Now offline utility is available on the GST portal to enable matching of GSTR2B with the purchase register of the tax payer in order to avail the correct ITC. Before explaining this reconciliation it is important for us to understand as to what is GSTR2B and its significance. It may be noted that GSTR2B has not been notified yet though it is available on GSTN portal. It is expected to get notified in near future.

What is GSTR2B?

GSTR2B is basically an improvised version of GSTR2A. It is derived from the outward supply returns filed by the suppliers i.e. GSTR1 (normal supplier),GSTR5 (Non-resident taxable person),GSTR7 (ISD supplier). It will also have entries relating to imports from ICEgate portal and procurements from SEZ.

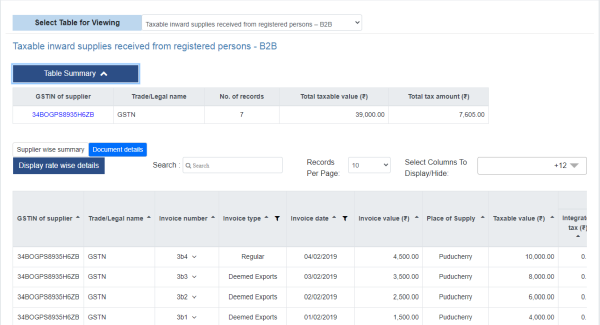

It will be a static statement which will be generated at 11.59 PM of 12th of the following month. For example, GSTR2B for the month of August will be locked at 11.59 PM on 12th of September. It will be same even if you see it in the month of December unlike GSTR2A which is dynamic it keeps on changing with every change made by the supplier. The GSTR2B can be viewed supplier wise or document wise and you can see the summary or detail.

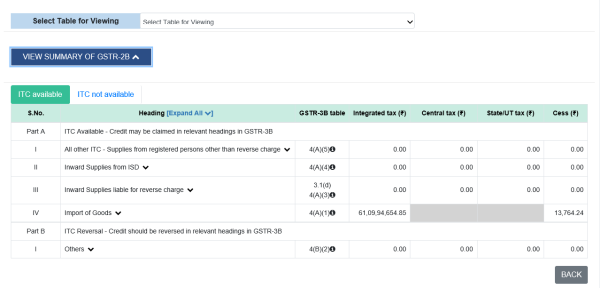

Further it will show if ITC is available or not available against each document. The non-availability will be seen from the point of time limit as specified under section 16(4) and the document GSTIN and POS are in same State but where the recipient is of another State (for example if taxpayer registered in Delhi avails hotel service in Punjab then hotel invoice will show CGST+SGST so this credit will not be available in Delhi).

The sample template of GSTR2B is shown below:

Summary

Detailed template - Table wise like B2B - (invoices, debit notes, credit notes) and amendments-

Reconciliation of Purchase register and GSTR2B:

There is Offline matching Utility available on the GSTN portal for this purpose. The steps for reconciliation are briefly summarized below-

- Download this Matching Utility Tool from the Portal (from Downloads > Offline Tools > Matching Offline Tool)

- Create your profile in the Utility.

- Download GSTR2B Jason file from the portal.

- Create excel file of your purchase register in the specified format.

- Upload purchase register in the Matching Utility

- Run Matching option

- It will show reconciliation of the register with GSTR2B by sorting records into fully matched, probable match, unmatched etc.

Please open this link below to see stepwise procedure & FAQs released by GSTN to carry out the reconciliation.

https://www.gst.gov.in/download/gstr2b

After the reconciliation you should take necessary actions on the unmatched items to ensure full availability of ITC.

It may be noted that that GSTR2B only facilitates availing the ITC but taxpayers have to ensure the correctness of ITC availed on self-assessment basis.

Disclaimer: The views in this article are personal of the writer and must not be construed as an advice.

CAclubindia

CAclubindia