Table of Contents

Budget Update

|

As per the Budget 2024 update, the revised TDS threshold for interest income under Section 194A is: Senior Citizens – ₹1,00,000 TDS is deducted only if interest exceeds the threshold. Senior citizens can avoid TDS by submitting Form 15H if total income is below the taxable limit. |

What are Form 15G and Form 15H?

Form 15G and Form 15H are self-declaration forms that can be submitted by individuals to their banks or financial institutions to request exemption from tax deduction at source (TDS) on interest income earned from fixed deposits, recurring deposits, and other investments.

| For individuals below 60 years of age | Form 15G |

| For senior citizens above 60 years of age | Form 15H |

When to submit Form 15G/15H?

Form 15G and Form 15H needs to be submitted at the beginning of each financial year, i.e., in the month of April, if an individual expects to earn interest income exceeding for individuals Rs. 40,000 and for senior citizens Rs. 50,000 during that financial year and wants to request exemption from TDS on that income. The form is valid for the entire financial year and needs to be submitted separately for each financial year if the individual continues to meet the eligibility criteria.

Apart from banks where Form 15G/15H can be submitted?

In addition to banks, Form 15G/15H can also be submitted to other financial institutions such as post offices, on EPF withdrawal, income from corporate bonds, LIC premium receipts, Insurance Commission, companies, and other entities that are required to deduct TDS on interest income.

How to Fill Form 15G and 15H

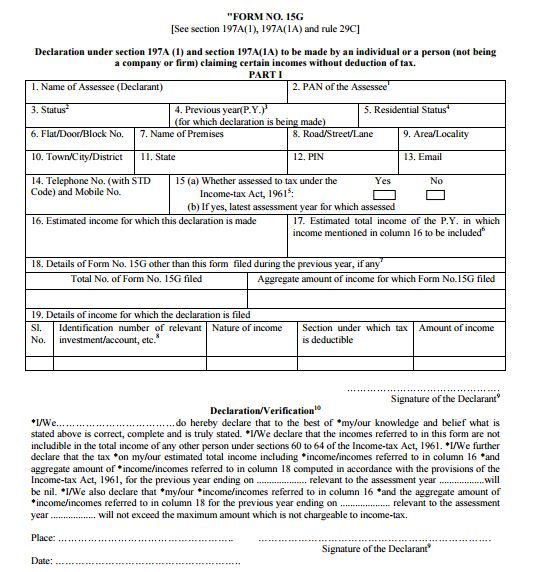

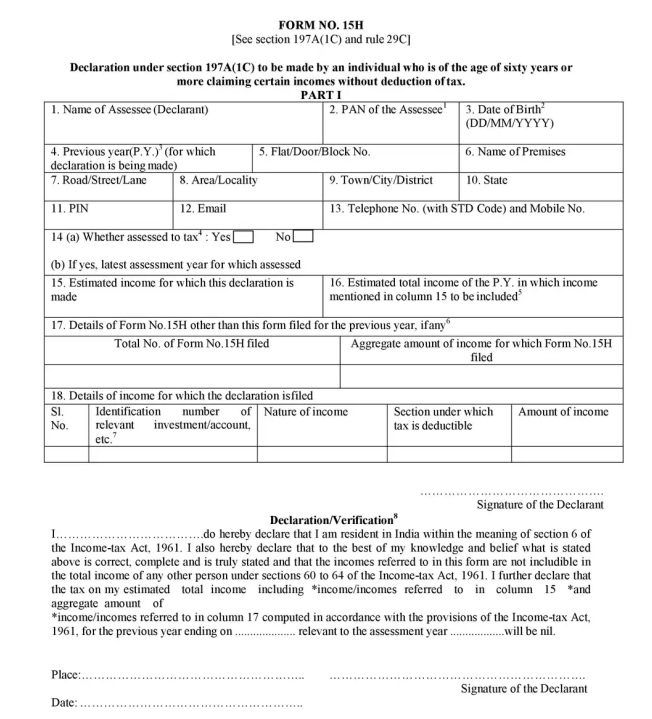

To fill Form 15G or Form 15H, an individual needs to provide their personal details such as name, address, PAN, and assessment year for which the form is being submitted. They also need to declare that their estimated total income for the financial year and provide details of the investments on which they expect to earn interest income.

The forms can be submitted physically or electronically, and the individual will receive a Unique Identification Number (UIN) upon electronic submission. If an individual has multiple deposits across different branches or banks, they will need to submit the forms at each branch before the first interest installment is paid.

If the forms are submitted after the first interest installment has been paid, the bank may deduct TDS but will provide a TDS certificate at the end of the year, which the individual can use to claim a refund while filing their income tax return.

Eligible Criteria for Submission of Form 15G & 15H

The criteria for submission of Form 15G and Form 15H are as follows:

- Form 15H is for individuals who are 60 years of age or above, while Form 15G is for individuals below 60 years of age, trusts, and Hindu Undivided Families.

- Non-resident individuals and companies cannot submit these forms.

- The age limit for eligibility may vary across different banks and financial institutions and is not a universal criterion.

- These forms need to be submitted at the beginning of each financial year if the individual expects to earn interest income exceeding Rs. 40,000 during that year and wants to request exemption from TDS on that income.

- The forms can be submitted physically or electronically, and the individual will receive a Unique Identification Number (UIN) upon electronic submission.

Form No.15G Format

Form No.15H Format

CAclubindia

CAclubindia