SVB- Special Valuation Branch Of Customs" & Valuation Of Goods Imported From Related Party

It is common for a commercial establishment whether manufacturer or a trading concern to import raw materials, semi finished goods or finished goods from other countries. Import plays an important role in terms of availability of new technology, better quality goods, rate of goods etc.

2. Importing goods from various countries can be a part of corporate strategy which is mostly cost effective for a company having its branches / subsidiaries in various countries. The cost effectiveness and ease in dealing with a sister concern/ subsidiary often leads to special treatments given to each other.

Example: " Ram and Shyam are brothers. Ram has a car which he wants to sell. Shyam showed his desire to purchase that car for his use. Ram offered Shyam a price of Rs 1 Lakh for the car, being totally aware that he can sell the car in the open market for Rs 150,000/-. But because Shyam is his brother he wants to give him a special discount."

The discount given by Ram to Shyam is quite natural and is human phenomenon. The same behavior is often seen between the corporates who are related to each other may be as a Holding – Subsidiary, Sister Concern having one or more holding regulators etc. Therefore when ever these companies buy and sell goods with each other, the sale is done without adding any profit margin or not at normal market value. This is called an influence on the price of goods due to the relation between the companies/parties.

3. As far as pricing between the related companies is concerned it can be a part of corporate strategy, obligations or through an agreement. But from the perspective of Revenue department, this kind of business behaviour leads to evasion of taxes / duties.

Example: Indian Company ( Importer) who is importing a particular product from its parent company in JAPAN at an invoice value of $5000 and pays customs duty on the said value. But if that Indian concern or any other importer imports the same product from an unrelated supplier, then the invoice value would be $ 8000 and applicable customs duty is to be paid on $8000.

In the aforementioned scenario, the Customs, is losing customs duty on $ 3000 since the parties are related. To curb the loss of revenue and to deal with such kind of scenarios, the authorities developed a Specialized Investigation Branch of Customs. This branch of customs is called "SPECIAL VALUATION BRANCH OF CUSTOMS (S V B)".

4. As per Rule 2 (2) of Customs Valuation (Determination of Value of Imported Goods) Rules,2007 (Customs Valuation rules),persons shall be deemed to be "related" only if:-

i) they are officers or directors of one another's businesses

ii) they are legally recognized partners in business ;

iii) they are employer and employee;

iv) any person directly or indirectly owns, controls or holds 5 per cent or more of the outstanding voting stock or shares of both of them;

v) one of them directly or indirectly controls the other ;

vi) both of them are directly or indirectly controlled by a third person;

vii) together they directly or indirectly control a third person;

viii) they are members of the same family.

Apart from the above categories and as per the facts and circumstances of each case those who are having Collaboration Agreement, Technical Assistance Agreement or any other agreement / contract with the foreign supplier have to prove genuineness of their declared value before the Jurisdictional Commissioner or SVB.

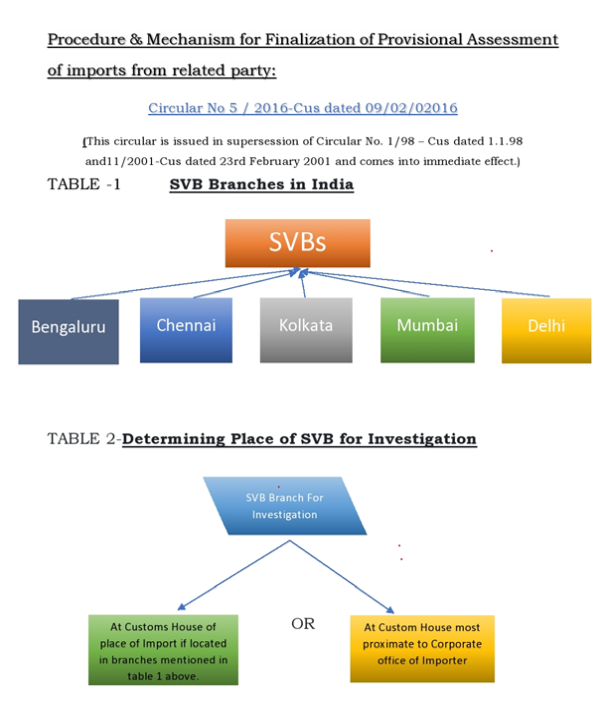

The SVBs are presently functioning at the Customs Houses at Bengaluru, Chennai, Kolkata, Delhi and Mumbai.In cases where the import takes place through Customs Houses of Mumbai / Delhi / Chennai / Kolkata / Bangalore, the importer is free to select the SVB of the Customs House of import or the Customs House most proximate to the corporate office, as convenient to him.

