Confusion regarding whether we should register in existing DVAT Act or wait for the GST

Registration is fundamental to the administration of any tax. The taxpayer enrols himself by following the prescribed procedure, and thereafter a unique identification code is granted to such taxpayer, which is to be used in all correspondence.

Some people have the confusion that whether they should wait for the GST or register their business in the existing law in this respect if you want to register your business in the existing law like VAT then your registration will be migrated into the GST by revenue authority and provide you the Provisional ID and Password then by this Provisional Id and Password you can migrate your registration into GST by filing the one form using the common portal of GST https://www.gst.gov.in/

After the application is submitted, an Application Reference Number (ARN) will be generated, which can be used for the future correspondence.

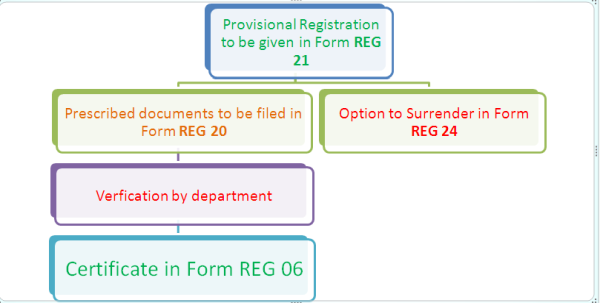

On the Appointed day i.e. 1st July 2017 the Provisional Registration Certificate will be made available for viewing and downloading on the GST common portal in FORM GST REG-21.

Following the registration rules which followed in the GST

Overview of Value Added Tax

It is a form of indirect tax and is in nature of multi-point sales tax. In India, it is the replacement of existing sales tax structure: the only difference is manner of levy, Tax on sale by States in the form of VAT continues to draw power from entry 54 in the list II of Seventh Schedule of the Constitution of India.

Why we should pay VAT?

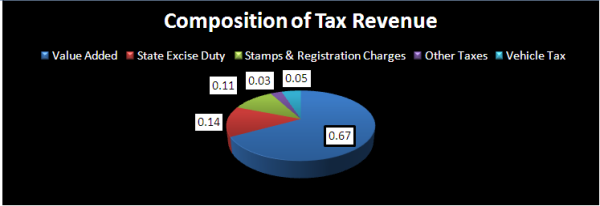

VAT is tax charged by the state government to generate their revenue by the help of this revenue the state government will utilize that money in the development of the state so that state will get the good facility at the minimum cost. As per the budget speech of the state government of Delhi following is the composition of tax revenue in Delhi.

Here, the detailed procedure to register your business in the DVAT Act and obtain Tin Number.

Who is liable for obtaining the TIN Number

Every dealer is required to apply for registration under the DVAT Act if-

- His turnover in the current year is more than 20 lakh

- He made interstate sale irrespective of the amount

Time Limit: As per rule 12(1), a dealer who liable to register their business shall make an application for registration within 30 days from the date of falling in the above mentioned criteria.

Penalty For Non Compliance:- If person fails to obtain the registration number within 30 days then penalty of Rs 1000/- per day immediately from the date on which he falls in criteria mentioned above to the date on which he makes an application for the registration but maximum to Rs 1,000,000/-

However if a person is dealing in the trading of the exempted goods as mentioned in the Schedule I of DVAT Act he shall not required to obtain the TIN Number.

In the DVAT Act you can do the Voluntary Registration this mean that if your sale value doesn't exceed amount of Rs 20 lakh and you didn't made any interstate sale but you want to register your business then you can do the same by applying Voluntary Registration.

Who is dealer?

Dealer means any person who buys and sells goods in Delhi directly or indirectly whether for cash or for the deferred payment or for other valuable consideration. Dealer can be

- Individual

- Partnership Firm

- Company whether public or private

- PSU

- Hindu Undivided Family

- Club/ Cooperative Society

- Bank

- Business on E-commerce website like Flipkart, Snapdeal.

Step by Step detail procedure for the Registration under DVAT Act

Step 1:- Visit to the DVAT site http://dvat.gov.in/website/home.html

After visiting above mentioned portal go to the New Registration Segment.

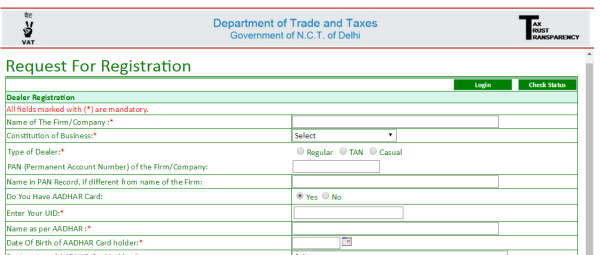

Step2:- After clicking on the New Registration Segment this tab will be open

In this you are required to fill some details like :

1. Detail of Pan of Dealer

2. Name of the business which you want to register

3. Constitution of Business

4. Type of Dealer

a. Casual Dealer: Casual Dealer are those dealer who buy, sell, supply and distribute the goods on the occasional basis in Delhi. It also includes the person who engage in exhibition cum sale activities in Delhi. There is no exemption in the sale amount for these type of dealers.

b. Regular Dealer: All the dealer other than casual dealer.

