(Goods and Service Tax)

Elite Authors already have discussed the Pros & Cons, needs, features & importance of Goods & Service Tax (GST). Therefore, it will not be rationale for me to write the same thing again for respected readers. Therefore, before discussing Goods & Service Tax (GST), let’s start discussing about our Tax System, Let’s talk about soul of Taxation world, and let’s start with a story so as to understand tax system in simple and easiest manner.

As we all know that human being is social animal. It’s their natural behavior to form groups & when these groups get divided on the basis of geographical location or religion or on other basis they are known as Countries. Later on, these groups find that there is a need of supervisor or guardian who will work for the benefit of their group or society or country as a whole. Therefore, they formed an apex body known as Government. The Government is similar to parents as we have in our family who pamper us so that we can grow and utilize our best potential. The government is also similar to Panchayat in the villages which take care of each & every basic need of villagers.

Now the government needed Funds for carrying out all the development related activity. But from where to arrange funds? Obviously, these funds will be collected from the citizens itself which is known as Tax. But again one more question arises & that question is on which basis we should collect Tax from citizens? The answer to this question is:

1. On Income Basis (For Example: Income Tax)

2. On Consumption Basis (For Example: Value Added Tax, Service Tax etc.)

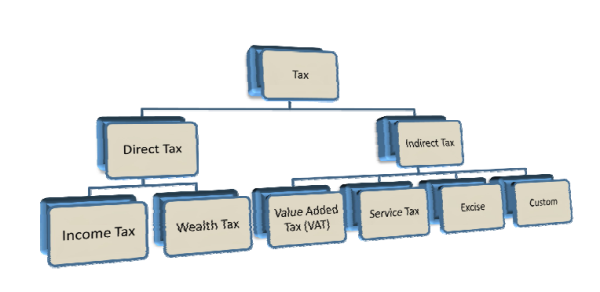

Tax can also be classified into two parts namely:

1. Direct Tax: When Tax incidence is borne by person paying tax then it is known as Direct Tax. For Example: Income Tax, Wealth Tax

2. Indirect Tax: When Tax incidence is borne by person other than the person paying tax then it is known as Indirect Tax. Example: Value Added Tax, Service Tax etc. It is regressive in nature i.e., based on consumption. The more you will consume product or service, more you will bear indirect tax.

Constitutional Right

As we all know that Constitution of India is the mother of laws & Acts in India. Therefore, in case of tax also the constitution provides power to government to charge tax. Article 246 (Schedule VII of Constitution) authorizes government for collecting and charging tax from public.

Article 246 (Schedule VII of Constitution) has 3 lists:

• Union List: Specify Tax which will be collected by Union government only.

• State List: Specify Tax which will be collected by State Government only.

• Concurrent List: Collected & Shared by Both Union & State Government.

In order to understand GST, Lets understand problem in present indirect taxation regime.

Indirect Tax do not constitute of single tax. It includes Value Added Tax, Central Sales Tax, Service Tax, Excise, Custom & lots more.

• Value Added Tax: In case of sale within the state, VAT is to be charged.

• Central sales tax: Charged in case of interstate sale i.e. sale from one state to the other.

• Service Tax: If any service provider has rendered services to any person such service provider shall be required to collect service tax.

• Excise Duty: It is payable in case of manufacturing of product & it is collected when the goods are removed from factory.

• Custom Duty: Custom Duty is payable in case of import/export of goods.

Limitation & Problems in Current Indirect Tax System

• Cascading Effect: Cascading effect means tax on tax. There are many instances when tax is being charged on tax.

• Multiple Registrations: If any entity is providing goods & services both then it needs to get registered in both department.

• Double Taxation: There are many cases when two or more tax is charged on same amount. For example: On software designing, development of software both VAT as well as Service Tax is charged.

And, In case of Air Conditioned Restaurant also, VAT as well as Service Tax is charged.

• Increase in Burden: Multiple return filing, multiple registration lead to increase in burden.

• Increase in Compliance Cost: Lots of compliance also increases cost.

Therefore, Goods & Service Tax is need of hour & solution of huge mountain like problems. As we all know that change is the only thing which is constant. Then, why our economy is resisting such change.

Let’s take a look at the new proposed model of GST.

