Vide Notification No. 82/2020 - Central Tax, the government has amended the Central Goods and Services Tax Act, 2017 (12 of 2017). These rules may be called the Central Goods and Services Tax (Thirteenth Amendment) Rules, 2020. Read all the amendments made in the act here.

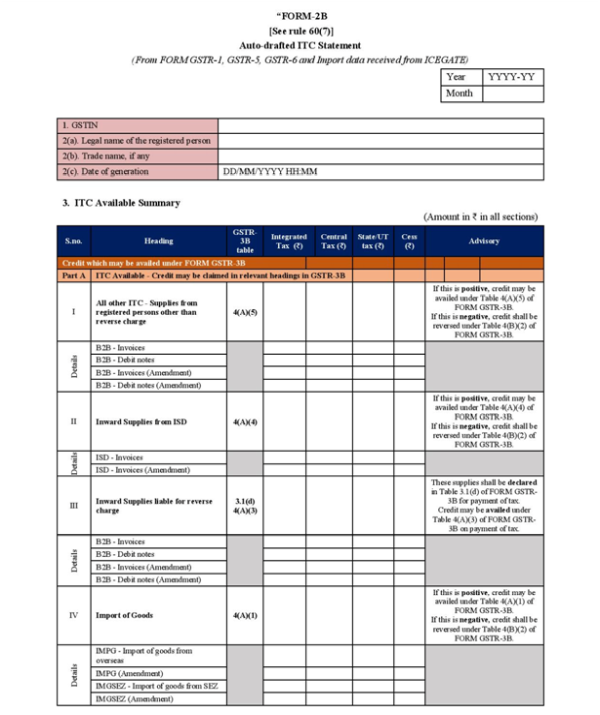

In the amendments made, CBIC has released a new GST Form-2B, which will be inserted after Form-2A. In this article, we discuss the particulars and format of the said new GST Form-2B.

Instructions

1. Terms Used:

a. ITC – Input tax credit

b. B2B – Business to Business

c. ISD – Input service distributor

d. IMPG – Import of goods

e. IMPGSEZ – Import of goods from SEZ

2. Important Advisory

a. FORM GSTR-2B is a statement that has been generated on the basis of the information furnished by your suppliers in their respective FORMS GSTR-1,5 and 6. It is a static statement and will be made available once a month. The documents filed by the supplier in any FORMS GSTR-1,5 and 6 would reflect in the next open FORM GSTR-2B of the recipient irrespective of the supplier’s date of filing. Taxpayers are advised to refer FORM GSTR-2B for availing credit in FORM GSTR-3B. However, in the case of additional details, they may refer to their respective FORM GSTR-2A (which is updated on a near real-time basis) for more details.

b. Input tax credit shall be indicated to be non-available in the following scenarios:

i. Invoice or debit note for the supply of goods or services or both where the recipient is not entitled to an input tax credit as per the provisions of sub-section (4) of Section 16 of the CGST Act, 2017.

ii. Invoice or debit note where the Supplier (GSTIN) and place of supply are in the same State while the recipient is in another State.

However, there may be other scenarios for which input tax credit may not be available to the taxpayers, and the same has not been generated by the system. Taxpayers, should self-assess and reverse such credit in their FORM GSTR-3B.

3. It may be noted that FORM GSTR-2B will consist of all the FORM GSTR-1s, 5s, and 6s being filed by your suppliers, generally between the due dates of filing of two consequent GSTR-1 or furnishing of IFFs, based on the filing option (monthly or quarterly) as chosen by the corresponding supplier. The dates for which the relevant data has been extracted is specified in the CGST Rules and is also available under the ―View Advisory‖ tab on the online portal. For example, FORM GSTR-2B for the month of February will consist of all the documents filed by suppliers who choose to file their FORM GSTR-1 monthly from 00:00 hours on 12th February to 23:59 hours on 11th March.

4. It also contains information on imports of goods from the ICEGATE system including data on imports from Special Economic Zones Units / Developers.

5. It may be noted that reverse charge credit on import of services is not part of this statement and will be continued to be entered by taxpayers in Table 4(A)(2) of FORM GSTR-3B.

6. Table 3 captures the summary of ITC available as on the date of generation of FORM GSTR-2B. It is divided into the following two parts:

a. Part A captures the summary of credit that may be availed in relevant tables of FORM GSTR-3B.

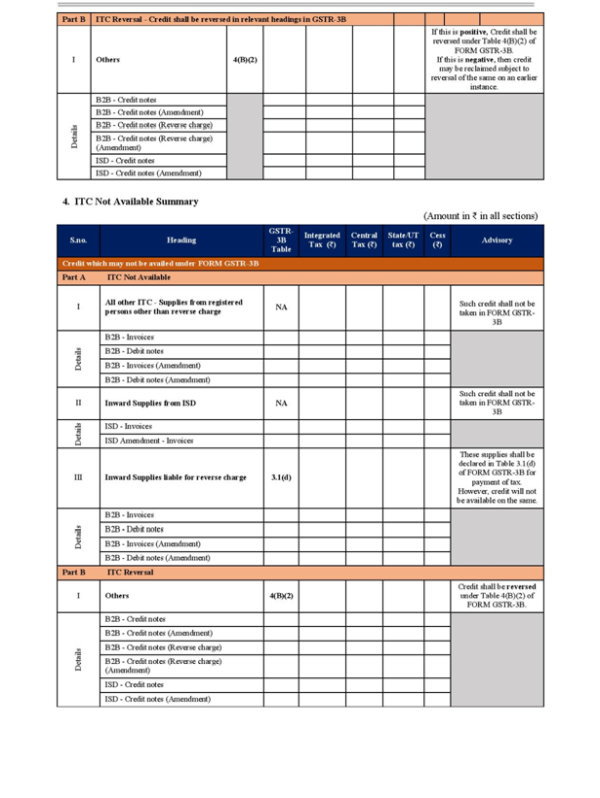

b. Part B captures the summary of credit that shall be reversed in the relevant table of FORM GSTR-3B.

