A dream of every tax assessee is to have a simpler and fair tax regime. The Tax Reforms Committee led by Dr. Raja Chelliah had recommended an - Estimated Income Method for small taxpayers in order to facilitate better tax compliance giving a window to convert the said dream into reality. In our country, where small businesses, unorganized sectors, and services are hard-to-tax, it is imperative that there exist presumptive schemes for such sectors wherein maintaining books of accounts is a tedious task. The outcome of the recommendation led to the birth of presumptive taxation schemes in Direct tax. One of the key provisions in the presumptive taxation is Section 44AD of the Income Tax Act, 1961 ('the Act') - Special Provisions for computing business income on a presumptive basis, which was introduced by virtue of Finance Act 1994, wherein the concept of taxing an assessee by a method of estimating income from its business was introduced especially for small businesses, contractors and goods carriers.

As per the amendments through Finance (No. 2) Act 2009 with effect from 01-04-2011,

i.e. I.T.A.Y. 2011-12, the scope is yet widened and a large number of assessees are covered under the net of presumptive income. As per this Act, Sec. 44AF is deleted and Sec. 44AD has been amended and is recast. In the Memorandum Explaining the Provisions of the Finance (No.2) Bill, 2009, while amending provisions of Sec. 44AD, it has been stated as under:-

(a) There has been a substantial increase in small business.

(b) A large number of business and service providers in rural and urban areas who earn substantial income are outside the tax net.

(c) Introduction of presumptive tax provisions would help a number of small businesses to comply with the taxation provisions.

(d) A presumptive income scheme lowers the compliance cost and also reduces the burden on the tax machinery.

In India, there is a need for a consolidated tax system where Direct Tax, Indirect Tax, and Property Tax are collected in a single window. With the introduction of GST, it is time to encourage assessees in small and unorganized sectors to pay their fair share of taxes, a combined tax system factoring both GST and Direct Tax would be the need of the hour as it will indeed live up to - One Nation, One Tax slogan. Alternatively, a separate chapter for taxing presumptive incomes may be introduced under the Act, so as to avoid any interpretation issues. With the focus of the current Government being to promote Ease of Business in India and also to bring a lot of small-time assesses into the tax bracket for the first time, a presumptive taxation scheme is a wonderful tool which caters to the needs of the Government

Why the presumptive basis was introduced?

• Under Income tax act provisions, a person engaged in business or profession is required to maintain regular books of account, and further, he has to get his accounts audited.

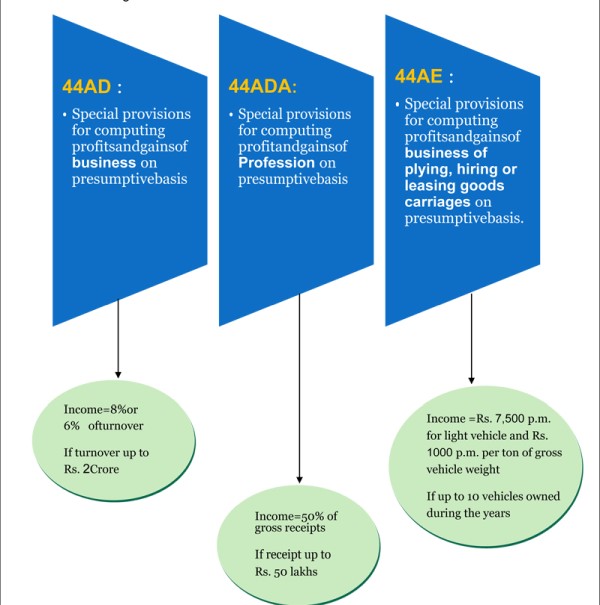

• To give relief to small taxpayers from this tedious work, the Income-tax Act has framed certain ―Special provisions for computing profit and gains on a presumptive basis under sections 44AD, 44ADA and44AE.

• A person adopting the presumptive taxation scheme can declare income at a prescribed rate and, in turn, is relieved from the tedious job of maintenance of books of account and also from getting the Accounts audited, etc.,

Presumptive taxation scheme

This is a system to calculate your tax on an estimated income or profit. It gets very difficult for a small taxpayer to keep track and maintain a copy of all invoices of his sales and expenses. Some of the taxpayers are also required to maintain the books of accounts and get their accounts audited. Moreover, it is very difficult for a small taxpayer to do so many things for the purpose of computation of Income. So as to ease the process of computation of Income, the system of Presumptive Taxation wherein the Income would be computed as a certain percentage of turnover, sales, or percentage.

The presumptive taxation system reduces the compliance cost and the administrative burden. However, it is important to note that whether the taxpayer opts for the Presumptive Scheme of Taxation or for the normal scheme of Taxation, the rates of tax applicable would remain the same. It is only the manner of computation of income on which the tax is levied and several legal compliances will change depending on the scheme opted for. Moreover, the taxpayer is free to decide whether he intends to opt for the Scheme of Presumptive Taxation or opt for the Scheme of Normal Taxation. The taxpayer can opt for any scheme as per his wish.

DETAILS OF PRESUMPTIVE TAXATION SCHEME

For small taxpayers the Income Tax Act has framed three presumptive taxation schemes as given below:

CAclubindia

CAclubindia