Whether the case require SVB investigation or not?

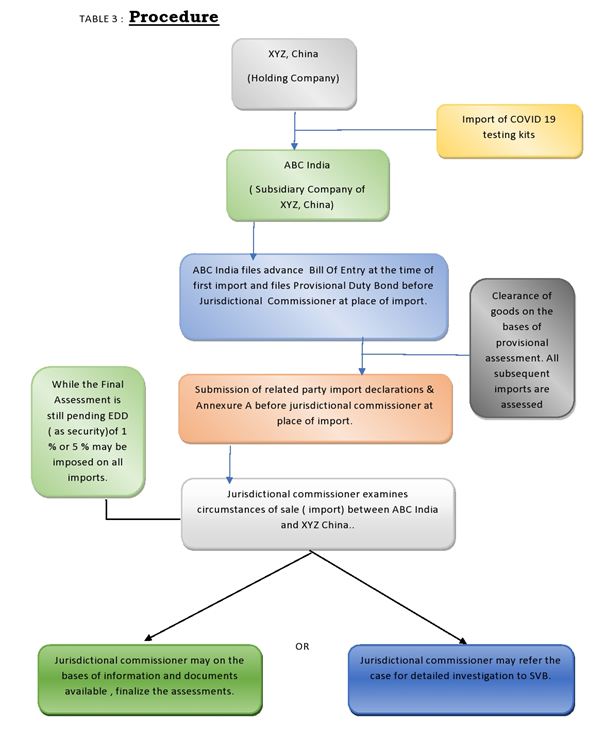

It is imperative on the part of the Importer to declare while filing Bill of Entry that the goods are being imported from a related party as it would be necessary for the Customs to examine whether or not the circumstances surrounding the sale of the imported goods indicate that the relationship has influenced the price. In such situation importers are advised that if their transaction falls in such a category they should, in so far as possible, file a prior bill of entry as provided under the second proviso to subsection (3) of section 46 of the Customs Act, 1962, preferably 15 days prior to the import. The clearing custom house may ask for PD Bond for such imports as it is generally presumed that such imports will be cleared on provisional assessment of the assessable value of the goods. If the prior PD Bond is not filed, the importer may face difficulties once the consignment has arrived at the port and end up in paying damages.

Submission of Annexure A before the Jurisdictional Commissionerate of Custom at the Place of Import.

After the importer declares the relation or while filing the bill of entry, he has to file prescribed Annexure A before the Commissioner of Customs or the concerned officer of the Customs House of Place of Import so as to enable such officer to determine whether, prima facie, there is a need for investigation by the SVB or not.

Decision of Jurisdictional Commissioner of place of import to refer or not to refer the case to SVB.

After taking and analysing the relevant information/ declarations submitted by the Importer under the related party import transaction, The Commissioner of the place of import can decide as to whether the case needs to be investigated by SVB or the assessment of such imports can be finalized by himself under rule 3 or 4 to 9 of Customs Valuation Rules, 2007.

Categories of cases where SVB investigation not required

The following cases are not to be taken up for inquiries by SVBs :

(i) Import of samples and prototypes from related sellers

(ii) Imports from related sellers where duty chargeable (including additional duty of Customs etc.) is unconditionally fully exempted or nil.

(iii) Any transaction where the value of imported goods is less than Rs 1 lac but cumulatively these transactions do not exceed Rs 25 lacs in any financial year