7. Table 4 captures the summary of ITC not available as of the date of generation of FORM GSTR-2B. Credit available in this table shall not be availed as a credit in FORM GSTR-3B. However, the liability to pay tax on a reverse charge basis and the liability to reverse credit on receipt of credit notes continues for such supplies.

8. Taxpayers are advised to ensure that the data generated in FORM GSTR-2B is reconciled with their own records and books of accounts. Taxpayers shall ensure that

a. No credit shall be taken twice for any document under any circumstances.

b. Credit shall be reversed wherever necessary.

c. Tax on reverse charge basis shall be paid.

9. Details of invoices, credit notes, debit notes, ISD invoices, ISD credit, and debit notes, bill of entries, etc. will also be made available online and through download facility.

10. There may be scenarios where a percentage of the applicable rate of tax rate may be notified by the Government. A separate column will be provided for invoices/documents where such a rate is applicable.

11. Table Wise Instructions

|

Table No. and Heading |

Instructions |

|

Table 3 Part A Section I All other ITC - Supplies from registered persons other than reverse charge |

i. This section consists of the details of supplies (other than those on which tax is to be paid on a reverse charge basis), which have been declared and filed by your suppliers in their FORM GSTR-1 and 5. ii. This table displays only the supplies on which input tax credit is available. iii. Negative credit, if any may arise due to amendment in B2B– Invoices and B2B – Debit notes. Such credit shall be reversed in Table 4(B)(2) of FORM GSTR-3B. |

|

Table 3 Part A Section II Inward Supplies from ISD |

i. This section consists of the details of supplies, which have been declared and filed by an input service distributor in their FORM GSTR-6. ii. This table displays only the supplies on which ITC is available. iii. Negative credit, if any, may arise due to amendment in ISD Amendments – Invoices. Such credit shall be reversed in table 4(B)(2) of FORM GSTR-3B |

|

Table 3 Part A Section III Inward Supplies liable for reverse charge |

i. This section consists of the details of supplies on which tax is to be paid on a reverse charge basis, which has been declared and filed by your suppliers in their FORM GSTR-1. ii. This table provides only the supplies on which ITC is available. iii. These supplies shall be declared in Table 3.1(d) of FORM GSTR-3B for payment of tax. Credit may be availed under Table 4(A)(3) of FORM GSTR-3B on payment of tax |

|

Table 3 Part A Section IV Import of Goods |

i. This section provides the details of IGST paid by you on the import of goods from overseas and SEZ units/developers on the bill of entry and amendment thereof. These details are updated on a near real-time basis from the ICEGATE system. ii. This table shall consist of data on the imports made by you (GSTIN) in the month for which FORM GSTR-2B is being generated for. iii. The ICEGATE reference date is the date from which the recipient is eligible to take an input tax credit. iv. The table also provides if the Bill of entry was amended. v. Information is provided in the tables based on data received from ICEGATE. Information on certain imports such as courier imports may not be available. |

|

Table 3 Part B Section I Others |

i. This section consists of the details of credit notes received and amendment thereof which have been declared and filed by your suppliers in their FORM GSTR-1 and 5 ii. Such credit shall be reversed under Table 4(B)(2) of FORM GSTR-3B. If this value is negative, then credit may be reclaimed subject to reversal of the same on an earlier instance. |

|

Table 4 Part A Section I All other ITC - Supplies from registered persons other than reverse charge |

i. This section consists of the details of supplies (other than those on which tax is to be paid on a reverse charge basis), which have been declared and filed by your suppliers in their FORM GSTR-1 and 5. ii. This table provides only the supplies on which ITC is not available. iii. This is for information only and such credit shall not be taken in FORM GSTR-3B. |

|

Table 4 Part A Section II Inward Supplies from ISD |

i. This section consists of the detailed supplies, which have been declared and filed by an input service distributor in their FORM GSTR-6. ii. This table provides only the supplies on which ITC is not available. iii. This is for information only and such credit shall not be taken in FORM GSTR-3B. |

|

Table 4 Part A Section III Inward Supplies liable for reverse charge |

i. This section consists of the details of supplies liable for the reverse charge, which have been declared and filed by your suppliers in their FORM GSTR-1. ii. This table provides only the supplies on which ITC is not available. iii. These supplies shall be declared in Table 3.1(d) of FORM GSTR-3B for payment of tax. However, a credit will not be available on such supplies. |

|

Table 4 Part B Section I Others |

i. This section consists of details of the credit notes received and amendment thereof which have been declared and filed by your suppliers in their FORM GSTR-1 and 5 ii. This table provides only the credit notes on which ITC is not available. iii. Such credit shall be reversed under Table 4(B)(2) of FORM GSTR-3B. |

Format of the New GST Form-2B

Given below is the format of the New GST Form-2B. You can also download the Form here.

CBIC has issues Important GST Notifications related to GSTR 1, Form-2B, GSTR-3B, and GST E-Invoicing on 10th November 2020. Read about all the notifications and changes made here

CAclubindia

CAclubindia