Agent is well known person in the commercial business parlance. The GST Law also talks about Agent as 'agent' means a person, including a factor, broker, commission agent, arhatia, del credere agent, an auctioneer or any other mercantile agent, by whatever name called, who carries on the business of supply or receipt of goods or services or both on behalf of another.'

Background

So now the question arises that who is a pure agent and why is a pure agent is so important in GST?

Broadly speaking, a pure agent is one who while making a supply to the recipient(Buyer), also receives and incurs expenditure on some other supply on behalf of the recipient(Buyer) and claims reimbursement (as actual, without adding it to the value of his own supply) for such supplies from the recipient of the main supply. While the relationship between them (provider of service and recipient of service) in respect of the main service is on a principal to principal basis, the relationship between them in respect of other ancillary services is that of a pure agent.

The concept is borrowed from the erstwhile Service Tax Determination of Value Rules, 2006 and carried forward under GST. As per the meaning given in GST Valuation Rules, a pure agent means a person who:

- enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both;

- neither intends to hold nor holds any title to the goods or services or both so procured or supplied as pure agent of the recipient of supply;

- does not use for his own interest such goods or services so procured; and

- receives only the actual amount incurred to procure such goods or services in addition to the amount received for supply he provides on his own account.

Note: The main important elements of Pure agent are, 'A Pure Agent does not use the goods or services so procured for his own interest and this fact has to be determined from the terms of the contract and the person who provides any service as a pure agent receives only the actual amount for the services provided.'

Exclusion from value

Expenditure incurred as pure agent becomes more relevant, when it comes to determining the value of a supply for levy of GST. The valuation rules of GST provide that expenditure incurred as pure agent, will be excluded from the value of supply, and thus also from aggregate turnover.

However, such exclusion of expenditure incurred as pure agent is possible only and only if all the conditions required to be considered as a pure agent and further conditions stipulated in the rules are satisfied by the supplier in each case.

The supplier would have to satisfy the following conditions (in addition to the condition required to be satisfied to be considered as a pure agent) for exclusion from values under:

- the supplier acts as a pure agent of the recipient of the supply, when he makes the payment to the third party on authorisation by such recipient;

- the payment made by the pure agent on behalf of the recipient of supply has been separately indicated in the invoice issued by the pure agent to the recipient of service; and

- the supplies procured by the pure agent from the third party as a pure agent of the recipient of supply are in addition to the services he supplies on his own account.

In case the conditions are not satisfied, such expenditure incurred shall be included in the value of supply under GST.

Note: The valuation Rule 33 of CGST Rules, 2017, only speaks about exclusion from value of supply only in case of 'Services', it does not hold for goods. In case of goods, Rule 29 of CGST Rules, 2017 will prevail.

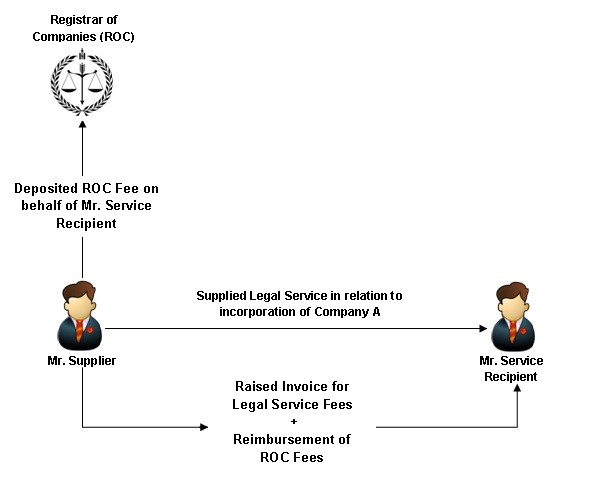

E.g. Corporate services firm Mr. Supplier is engaged to handle the legal work pertaining to the incorporation of Company A. Other than its service fees, Mr. Supplier also recovers from Mr. Service Recipient, registration fee and approval fee for the name of the company paid to the Registrar of Companies. The fees charged by the Registrar of Companies for the registration and approval of the name are compulsorily levied on Mr. Service Recipient. Mr. Supplier is merely acting as a pure agent in the payment of those fees. Therefore, Mr. Supplier‘s recovery of such expenses is a disbursement and not part of the value of supply made by Mr. Supplier to Mr. Recipient.

Some examples of pure agent are:

- Port fees, Port charges, Custom duty, dock dues, transport charges etc. paid by Customs Broker on behalf of owner of goods.

- Expenses incurred by C&F agent and reimbursed by principal such as freight, godown charges.

Conclusion:

A pure agent concept is an important one for businesses as it has direct implications on the value of taxable service. It has direct bearing on the amount of GST charged on a particular supply. It also has bearing on the aggregate turnover of the supplier and therefore on calculating the threshold limit for registration. Whenever the intention is to act as a pure agent, care should be taken to ensure that the conditions specified for such pure agents and further conditions given in the valuation rules are also met so that only the real value of the service provided is subjected to GST.

DISCLAIMER: The views expressed in this article are strictly of the author. The contents of this article are solely for informational purpose. It does not constitute professional advice or recommendation by the author. The author does not accept any liabilities for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon.

The author can also be reached at cavrjsharma@gmail.com

CAclubindia

CAclubindia