Procedure followed in Special Valuation Branch

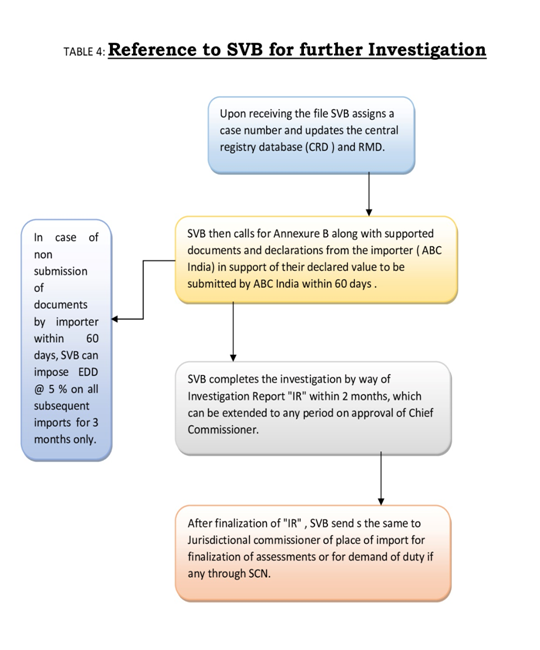

Upon receipt of all related records from the referring customs formation, the SVB shall forthwith assign a case number and update the Central Registry Database (CRD) maintained by DGoV. The SVB shall also inform the RMD of the details of the importer, his IEC code, and details of seller for inserting suitable instructions for assessing officers at all Customs Houses so as to ensure assessments during the currency of SVB inquiries.

Submission of Annexure B with relevant documents

SVB after receiving the reference from Commissionerate of Place of import, then call for other information, documents and declarations including prescribed Annexure B from the importer, and shall commence inquiries. The importer is also given suitable opportunity to submit all documents, declarations and evidence in support of the declared value.

Levy of Extra Duty Deposit (EDD) during pendency of SVB investigation.

The procedure and mandate of levy of EDD upon the importer while the case is pending before SVB investigation has been amended vide circular no 05/2016 Customs, wherein it is provided that no EDD shall be obtained from the importers in case the importer provides the documents and information required for SVB inquiries within 60 days of such requisition. But in case the importer fails to provide such documents and information within such stipulated time then EDD @ 5 % of the declared assessable value shall be imposed by the Commissioner for a period not exceeding the next three months. As the EDD is in the nature of security deposit the Importer has an option to pay EDD by way of cash deposit or a Bank Guarantee.

It is important to note here that vide the circular 05/2016 it has been very clearly specified that the EDD @ 5 % can not be imposed for a period of more than 3 months. But it is seen and observed many a times while dealing with various SVB branches across the country that the SVB investigations are kept pending even after providing all the information/ documents and EDD @5 % is being levied for period of more than 3 months till the time IR is finalized by SVB. Importers are advised to be cautious over this aspect and must try to provide all the required documents within stipulated time of 60 days to avoid payment of EDD @ 5 % for 3 months or even for more than 3 months. Importer must insist SVB to finalize the "IR" at the earliest because the burden of EDD is often overseen by the importers, which consequently reduces margin in the product and increases financial burden.

Key Circumstances / Factors to be examined during investigation.

The proper officer or SVB as the case may be, shall carefully examine the "circumstances surrounding the sale" and evaluate the case on the following parameters:-.

|

i. |

Has the importer declared the price of the goods imported is a "transfer price"? |

|

ii. |

What is the basis on which the price has been settled between the buyer & seller? |

|

iii. |

Has the price been settledin a manner consistent with the way the seller settles prices for sales to buyer who are not related to the seller? |

|

iv. |

Does the nature of relationship between the buyer and seller appear to influence the price? |

|

v. |

Is the information provided by the importer in terms of rule 3 (3) (b) able to demonstrate that the transaction is at arms length? |

|

vi. |

Are there any payments, such as royalty, licence fee etc., actually made or to be made, as a condition of sale of the imported goods, by the buyer to the seller, or by the buyer to a third party to satisfy an obligation cast by the seller? Are such payments included in the price actually paid or payable? |

|

vii. |

Whether any part of the proceeds of subsequent re-sale, disposal or use of the imported goods accrues, directly or indirectly, to the seller? |

|

viii. |

What is the nature of other payments, if any, made or to be made by the buyer as a condition of sale of the imported goods? |

|

ix. |

Has the importer entered into an Advance Pricing Agreementwith the Income Tax Authorities or obtained an Advance Ruling? |

|

x. |

Will the pricespaid or payable by the importer be settled with the seller at the end of a defined period by means of a debit note / credit note? |

|

xi. |

Is there any royalty and licence fee’ paid by the importer to the supplier or related party. |

|

xii. |

Whether the value of any part of proceeds of any subsequent resale, disposal or use of imported goods accrues to the seller? |

|

xiii. |

Whether any other payments are made or are contemplated to be made in future by buyer to seller as a condition of sale of imported goods etc.? |

There can be other determination factors to be examined by the officer on case to case bases such as nature of the imported goods, the nature of the industry itself, the season in which the goods are imported, and whether the difference in values is commercially significant.

