Impairment is determined by comparing CARRYING VALUE of the asset with it's RECOVERABLE AMOUNT. It will be higher of Fair Value less Cost of Disposal and its Value in Use. Impairment rules apply to both Tangible and Intangible Assets.

Scope and Applicability:

It applies to all tangible, intangible and financial assets except-

• Inventories (IAS 2)

• Contract Assets or Assets obtained through fulfilling a Contract (IFRS 15)

• Deferred Tax Assets (IAS 12)

• Assets arising from Employee Benefits (IAS 19)

• Financial Assets within the scope of IFRS 9 'Financial Instruments'

• Investment Property measured at Fair Value (IAS 40)

• Non-Current Assets Held for Sale (IFRS 5)

Important Terminology:

• Impairment Loss: Amount by which Carrying Amount of an asset or a Cash Generating Unit (CGU) exceeds its Recoverable Amount.

• Carrying Amount: Amount at which asset is recognized after deducting accumulated depreciation and impairment losses, if provided earlier.

Accounting Issues to be Considered:

• Identification of occurrence of Impairment Loss.

• Measurement of Recoverable Amount of an asset.

• Reporting of an 'Impairment Loss' in Financial Statements.

Identification of Potential Impairment

An organization should check for the identifications of impairment to assets at the end of every reporting period. In such identification process, one should keep in mind the concept of 'Materiality' and only a potential material impairment loss needs to be taken care of.

Standard lays down the indications of a potential impairment of assets. It is divided into 2 different sources namely,

External Source of Information

• A steep fall in asset's market value against the expectation.

• A significant change in Technological, Market, Legal or Economic environment of the industry in which entity is operating.

• Carrying Amount of entity's net assets being more then Market Capitalization.

• A considerable change Market Interest Rates or Risk-Free Rates likely to affect the Discount Rates used in calculating Value in Use.

Internal Source of Information

• Evidence of Obsolescence or Physical Damage.

• Significant fall in Asset's Economic Performance.

• Adverse Changes in use to which the asset is put.

If no identifications of impairment are traceable, then still the following assets always be tested for impairment at each reporting period:

• An intangible asset with Indefinite Useful Life.

• Goodwill acquired in Business Combination.

Measurement of Recoverable Amount

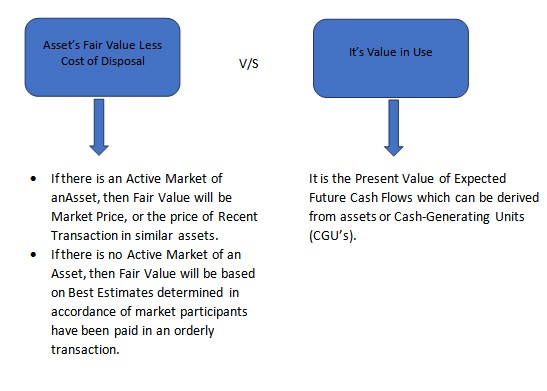

The recoverable amount of an asset should be measured as a Higher Value of:

Recognition of an Impairment Loss

Impairment Loss should be treated as a Revaluation decrease under the relevant IFRS Standard.

It depicts:

• To the extent of Revaluation Surplus held in respect of that specific asset, Impairment Loss should be charged to Other Comprehensive Income (OCI) and should be disclosed in Revaluation Surplus.

• Remaining supposed to be charged to Statement of Profit & Loss.

Cash-Generating Units(CGU's)

A Cash-Generating Unit is a smallest identifiable group of assets that generates cash inflows that are majorly independent of the cash inflows from the other assets or group of assets.

Sometimes, it become difficult to estimate the value for an individual asset, specifically in the calculation of Value in Use and Recoverable Amount, because cash inflows and cash outflows cannot be attributed to the individual assets. Thus, it generates the need of formation of CGU's.

CGU's should be identified constantly from time to time for the same of type of asset unless any change is identifiable.

If there is any active market exists for the output produced by the asset or group of assets, then such asset or group of assets should be identified as a Cash-Generating Unit.

