Form GST TRAN-1 has been the subject matter of all the controversies from the beginning of transition into GST. A contrast between recent notifications and the GST council decision have made it more controversial and created a panic in the minds of taxpayers and consultants. Lets understand this below:-

The Central Govt. has issued a notification no. 34/2017 dated 15th September, 2017 wherein various rules under CGST Rules, 2017 were amended keeping in view the decisions taken by the GST Council in its meeting dated 09th September, 2017. The notification inserts a new rule 120A to the CGST Rules, 2017 reproduced below:-

"120A. Every registered person who has submitted a declaration electronically in FORM GST TRAN-1 within the time period specified in rule 117, rule 118, rule119 and rule 120 may revise such declaration once and submit the revised declaration in FORM GST TRAN-1electronically on the common portal within the time period specified in the said rules or such further period as may be extended by the Commissioner in this behalf.";

The above rule says that the GST TRAN-1 form can be revised once only within the time period specified in the said rules. The time period has been specified in Rule 117 r/w Order No 2 issued by commissioner dated 18th September, 2017.

Rule 117 of CGST Rules, 2017 specifies the time period to be 90 days from the appointed date i.e. effectively 28th September, 2017.

There was an extension of date for filing TRAN-1 as per GST Council recommendations. The said extension was made vide order No. 2 dated 18.09.2017. This order reads as follows:-

In exercise of the powers conferred by rule 120A of the Central Goods and Services Tax Rules, 2017 read with section 168 of the Central Goods and Services Tax Act, 2017, the Commissioner, on the recommendations of the Council, hereby extends the period for submitting the declaration in FORM GST TRAN-1 till 31st October, 2017.

As per the order of commissioner the date under rule 120A has been extended only i.e. only the revisionary time limit which is specified in newly inserted rule 120A has only been extended.

There is no order/notification/circular for extending the date specified for filing form GST TRAN-1 under rule 117/118/119/120 where the original time limit of filing form TRAN-1 has been specified.

Due to this now the situation appears as follows:-

- File original GST TRAN-1 latest by 28th September, 2017 (preferably 27th September, 2017 to avoid any last minute hassles on the portal)

- You can file the revised GST Tran-1 by 31st October, 2017.

The above discussion seems to be in complete contrast with the decision taken by the GST Council in their 21st meeting held on 09th September, 2017. GST Council took the following 2 decisions in relation to filing form TRAN-1, (excerpts from the press release available on the PIB Website)

f) FORM GST TRAN-1 can be revised once.

g) The due date for submission of FORM GST TRAN-1 has been extended by one month i.e. 31st October, 2017.

From the point (g) of the above definition, it was very clear that the GST Council took the decision to extend the date of filing TRAN-1 to 31st October, 2017. They did not attached any rider that such extension will be in relation to revised form GST TRAN-1 only.

However from the earlier discussion also it seems that department has taken a U turn here from what was decided by the GST Council.

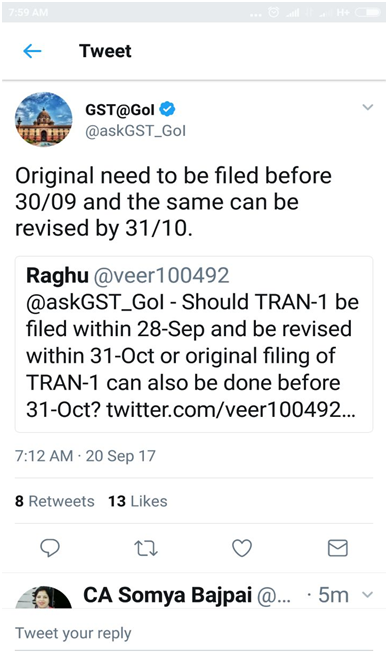

Their intention is also reflected from the tweet of official handle of CBEC @askGST_GOI as under:-

Thus looking at the above discussions, it is advised to file form GST TRAN-1 before 28th of September, 2017 and if required, revise the same by 31st October, 2017.

CAclubindia

CAclubindia