What is Form GST DRC-03?

FORM GST DRC-03 is a digital intimation of payment made by the taxpayer voluntarily or made against show cause notice issued by the department or in adherence to section 142(2) and 142(3) of CGST Rules 2017.

The tax officer is expected to verify the payment received from the taxpayer and if the amount paid falls short of the amount actually payable, they shall proceed to issue a notice in respect of such amount which falls short of. Accordingly, verification of DRC 03 payment is built in this module.

Eligible individuals can view & download the Form GST DRC 03 in PDF format.

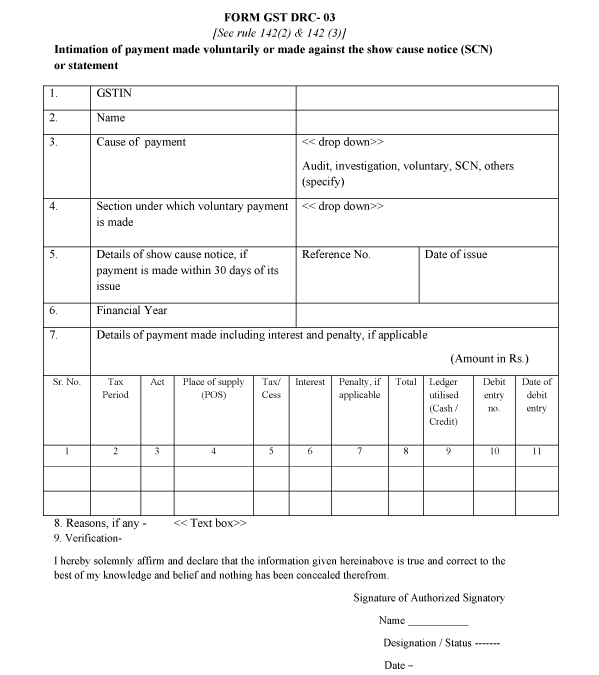

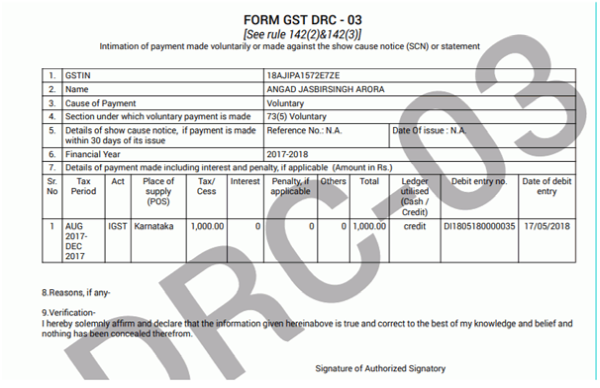

The format of Form GST DRC-03 looks like -

When a taxpayer is expected to make a payment through Form DRC-03?

- While making voluntary payment of outstanding liabilities u/s 73 and 74 of the CGST Act.

- A taxpayer can himself ascertain the tax before issuance of SCN or within 30 days of SCN determination to avoid the struggle of demand and recovery provisions.

You cannot make voluntary payment after 30 days of issue of SCN.

What are the pre-conditions to make voluntary payment?

The pre-conditions to make voluntary payment are:

- Make voluntary payment before the issue of SCN or

- If voluntary payment is made after the issue of SCN or statement then 30 days' time limit should not lapse since SCN is issued.

What is the procedure to file DRC-03?

There are mainly two steps to be performed to file DRC-03 Form -

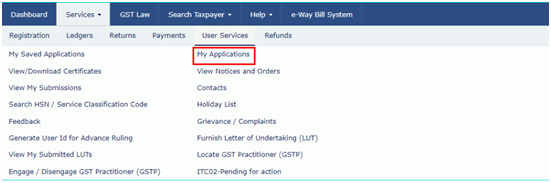

Step 1 - Login to GST Portal and then select User Services and go to MY Applications

Step 2 - There are three cases under which a taxpayer makes payment

Case 1: A taxpayer has not made any payment and does not have a payment Reference Number (PRN).

Case 2: A taxpayer has generated PRN but is unutilized and comes for payment within 30 minutes of the generation of PRN.