Goodwill Allocation & it's Impairment

Goodwill acquired in Business Combination generate cash flows on the basis of other acquired assets. Thus, it needs to be allocated to acquirer's CGU or group of CGU's that are expected to be benefitted from the synergies of combination. Goodwill allocation should:

• Represent the Lower Most Level within the organization at which goodwill is monitored for internal management purposes.

• Not be Larger than Operating Segment determined in accordance with IFRS 8 'Operating Segments'

The annual impairment test should be performed at any time during an accounting period, but must be performed at the Same Time every year.

When an impairment loss arises, goodwill is always written off first with any excess impairment allocated to other assets on Pro-Rata basis.

Allocating impairment loss to goodwill is further complicated by the choice in IFRS 3 Business Combinations to value the Non-Controlling Interest at Fair Value or at Proportionate Share of Net Assets.

Order of Allocating Impairment Loss in a CGU

• Against that specific destroyed or damaged assets, if been identifiable.

• Against Goodwill; then,

• Against all Non-Current Assets on a Pro-Rata Basis.

Illustration on Allocation of Impairment Loss

| A CGU consists following: |

$Million |

| Building | 30 |

| Plant & Machinery | 6 |

| Goodwill | 10 |

| Current Assets | 20 |

| 66 |

Because of Recession, Recoverable amount of CGU has been fallen to $50 Million. Allocate the Impairment Loss.

According to the above-mentioned order, impairment loss should be first charged to Goodwill and then on the Non-Current Assets on Pro-Rata Basis. Current assets will be stated at Fair Value and therefore, no impairment loss is allocated to them. After writing off Goodwill, balance of $6 million will be allocated on pro-rata over the total of $36 Million for the remaining Non-Current Assets.

| Carrying Amount | Impairment Loss |

Carrying amount - Post Impairment |

|

| Building | 30 | (5) | 25 |

| Plant & Machinery | 6 | (1) | 5 |

| Goodwill | 10 | (10) | - |

| Current Assets | 20 | (-) | 20 |

| 66 | (16) | 50 |

Accounting Treatment of Impairment Loss

• The asset's Carrying Amount should be reduced to Recoverable Amount in the Statement of Financial Position.

• Impairment loss should be immediately be charged through Profit and Loss unless asset has been revalued upward in which loss will be treated as a Revaluation Decrease.

Now depreciation will be charged on the basis of new carrying amount after when asset will be reflected to its Recoverable Amount.

Reversal of Impairment Loss

The annual assessment to determine impairment applies to all assets, including those assets which have been impaired in the past. Thus, it could happen that recoverable amount of the asset that has been previously impaired has been higher than its current carrying amount. This will lead to the scenario of 'Reversal of Impairment Loss'.

In such scenario, carrying amount should be increased to new recoverable amount by:

• If an asset is carried at revalued amount, then reversal should be accounted for as a revaluation increase (Applying IAS 16 'PP&E': Recognized in OCI and accumulated as a Revaluation Surplus in Equity)

• If an asset hasn't been carried at revalued amount, then reversal should immediately be recognized as Income in

Profit & Loss.

The asset cannot be revalued to a carrying amount that is higher than its value would have been if the asset had not been impaired originally, i.e. Depreciated Carrying Amount had the impairment not taken place. Depreciation will now be based on its new revalued amount.

An exception to this rule is for Goodwill. An impairment loss for goodwill should not be reversed in a Subsequent Period. (IAS 36: Para. 124).

For Instance:

Non depreciable asset with a carrying value of $500,000 having a recoverable value of $ 470,000 on December 31,2019. On December 31,2020, the recoverable amount has been increased to $ 520,000. What amount of reversal should be recognized?

$30,000 supposed to be recognized as carrying amount can be increased to amount recorded prior to the impairment.

Disclosures

• Events and Circumstances that lead to recognition and reversal.

• Impairment Loss recognized/reversed recorded during the current year.

• Discount Rate used to determine Value in Use

• In case of Segment Reporting, Impairment Loss recognized/reversed for Each Reportable Segment.

• Key Assumptions used in determining CGU's Recoverable Amount or Value in Use.

CAclubindia

CAclubindia