Proposed Model of GST

GST is one of the widely accepted indirect taxation system & prevalent in more than 150 countries across the globe. GST is a tax on goods and services with comprehensive and continuous chain of set-off benefits from the producer’s point and service provider’s point up to the retailer’s level. It is tax only on value addition at each stage, and a supplier at each stage is permitted to set-off, through a tax credit mechanism, the GST paid on the purchase of goods & services as available for set-off on the GST to be paid on the supply of goods & services. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

Salient Features of the Proposed Model

GST will have two components:

• CGST (Central Goods & Service Tax)

• SGST (State Goods & Service Tax)

On sale of goods & services CGST & SGST are to be charged and to be paid to the Central & State Government respectively. In general, taxes paid against the Central GST shall be allowed to be taken as input tax credit (ITC) for the Central GST & could be utilized only against the payment of Central GST.

The same principle will be applicable for the State GST. However, the cross utilization of CGST &SGST would not be allowed except in the case of inter-state supply of goods and services.

In case of interstate sale of goods & services central government will levy Integrated Goods & Service Tax (IGST). IGST is nothing but the sum total of CGST and SGST. This IGST payable can be paid after adjusting the available credit of IGST, CGST and SGST paid on purchases. Selling state will transfer to Centre the credit of SGST used in payment of IGST. Buyer of the other state will claim credit of IGST while discharging his SGST liability.

The CGST & SGST would be levied simultaneously on every transaction of supply of goods and services except the exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits.

Composition Scheme will be an important feature of GST to protect the interests of small traders and small scale industries.

Tax Subsumed in Goods & Service tax

Following Central & State Taxes will be subsumed under the Goods and Services Tax:

• Central Excise Duty

• Additional Excise Duties

• The Excise Duty levied under the Medicinal and Toiletries Preparation Act

• Service Tax

• Additional Customs Duty, commonly known as Countervailing Duty (CVD)

• Special Additional Duty of Customs - 4% (SAD)

• Surcharge

• Cess

• VAT / Sales tax

• Luxury tax

• State Cess and Surcharges if they relate to supply of goods and services

Advantages of GST

For Central and State Government

• Simple and easy to administer

• Better controls on leakage

• Consolidation of tax base

• Simplification of tax system

• Higher revenue

For Consumer/Businessman

• Single and Transparent taxation

• Reduction of prices

• Reduce Burden

• Reduce Compliance Cost

A National Council of Applied Economic Research study, commissioned by the Thirteenth Finance Commission has stated that implementation of a comprehensive GST is expected to provide gains to India‘s GDP somewhere within a range of 0.9 to 1.7%. The additional gain in GDP originating from the GST reform would be earned during all years in future over & above the growth in GDP which would have been achieved otherwise. Gains in exports are expected to vary between 3.2 and 6.3%

Challenges to GST

• A large part of the success of GST depends on two prominent factors – ‘RNR’ & ‘threshold limit’ for GST. RNR stands for Revenue Neutral Rate & is the rate at which there will be no revenue loss to the government after implementation of GST. RNR will impact India economy adversely, if it will be higher than the present tax structure.

• The threshold limit of turnover for dealers under GST is debatable issue & if threshold limit will be high then It will also increase the tax payers under GST.

• Robust IT backbone which needs to develop for GST

• Critics claim that CGST, SGST and IGST are nothing but new names for Central, Excise, Service Tax, VAT and CST, and hence GST brings nothing new to the table.

Synopsis (Summary)

Now, as I have already discussed some of the problems which our economy is facing & in present scenario these problems are hindrances for the growth of the business, Industry and economy as a whole. Therefore, there is a need of the system which can erode all such problems & can lead to the path which will simplify the taxation system & will give freedom from complex & ambiguous taxation. Therefore, GST is the only solution of such problem.

I hope every one of us would have observed a small plant which need optimum amount of sunrays and water to develop and grow. Can we imagine, what will happen, if the small plant will get only sunrays and will not get even a single drop of water? That plant will not be able to survive. Our Indian economy is also the same. We have sunrays. It means we have potential, we have market, we have resources but we don’t have GST i.e., we don’t have accurate system, we don’t have accurate procedure. I know that Indian economy is performing real nice, but we can’t neglect the fact that it can perform better than the present performance. Even our Finance Minister Mr. Arun Jaitley also used to convey the same message in their speech regarding GST and Taxation regime. I hope all of us will heartily welcome GST and will open the path of opportunity for our economy to grow.

CAclubindia

CAclubindia