Entities Coming under Segmental disclosures:

This Accounting Standard shall apply to companies to which Indian Accounting Standards (Ind. ASs) notified under the Companies Act apply. If an entity that is not required to apply this Indian Accounting Standard chooses to disclose information about segments that does not comply with this Indian Accounting Standard; it shall not describe the information as segment information.

If a financial report contains both the consolidated financial statements of a parent that is within the scope of this Indian Accounting Standard as well as the parent's separate financial statements, segment information is required only in the consolidated financial statements.

Operating segments:

• An operating segment is a component of an entity: that engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses relating to transactions with other components of the same entity)

• Whose operating results are regularly reviewed by the entity's chief operating decision maker(CODM) to make decisions about resources to be allocated to the segment and assess its performance, and

• For which discrete financial information is available.

An operating segment may engage in business activities for which it has yet to earn revenues, for example, start-up operations may be operating segments before earning revenues.

Management Approach:

Management approach entails segment disclosure based on operating segments known as components of the entity that management monitors in making decisions on operating matters. Such Operating Segments are identified on the basis of internal reports that the entity's CODM assesses regularly in allocating resources to segments in evaluating performance.

Aggregation of operating segments:

The aggregation of operating segments is allowed only when the segments are similar in nature and meet the number of identified measures. In other words, two or more operating segments may be aggregated into a single operating segment if aggregation is consistent with the core principle of this Indian Accounting Standard, the segments have similar economic characteristics, and the segments are similar in each of the following respects:

(a) the nature of the products and services;

(b) the nature of the production processes;

(c) the type or class of customer for their products and services;

(d) the methods used to distribute their products or provide their services; and

(e) if applicable, the nature of the regulatory environment, for example, banking, insurance or public utilities.

Matrix form of organisation:

The characteristics dealt with above under 'Operating segments' may also apply to two or more overlapping sets of components for which managers are held responsible. That structure is sometimes referred to as a matrix form of organisation. For example, in some entities, some managers are responsible for different product and service lines worldwide, whereas other managers are responsible for specific geographical areas. The chief operating decision maker regularly reviews the operating results of both sets of components, and financial information is available for both. In that situation, the entity shall determine which set of components constitutes the operating segments by reference to the core principle.

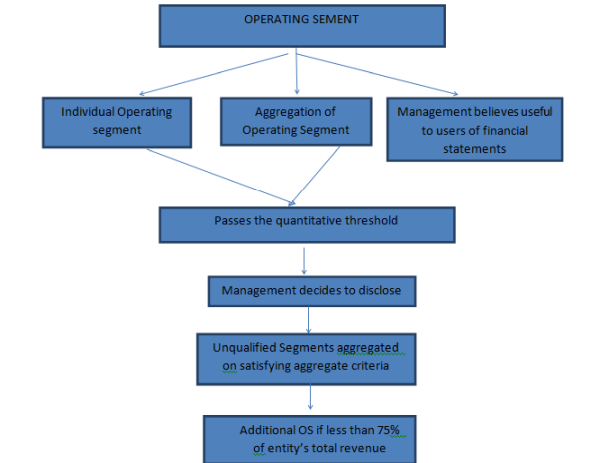

Quantitative thresholds:

An entity shall report separately information about an operating segment that meets any of the following-quantitative-thresholds:

• Its reported revenue, including both sales to external customers and intersegment sales or transfers, is 10 per cent or more of the combined revenue, internal and external, of all operating-segments.

• The absolute amount of its reported profit or loss is 10 per cent or more of the greater, in absolute amount, of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss.

• Its assets are 10 per cent or more of the combined assets of all operating segments.

Operating segments that do not meet any of the quantitative thresholds may be considered reportable, and separately disclosed, if management believes that information about the segment would be useful to users of the financial statements.

All other reportable segments:

Information about other business activities and operating segments that are not reportable shall be combined and disclosed in an 'all other segments' category separately from other reconciling items. The sources of the revenue included in the 'all other segments' category shall be described.

Other Guidelines as to Operating Segments:

• If management judges that an operating segment identified as a reportable segment in the immediately preceding period is of continuing significance, information about that segment shall continue to be reported separately in the current period even if it no longer meets the criteria for reportability-in-paragraph-13.

• If an operating segment is identified as a reportable segment in the current period in accordance with the quantitative thresholds, segment data for a prior period presented for comparative purposes shall be restated to reflect the newly reportable segment as a separate segment, even if that segment did not satisfy the criteria for reportability in paragraph 13 in the prior period, unless the necessary information is not available and the cost to develop it would be excessive.