Case 3: A taxpayer has generated PRN and is unutilized and the taxpayer comes for payment after 30 minutes of the generation of PRN.

Steps to be performed in Case 1 are as follows

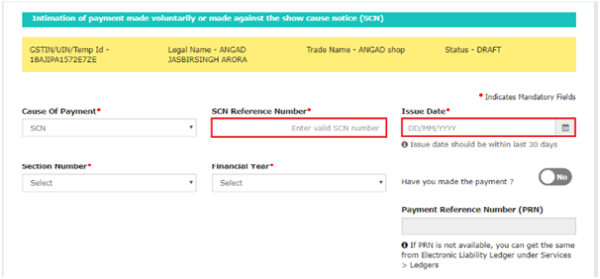

Step 1 - Select the Application Type as 'Intimation of Voluntary Payment - DRC-03' and then click 'New Application.'

Step 2 - A taxpayer will get 2 options:

Option 1: Voluntary payment: Payment date will be auto-populated without an option to edit.

Option 2: Payment against SCN: A taxpayer has to manually enter SCN Number and select the issue date which must be within 30 days of making payment.

To view your saved application, navigate to Services > User Services > My Saved Applications option.

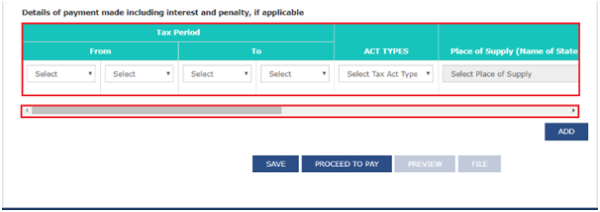

Step 3 - Choose the Section under which payment is being made, the Financial Year and then select the from date and to date of the overall tax period.

Step 4 - Taxpayer should provide details of payment including the amount of interest and penalty. A taxpayer can provide additional details by clicking on 'Add'.

Then click on 'Proceed To Pay'.

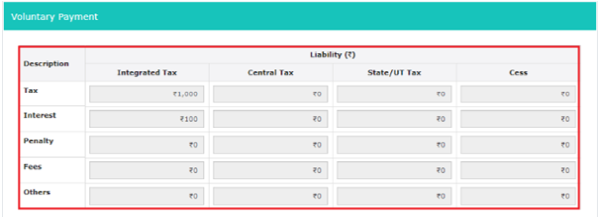

Step 5 - Voluntary payment page will be displayed which will be divided into 3 sections:

Liability Details: Liabilities are displayed in this table.

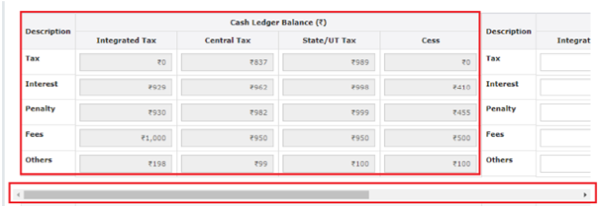

Cash Ledger balance: The cash balance available as on a particular date is reflected in this table. The taxpayer has to enter the value of cash to be paid from the available balance against outstanding liabilities.

Credit Ledger balance: ITC available as on date is reflected in this table. The taxpayer has to enter the value of the liability to be paid through ITC and click Set Off.

Step 6 - A confirmation message will pop up on the screen showing the balance of cash and ITC which is being used for making payment.

By clicking 'Ok', a PRN will be generated along with a successful payment message.

If PRN is not available, it can be extracted from the 'Electronic Liability Register' under Services>Ledgers>Electronic Liability Register.

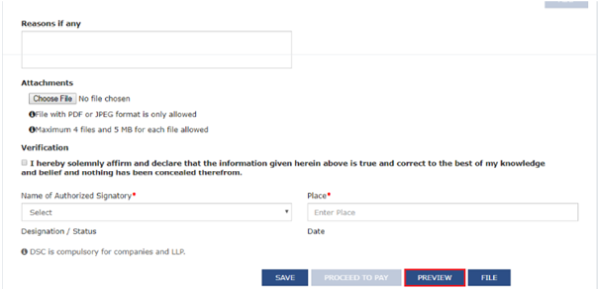

Step 7- There is a facility to view the draft DRC-03.

