Your capital may erode slowly. You might have to work in later stages of life even if you don't want to.

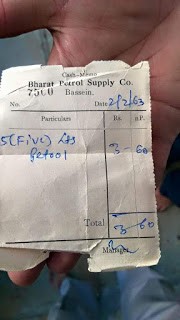

In 58 years, petrol has approached INR 100 per litre with the implied growth in price of 8.86% per annum to date.

Similar is the inflation rate for other expenses as well. Simply, if your money doesn't earn at least 8.86% post-tax, you are losing its value.

Human nature is a failed investor

The human being is naturally bound by a complex of fatal misperceptions diminishing the capacity of executing a successful lifetime investment strategy. Cultural factor is a major factor contributing to the essential human incapacity for successful investing.

Humans, in general, cannot distinguish between currency and money.

Currency is a medium of exchange. Money is a store of purchasing power.

The only rational long-term definition of "money" is "purchasing power" is a perception that is culturally unavailable to human mind. - Nick Murray

Invest for maximum total REAL return. This means the return on invested dollars after taxes and after inflation. This is the only rational objective for most long-term investors. Any investment strategy that fails to recognize the insidious effect of taxes and inflation fails to recognize the true nature of the investment environment and thus is severely handicapped. - Sir John Templeton.

Let's talk about retirement as one of a goal. If your investments do not beat inflation and taxes over 5+ years, you have two problems:

- No plan. People do not even know with any precision, what sum of capital they'll need to accumulate in order to support four decades of lifestyle-sustaining income, and then have a meaningful legacy.

- Investing for retirement in all the wrong things.

If you don't feel okay with your finances and investments, you can always consult an expert. Better late than never.

The author is the Founder and Catalyst at Aaditya Chhajed Financial Services and can also be reached on email at aadityachhajed@acfas.in

CAclubindia

CAclubindia