• There may be a practical limit to the number of reportable segments that an entity separately discloses beyond which segment information may become too detailed. Although no precise limit has been determined, as the number of segments that are reportable in accordance with paragraphs 13-18 increases above ten, the entity should consider whether a practical limit has been reached.

Ind.AS 108 Vs AS 17:

Ind. As 108 is known as Operating Segments as against As 17 is christened as Segmental reporting.

The latter deals with two kinds of /types of segments -

1. Business segments and

2. Geographical Segments.

But, as has been spelt out earlier, in Ind. ASs 108 'Management approach' is the kernel that determines and gives the road map to decide on 'operating segments' known as components of the entity that management monitors in making decisions on operating matters.

Disclosures:

• An entity shall disclose information to enable users of its financial statements to evaluate the nature and financial effects of the business activities in which it engages and the economic environments in which it operates.(Para-21)

• An entity shall also disclose the following for each period for which a statement of profit and loss is presented:

--- Information about reported segment profit or loss, including specified revenues and expenses included in reported segment profit or loss, segment assets, segment liabilities and the basis of measurement, as described in paragraphs 23–27; and

---- Reconciliations of the totals of segment revenues, reported segment profit or loss, segment assets, segment liabilities and other material segment items to corresponding entity amounts as described in paragraph 28.

-----Reconciliations of the amounts in the balance sheet for reportable segments to the amounts in the entity's balance sheet are required for each date at which a balance sheet is presented. Information for prior periods shall be restated as described in paragraphs 29 and 30.

General information (Para 22):

An entity shall disclose the following general information:

--- Factors used to identify the entity's reportable segments, including the basis of organisation (for example, whether management has chosen to organise the entity around differences in products and services, geographical areas, regulatory environments, or a combination of factors and whether operating segments have been aggregated), and

--- Types of products and services from which each reportable segment derives its revenues.

Information about profit or loss, assets and liabilities (Para 23):

An entity shall report a measure of profit or loss for each reportable segment and a measure of total assets and liabilities for each reportable segment if such amounts are regularly provided to the chief operating decision maker. An entity shall also disclose the following about each reportable segment if the specified amounts are included in the measure of segment profit or loss reviewed by the chief operating decision maker, or are otherwise regularly provided to the chief operating decision maker, even if not included in that measure of segment profit or loss:

(a) revenues from external customers;

(b) revenues from transactions with other operating segments of the same entity;

(c) interest revenue;

(d) interest expense;

(e) depreciation and amortisation;

(f) material items of income and expense disclosed in accordance with paragraph 97 of Ind. AS 1 Presentation of Financial Statements ;

(g) the entity's interest in the profit or loss of associates and joint ventures accounted for by the equity method;

(h) income tax expense or income; and

(i) material non-cash items other than depreciation and amortisation.

An entity shall report interest revenue separately from interest expense for each reportable segment unless a majority of the segment's revenues are from interest and the chief operating decision maker relies primarily on net interest revenue to assess the performance of the segment and make decisions about resources to be allocated to the segment. In that situation, an entity may report that segment's interest revenue net of its interest expense and disclose that it has done so.

An entity shall disclose the following about each reportable segment if the specified amounts are included in the measure of segment assets reviewed by the chief operating decision maker or are otherwise regularly provided to the chief operating decision maker, even if not included in the measure of segment assets( Para22):

(a) the amount of investment in associates and joint ventures accounted for by the equity method, and

(b) the amounts of additions to non-current assets1 other than financial instruments, deferred tax assets, post -employment benefit assets (see Ind AS 19 Employee Benefits paragraphs 54–58) and rights arising under insurance contracts.

Information about geographical areas:

Revenue from external customers - country of domicile as well from all foreign countries in total (if from individual foreign is material to be disclosed separately. On a similar pattern, information as to Non-Current assets other than deferred tax assets, Post employment benefit assets and rights arising from insurance contracts are to be provided

Information about Major Customers:

An entity should provide information about the extent of its reliance on its major customers. If revenues from transactions with a single external customer amount to 10 percent or more of an entity's revenues, the entity should disclose as to the fact; the total amount of revenues from each such customer; and the identity of the segment or segments reporting the revenues. The entity need not disclose the identity of a major customer or the amount of revenues that each segment reports from that customer.

Reconciliations:

Ind. AS 108 requires reconciliation --as to total reportable segmental revenues to entity's revenue; total reportable segmental assets and liabilities to entity's; as well total reportable segmental profit or loss before tax and discontinued operations; total reportable segment amounts for every material information material amounts disclosed. (Dealt with earlier also)

CAclubindia

CAclubindia