tax credit shall be allowed in respect of

'Construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier.

CAclubindia

CAclubindia