COMPOSITION SCHEME

The objective of composition scheme is to bring simplicity and to reduce the compliance cost for the small taxpayers. Moreover, it is optional and the eligible person opting to pay tax under this scheme can pay tax at a prescribed percentage of his turnover every quarter, instead of paying tax at normal rate.

1. What is composition levy limit under GST?

• The composition levy is an alternative method of levy of tax designed for small taxpayers s having annual aggregate turnover of up to Rs. 1 crore (75 Lakhs for specific states)

• Persons who are providing any exempt service (such as extending deposits to banks for which interest is being received) also eligible for availing the composition scheme.

2. How will the aggregate turnover be computed for the purpose of composition?

• Aggregate turnover will be computed on the basis of turnover on an all India basis and will include value of all Taxable supplies, Exempt supplies and Exports made by all persons with same PAN, but would Exclude inward supplies under reverse charge as well as central, State/Union Territory and Integrated taxes and cess as per Section 2(6) of the CGST / SGST Act.

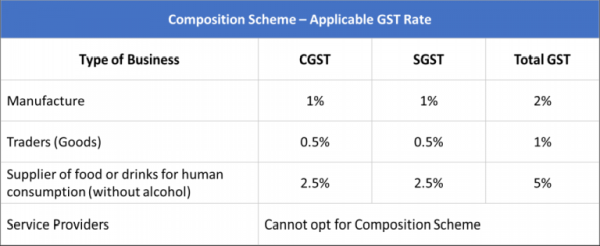

3. What is the specified rate of composition levy?

4. Which are the Special Category States in which the turnover limit for Composition Levy for Central tax and State tax purpose shall be Rs. 75 lakhs?

a) Arunachal Pradesh b) Assam c) Manipur d) Meghalaya e) Mizoram f) Nagaland g) Sikkim h) Tripura i) Himachal Pradesh

5. Who cannot opt for Composition Scheme

The following people cannot opt for the scheme:

- Supplier of services other than restaurant related services

- Manufacturer of ice cream, pan masala, or tobacco

- Casual taxable person or a non-resident taxable person

- Businesses which supply goods through an e-commerce operator

6. Compliance requirements in Books of accounts

• The taxpayer has to mention the words 'composition taxable person' on every notice or signboard displayed prominently at their place of business

• The taxpayer has to mention the words 'composition taxable person' on every bill of supply issued by him

• A composition dealer cannot issue tax invoice, Hence, the dealer has to issue a Bill of Supply

7. Is liability to pay taxes under Reverse Charge Mechanism covered under the Composite Scheme?

• A Composition Dealer has to pay tax under Reverse Charge Mechanism wherever applicable. There is no exemption to a composition dealer here.

8. In case a person has registration in multiple states? Can he opt for payment of tax under composition levy only in one state and not in other state?

• The option to pay tax under composition scheme will have to be exercised for all States.

9. What are the advantages of Composition Scheme?

- Lesser compliance (NO monthly returns, NO maintaining detailed books of records, NO issuance of Tax invoices)

- Limited tax liability

- High liquidity as taxes are at a lower rate

- There is no restriction on procuring goods from inter-state suppliers by persons opting for the composition scheme

10. What are the disadvantages of Composition Scheme?

- A limited territory of business i.e. only INTRA state outward supplies (NO INTER STATE transactions)

- No Input Tax Credit available to composition dealers

- The taxpayer will not be eligible to supply goods through an e-commerce portal

- Purchasers from composition dealers cannot avail credit(As the composition dealer cannot collect tax paid by him on outward supplies from his customers)

- Composition Dealer is not allowed to collect composition tax from the buyer

11. When will a person opting for composition levy pay tax?

• A person opting for composition levy will have to pay tax on quarterly basis before 18th of the month succeeding the quarter during which the supplies were made.(DUE DATE may vary accordingly council decisions)

12. Which RETURNS are required to be filed by a taxable person registered under Composite Scheme?

• The taxable person is required to furnish only one return i.e. GSTR-4 on a quarterly basis and an annual return in FORM GSTR-9A.

13. A person availing composition scheme during a financial year crosses turnover of Rs. 100 lakhs / 75 lakhs during the course of the year, Will he be allowed to pay tax under composition scheme for the remainder of the year?

• No, The option to pay tax under composition scheme lapses from the day on which his aggregate turnover during the financial year exceeds the specified limit (Rs.100 lakhs / Rs.75 lakhs). He is required to file an intimation for withdrawal from the scheme in FORM GST CMP-04 within seven days from the day on which the threshold limit has been crossed.

• However, such person shall be allowed to avail the input tax credit in respect of the stock of inputs and inputs contained in semi-finished or finished goods held in stock by him and on capital goods held by him on the date of withdrawal and furnish a statement within 30 days of withdrawal containing the details of such stock held in FORM GST ITC-01 on the common portal.

14. What is the treatment for input credit availed when transitioning from normal scheme to Composition Scheme?

• When switching from normal scheme to composition scheme, the taxpayer shall be liable to pay an amount equal to the credit of input tax in respect of inputs held in stock on the day immediately preceding the date of such switchover.

• The balance of input tax credit after payment of such amount, if any lying in the credit ledger shall lapse.

15. Can a person paying tax under composition levy, withdraw voluntarily from the scheme? If so, how?

• Yes. The registered person who intends to withdraw from the composition scheme can file a duly signed or verified application in FORM GST CMP-04.

• Every person who has filed an application for withdrawal from the composition scheme, may electronically furnish, a statement in FORM GST ITC-01 containing details of the stock of inputs and inputs contained in semi-finished or finished goods held in stock by him on the date of withdrawal, within a period of 30 days of withdrawal.

The author can also be reached at maheshbobbili.ca@gmail.com

CAclubindia

CAclubindia