Note: During the investigation by SVB, the transfer pricing reports of the importer company plays an important role because to determine the genuineness of import value, the declarations made by importer before transfer pricing authorities for declaring the values as arrived at arms length bases becomes the bases of submissions before SVB.

Time frame to complete the investigation.

As per the circular 06/2016 it is prescribed that the SVBs shall as far as possible, complete the investigations and issue its findings within two months from the date of receipt of information in Annexure B. But most of cases there is always a need to extend the time period due to detailed information sought by SVB and time taken by the importers to submit the same. Therefore where the enquiry is not complete in 2 months, the SVB seeks the approval of the jurisdictional Commissioner for such extended time period as is deemed necessary to complete investigations.

Completion of investigation and submission of "Investigation Report" ("IR").

Upon completing investigations, the SVB prepares an Investigation Report ("IR") with due approval of the Principal Commissioner/Commissioner, by incorporating all relevant facts, submissions made by the importer, investigative findings, grounds for acceptance or rejection of transaction value, and the extent of influence on declared transaction value, if any. The IR also includes all relied upon documents and is communicated to the referring customs station/appraising group and such other stations where imports have been provisionally assessed. A copy of the IR shall also be sent to the DGoV and concerned customs stations where imports of the importer are being finalized provisionally.

Finalisation of assessments

• Where under the findings in "IR", the declared value is found to be un influenced ( Rule 3 CVR 2007)

The customs stations where provisional assessments have been undertaken immediately proceeds to finalize the same. There will be no issuance of a speaking order for finalising the provisional assessments in such cases.

• Where as per findings in IR, the declared value is found to be influenced.

The Commissionerate at the custom station of the place of import shall issue a show cause notice creating demand of duty to the importer within 15 days of the receipt of the IR, under intimation to the concerned SVB. After the adjudication of such Show cause notice, the order so passed by the adjudicating authority is Order in Original and appeal lies under Section XV of the Customs Act against such order.

Validity of "IR" or Final assessment and Change in circumstances surrounding the sale post finalization of assessment. (Annexure C)

In the earst while regime of SVB investigations, the SVB order so passed was valid for 3 years and importers were required to renew the said order by declaring if there is any change in circumstances or even no change in circumstances.

At present vide circular 05/2016 Customs, the SVB no longer pass an order in original or an appealable order on its own, rather it finalizes an Investigation Report ("IR"), on the bases of which the Jurisdictional Commissionerate at place of Import finalizes the provisional assessments or passes adjudication order as the case may be. Such "IR" or final assessment or adjudication order is valid indefinitely unless there is change in circumstance of sale or terms and conditions of agreement between importer and his related party supplier. In such a case the importers are required to declare the same at the place of import in the prescribed format under Annexure C.

In all such cases, the proper officer at the place of import shall examine the transactions as per procedures laid out above and the jurisdictional Commissioner shall refer the matter to SVB, where required.

Closing notes: SVB investigations are being handled differently across the country and by different kind of professionals such as Charted Accountants, Lawyers and even by teams of CHA’s. It has been observed that SVB investigation requires specialized knowledge of Valuation Rules, relevant provisions Customs Laws, import transactions and understanding of the importance of the documents submitted before SVB. The basic documents which are required to be submitted are as under:

a. Copy of the Audited Financial Statements of at least 3 preceding financial years.

b. Transfer pricing declarations made by the importer Form 3CEB, and TP Reports for last few years.

c. All agreements with related parties.

d. Price list of products.

e. Back to back invoices of the imported products or cost certificates from supplier.

f. Advance Pricing agreements with CBDT.

Importer must be very careful in submitting the above documents along with other certificates and declarations asked for by SVB during investigations. Any wrong declaration or mistake on part of importer can be fatal leading to loading of the declared value of the imported goods in many folds. Such loading may lead to increased cost of import, reduced profits along with penalties and interest imposed upon the importer by the customs authorities.

We endeavour to discuss and write in our subsequent publications on the technicalities of various declarations, certificates and documents filed before SVB for the purpose of proving the genuineness of the declared value of the imports.

CAclubindia

CAclubindia