When taxpayers are involved in making payments to Non-Residents, they shall comply with the provisions of income tax which requires the taxpayers to file Form 15CA and 15CB as applicable.

Why should Form 15CA and Form 15CB be filed?

Section 195(6) made mandatory to file Form 15CA and 15CB as applicable.

According to Section 195(6):

- The person responsible for paying any sum to a non-resident,

- whether or not chargeable under the provisions of this Act,

- shall furnish the information relating to the payment of such sum, in such form and manner, as may be prescribed.

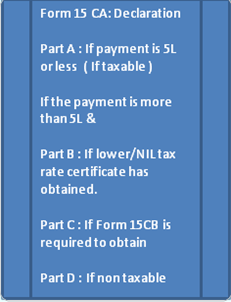

What is Form 15CA?

- It is a self-declaration by the payer.

- The purpose of the form is to capture the information and track the foreign outward remittances.

What is Form 15CB?

- It is a certificate to be obtained from the chartered accountant.

- The purpose of the form is to ensure compliance with TDS & DTAA provisions of Income-tax.

What are the Exemptions from the filing of Form 15CA and Form 15CB?

Form 15CA & 15CB is not required to be filed:

- For Payments listed in the Exempted list (Rule 37BB)

- For Payments by individuals which does not require RBI approval

Form 15CB is not required to be filed:

- if the payments do not exceed 5 lakhs

- if the payments are not subject to tax under income tax provisions.

Can I withdraw filed Form 15CA and Form 15CB?

- Form 15CA can be withdrawn within 7 days

- Form 15CB can not be withdrawn once filed

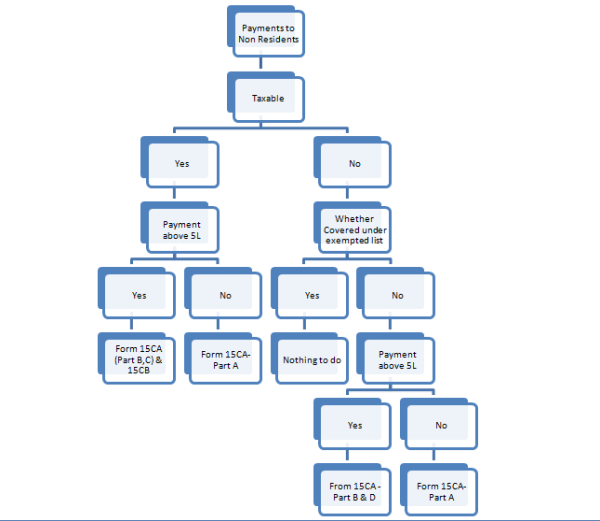

Form 37BB prescribes rules and procedure for filing Form 15CA and Form 15CB

The below chart explains when to file Form 15CA and Form 15CB as per Income Tax Rules 37BB

CAclubindia

CAclubindia