Series 1:

A. Loosening of financial conditions, adjustments in government spending and better coordination with States can spur a growth cycle

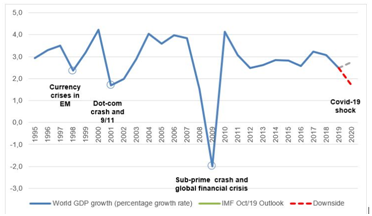

• India's pre-emptive lockdowns have saved many lives and may have reduced long-run economic costs of the Covid-19 crisis. But it necessitates a large stimulus to compensate for the short-run economic losses of the lockdown and to revive growth.

• Apart from medical supplies, the first measures aimed at helping workers and firms survive the large negative supply and demand shock.

• A phased opening now allows supply to recover while keeping the virus in check.As we think of a post-lockdown India, an interesting possibility manifests that can make a virtue out of a necessity.

B. Relaxing financial conditions

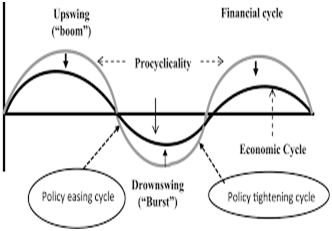

i. As supply recovers while commodity prices remain constrained, there is an opportunity to switch from the low credit and money growth that characterised India's post 2011 growth slowdown, to a credit-led recovery that also reduces the financial sector stress. Financial conditions can be relaxed, especially as essential structural improvements are adequate and over-tightening created stress.

ii. In India, credit growth has been pro-cyclical tending to follow and over-enhance rather than lead growth. Especially since 2011, pro-cyclical regulations and focus on financial cleaning and reforms squeezed credit growth. In an era when elsewhere in a world awash in cheap money, corporate and household debt was increasing apace, there was hardly any credit growth in India.

iii. The post Covid-19 macro-financial package could trigger a virtuous growth cycle, by raisingmarginal propensities to spend above those to save, as demand is kept a step ahead of gradual relaxation in supply constraints. Activating India's large domestic demand can potentially insulate from global shocks and a likely prolonged shrinking of trade.

iv. In India, credit growth has been very low, so a loosening of financial conditions can help asset values recover. Tightening following the excesses and scams of the post-global financial crisis period created a trust deficit. There were valid moves away from giving individual favours towards improving business conditions. But in a large external shock like Covid-19, aid from the government and regulators can apply balm to current as well as old wounds, revive trust and help society pull together once more.

Series 2:

C. Growth constraints

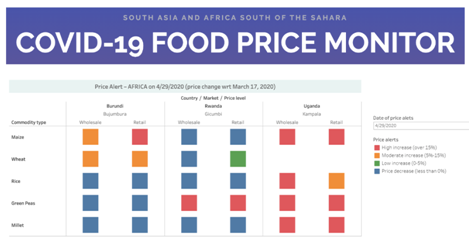

i. Among these constraints are commodity price shocks and other supply-side bottlenecks; financial repression, mono-culture and discretionary allocation; and fiscal space. Changes in the political economy of oil pricing, diversified sources of supply, and a secular fall in demand will keep oil prices soft. Structural improvements in agriculture will restrain food inflation, while flexible inflation targeting moderates the pass-through from commodity price shocks. Banks' net NPAs are in single digits, there is improvement in governance and in risk-based lending.

ii. In order not to overstrain government finances, stimulus should work through the financial sector, be targeted, temporary and self-limiting. Financing schemes will have to be designed to minimise impacts on future fiscal deficits, while maximising growth revival. Fiscal stimulus can be increased to the point where reduction in debt ratios due to increased growth equals the increase in debt ratios from further borrowing. Changing the composition of expenditure and cutting flab would enhance the growth boost.

iii. One reason for India's conservative polices was a fear of outflows. But size and diversity in a $2 trillion-plus economy creates much more depth and resilience. Growth matters more than other risks-even for rating agencies and spending to revive growth is acceptable, especially since every country is doing this. Despite this peer effect, emerging markets have to be more careful. If early pre-emptive action and effective follow-up makes India relatively less affected by Covid-19, inflows will resume.

iv. Reversal of the tightening of financial conditions that characterised the last decade will help the financial sector move forward. Critical complementary reforms include fiscal restructuring, better coordination with States, strengthening corporate governance, and counter-cyclical financial sector regulation.

D. Temporary, targeted measures

i. A seed fund can be leveraged many times. For example, credit guarantees are off-budget sheet items, and may not add much to debt as recovery takes place. Banks can be incentivised to not invoke them. If the guarantee is only partial, banks will lend, but rather continue to carefully assess credit risks.

ii. Wage/PPF subsidies and interest rate subventions should be targeted to MSMEs and the most affected sectors, and made conditional on preserving employment in the short-run, and upskilling and re-structuring over time. Transfers should only be to low income groups, combining tax and Aadhaar databases. All government payments due must be made and expenditure on the national infrastructure pipeline frontloaded. Movement to India's optimal tax structure of low rates and a large base must not be given up. Voluntary contributions for the Covid-19 effort must be encouraged from the well-off, especially the super-rich.

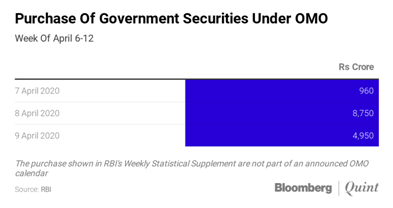

iii. The RBI can announce an OMO calendar and if necessary, finance special Covid-19 government bonds. These would take pressure off the bond markets, allowing interest rates to ease, while it is clear they are for a well-defined purpose and limited time. There is room to expand reserve money since broad money growth has been low for some time, and a monetary expansion that finances a growth recovery would not be inflationary. Firms that are not receiving payments are afraid of running out of cash and are hoarding liquidity. Since banks now only make risk-based lending, a government credit guarantee would be necessary for banks to undertake wider liquidity infusion. Even so, alternative direct liquidity channels may have to be established to reach those starved of funds.

iv. The crisis reveals longer-run supply-side opportunities and directions for change. Examples include a larger share of distance work, economising on fuel - the import of which has been India's weakness — and encouraging the digital economy, which is India's strength. Supply chains can be incentivised to shift from China. States that are the source of migration should think of packages to attract FDI, thus reducing out-migration, excess labour living precariously in large cities. While some firms will suffer irreversible balance sheet shocks, and may not recover, others such as pharma, digital businesses and home services will do well.

To enroll Business Economics (CA Foundation) subject of the author: Click Here

CAclubindia

CAclubindia