After providing the detail in the request for registration form then submit the form.

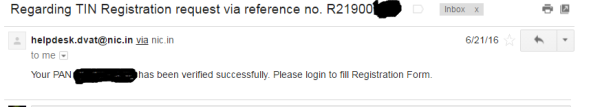

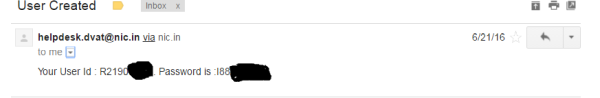

Step 3:- After the verification of the pan you will notify with email from the DVAT helpdesk regarding to the Success of the PAN Verification.

Step 4:- After this email the department will again notify you an email and in this email, department will provide you the Reference No. and Password for the further Registration Process.

Step 5:- After receiving this email again visit the portal of Department of Trade and Taxes http://dvat.gov.in/website/home.html and in Login segment select Dealer then new tap will be open fill the detail of the user id and password (which is provided by the department in the email) and change the password.

Update your new login and approval password.

Step 6:- After change of the password again login with the Reference Number and this time provide the new password (which you choose)

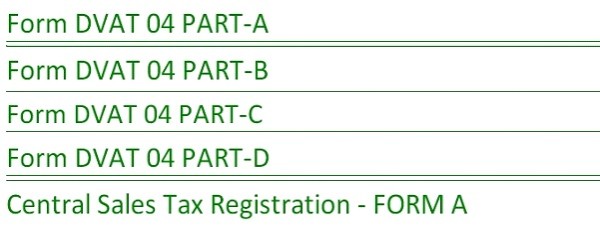

Step 7:- Now start filing the DVAT 04 i.e. Registration Form

It has the 5 parts namely

- Part A: It includes the details of the business and the product which you buy and sell in Delhi. The Code of the Item should be selected from the Schedule of DVAT

|

Schedule Number |

Rate at which Commodity is Taxable In Delhi |

|

Schedule Number 1 |

Exempted Goods |

|

Schedule Number 2 |

1% |

|

Schedule Number 3 |

5% |

|

Schedule Number 4 |

20%/12.5% |

- Part B: It includes the detail of the Person who is interested in the business.

- Part C: It includes the detail of the addition place which is related to your business like warehouse.

- Part D:-It includes the detail of the authorized signatory who sign all the documents of the business in DVAT

- Form A : It includes the registration of business for the purpose of making interstate sale and purchase.

Step 8:- Now upload the documents.

Documents required for the 3 different constitution of business

|

Proprietorship |

Partnership Firm |

Company |

|

PAN of Proprietor |

PAN of Partnership Firm |

PAN of Company |

|

Identity Proof of Proprietor |

Identity Proof of all Partners |

Identity Proof of all Directors |

|

Address Proof of Place of Business |

Address Proof of Place of Business |

Address Proof of Place of Business |

|

Photograph of Proprietor |

Photograph of all Partners |

Photograph of all Directors |

|

Bank Account Detail |

Bank Account Detail |

Bank Account Detail |

Step 9:- Now after the uploading the documents its time for making the payment in respect of the registration charges as prescribed by the law. For the making the payment go to the Payment section of Registration Profile and select option Go for Payment option

There is two mode of the payment

- Online Mode:- Payment through net banking of your bank

- Offline Mode:- In this mode the challan will be generated then submit this challan amount to bank and after 3 days the challan will be credited on your Registration Profile.

Step 10:- Now submit the Registration Form by the choosing the Submission Section on your Registration profile.

Step 11:- After submitting the form the DVAT Helpdesk will notify you on your registered email with the TIN Number and Provisional Password.

Step 12:- After obtaining the Tin Number and Provisional Password again visit the DVAT Common Portal and in login segment select dealer provide your User Id i.e. you TIN Number allotted by the Department of Trade and Taxes and change your login password.

Note:- It is recommended that you should chose the same password as your login and as your approval because approval password is used when you want to change your email id and mobile number in department record.

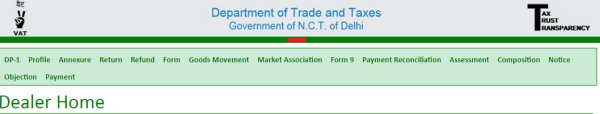

Step 13:- After login by your Registration Number this window is open

Step 14:- Now in the above the image select the section of DP 1 i.e. Dealer Profile it is mandatory for every dealer to file their DP 1 within the prescribed time vide Notification Number. F.3(352)/policy/VAT/2013/231-241 dated 28.05.2013 .

Penalty for non filing of DP 1:- If the dealer fails to file the DP 1 then penalty of Rs 200/- per day from the last date of filling the DP 1 till the date of rectify the mistake but maximum to Rs 50,000/-

As in case of Sewing System (P) Ltd V/S CTT, the dealer failed to furnish FORM DP-1 in time, hence the penalty of Rs 50,000/- was imposed. Later the DVAT Commissioner himself extended the date so on this behalf the Tribunal quashed the order of penalty in view that Form DP-1 was filed before the extended date.

The author can also be reached at gaganaggarwal958@gmail.com

CAclubindia

CAclubindia