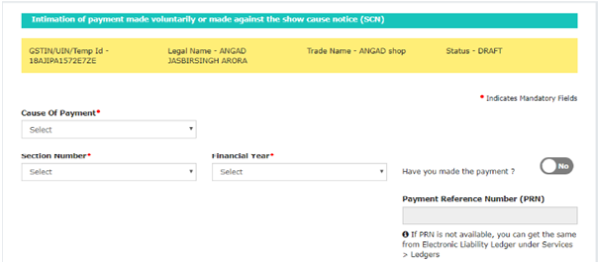

Click the 'Preview' button on the page-'Intimation of payment made voluntarily or against SCN'.

Step 8 - Provide reasons if any, in the field provided. Choose a file in the attachments section to upload. Click on the verification checkbox and then select the 'Authorised Signatory' and enter the 'Place'.

Step 9- Click on 'File'. Then two options will be available:

- Option 1 - File with DSC: Browse the certificate and click on the button 'sign'.

- Option 2 - File with EVC: An OTP will be sent to the registered mobile number and email ID. On validation of OTP, a success message will be received along with ARN.

Steps to be performed for Case 2

Step 1 - Follow the steps as mentioned in Case 1 till the taxpayer reaches on Intimation of payment made voluntarily or against the SCN page.

Step 2 - Select 'Yes' for the option of Have you made payment? By entering the PRN.

Step 3 - A link like 'Get payment details' will be displayed. Once the taxpayer clicks on it, details will be auto-populated on the basis of the respective payment that was made.

Step 4 - Click on 'Preview' to view draft DRC-03 and then follow the same steps to file the application as mentioned in Case 1.

Steps to be performed for Case 3

Step 1 - Follow the steps as mentioned in Case 1 till the taxpayer reaches on Intimation of payment made voluntarily or against the SCN page.

Step 2 - Select Yes for the option - Have you made payment? and enter the PRN.

Step 3 - A link, known as 'Get payment details' will be displayed. Click on the link and enter the details, since the details will not be auto-populated as mentioned in Case 2. This happens because the time limit of 30 minutes has passed.

The processing will happen in the Back end, wherein the system will check whether the amount entered by taxpayer matches with the payment made. If yes, the intimation form will be accepted. If no, an error message will pop up.

Step 4 - Then follow the same steps as mentioned in Case 1 for filing the application DRC-03.

For Case 2 and Case 3 if the PRN is already utilized, an error message will be displayed asking the taxpayer to enter the unutilized PRN.

Where to report cash payments in GST returns?

Cash Payments in various GST returns are shown in the below manner:

| GST Return/Application | Electronic Cash Ledger |

| GSTR-3B(Monthly Return) | Electronic cash ledger is an e-wallet. All payments made in cash/bank are reflected in this ledger. A taxpayer can first utilize his balance in ITC to pay tax liabilities. If the liabilities are greater than the balance in ITC, the same has to be paid in cash. |

| GSTR-9 (Annually) | Any balance tax liability if not paid while filing GSTR-3B needs to be paid while filing GSTR-9. Available balance in electronic cash ledger is used to make payment of outstanding liabilities. In case, the liabilities are higher than the available cash balance, a challan has to be created for making additional cash payment. |

| In case of demand notices | In case of demand notice, payment can be made by utilizing ITC and balance cash available in the Cash Ledger. The remaining liability needs to be paid in cash by creating additional cash challan. Interest and Penalty need to be compulsorily paid in cash. A proper officer will issue an acknowledgement in Form DRC-04 regarding the payment made in Form DRC-03 and the proceedings will be concluded by the Officer by issuing an order in Form DRC-05. |

Is partial payment allowed against a liability raised in an SCN?

GST Portal does not allow for making partial payments against a liability raised in an SCN. Complete payment of the amount being demanded in SCN has to be made by the taxpayer.

What will happen after Form GST DRC-003 is filed?

Once the form is successfully filled, the electronic liability register, electronic cash ledger and electronic credit ledger will automatically get updated. The entries will be posted and the PRN will get created automatically.

CAclubindia

CAclubindia