To reduce the burden of GST on home buyers, GST council in its 33rd meeting has reduced the rate to 5% without input tax credit ('ITC') for non-affordable houses and 1% without ITC for affordable houses where affordable houses are defined as residential house/flat of carpet area upto 90 sqm in non-metropolitan cities and 60 sqm in metropolitan cities having value upto Rs.45 lacs in both the cases.

Proposed rates will apply from 1 April 2019 and detailed contents of the scheme will be notified separately.

With the Governments announcement that the reduced rates will apply from 1 April 2019, home buyers are in a quandary as to whether reduced rates will apply to ongoing construction work or the benefit of reduced rate is available to projects coming post the revision of rates. Confusion prevails for Home buyers whether to go in for sale agreement before 1 April 2019 or after 1 April 2019.

The answer to this lies in the time of supply provisions as provided under Section 14 of the Central Goods and Services Tax Act, 2017 ('CGST Act') i.e. determination of time of supply in the case of change in rate of tax.

Before proceeding to dissect provisions of Section 14 of CGST Act, it is imperative to analyse other relevant provisions related to such construction contract

In terms of Section 7 (1) (a) of Central Goods and Services Tax Act, 2017, ('CGST Act') read with entry no. 5(b) of Schedule II issued under Section 7(1A) of CGST Act, sale of under-construction houses/flats would be treated as supply of services.

Further, such type of construction contracts are classified under the category of 'Continuous supply of services' under Section 2(33) of CGST Act for the reason that factors such as contracts are executed over a period of three months, periodic payment obligations etc., render them within the purview of the said definition.

Being in the nature of continuous supply of service, it is obligatory to the provider of service to raise invoice in the manner provided in Section 31(5) of CGST Act, as under:

- Where the due date of payment is ascertainable from the contract, the invoice shall be issued on or before the due date of payment;

- Where the due date of payment is not ascertainable from the contract, the invoice shall be issued before or at the time when the supplier of services receives the payment

- Where the payment is linked to the completion of an event, the invoice shall be issued on or before the date of completion of that event

Accordingly, in terms of Section 13 of the CGST Act, 2017, the time of supply in normal cases (to determine rate of tax applicable on the date of provision of supply) will be treated as the date of issue of invoice or in case payment is received before the date of issue of invoice, the date of receipt of such payment.

In the present situation where there is a reduction in rate of tax, the time of supply for applicability of rate of tax is to be determined under the provisions of Section 14 instead of Section 13.

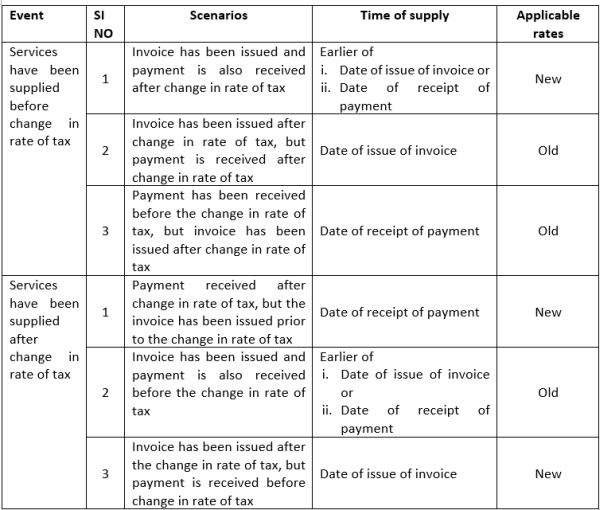

In terms of provisions of Section 14 time of supply depends upon the following three events namely

- When Services have been supplied whether before the change in rate of tax or after change in rate of tax

- When the invoice is raised

- When payment is received

In terms of Section 14 time of supply in such case will de determined basis the period where majority of the above three events has happened. If the majority of the three events has happened before the change in rate, the earlier rate will apply and if majority of the three events has happened post the change in rate the new rate will apply

The following Table will help in understanding the provisions

The Home buyers need to apply the above understanding before they approach the Builders with request for reduction in rate in terms of the proposed reduction applicable from 1 April 2019

Apart from the above, the promise of reduced price to the home buyers will depend upon the extent of credits becoming cost on account of input tax credits being barred in the case of the proposed reduction in rates

The question therefore remains whether new rates suggested by the GST council turns out beneficial to the home buyers or merely remains a mirage in the horizons of GST

DISCLAIMER: The views expressed are strictly of the Author. The contents of this presentation are solely for informational purpose. It does not constitute professional advice/recommendation of Author & its affiliates does not accept any liabilities for any loss/damage of any kind arising out of any information in this presentation nor for any actions taken in reliance thereon

The author can also be reached at canilesh14@gmail.com

CAclubindia

CAclubindia