Since previous some days many professionals have asked one question to 'Whether MGT-9 is required to be preparing for F.y. 2017-18 or not'.

As per CA, 2013 section 134, Companies was required to prepare MGT-9 extract of Annual Return and such MGT-9 was required to file with Directors Report.

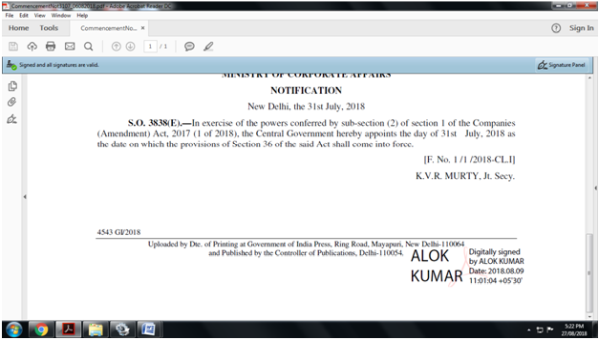

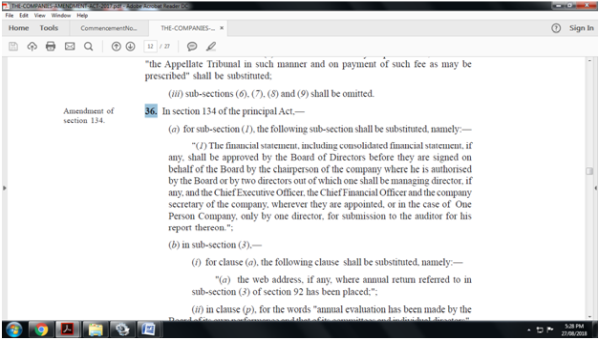

However, this provision has been amended by CAA, 2017 w.e.f. 31.7.2018 i.e. as per notification dated 31st July, 2017 provision in relation to MGT-9 has been removed from Section 134 and a new provision I added i.e. 'the web address, if any, where annual return referred to in sub-section (3) of section 92 has been placed'.

Therefore, one can opine that MGT-9 is not required to prepare by any Company if Directors Report approved in Board Meeting on or after 31st July, 2018.

Note: As per above mentioned two screenshot

i. First: Notification of Section 36 of Companies Amendment Act, 2017

ii. Second: Section 36 of Companies Amendment Act, 2017 or can say section 134 of Companies Act, 2013.

Therefore, one can opine that w.e.f. 31st July, 2018

I. OPC and Small Company shall prepare directors report as per Rule 8A and rule 8A states 'the web address, if any, where annual return referred to in sub-section (3) of section 92 has been placed'

II. Companies other than OPC and Small Company follow section 134 and section 134 states 'the web address, if any, where annual return referred to in sub-section (3) of section 92 has been placed'

Note: Company have to give Link of Annual Return 'not Extract of Annual Return' Which means, MGT-9 is totally removed from Companies Act, 2013 w.e.f. 31st July, 2018.

CAclubindia

CAclubindia