"Risks not taken are opportunities lost!!"

What is Financial Risk?

Financial risk is a risk that the company won't be able to pay back all of its debt. It basically means that the investors won't get their money back. It is one of the important factors that any shareholder or investor should consider before investing in any company because all companies in some or the other way are exposed to financial risk.

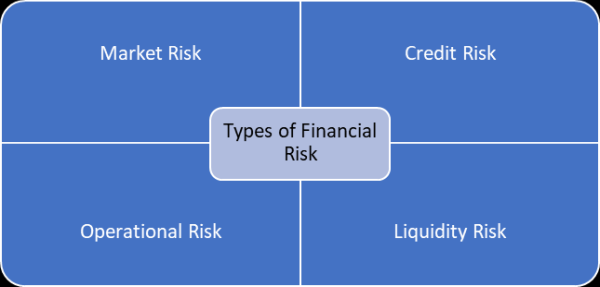

Types of Financial Risk.

- Market Risk: The risk a company is exposed to due to uncertainty prevailing in the entire financial market as a whole. It involves changes in interest rates, changes in equity prices, changes in foreign currency risks and changes in commodity prices It is difficult to hedge market risk using diversification as it affects the entire market.

- Credit Risk: It refers to risk where company's debtors fail to make required payments as per the contractual obligation. In simple terms it means that the lender is unable to recover the principal and interest amount that is owed by others which hampers smooth cash flows and hence the effective functioning and survival of the organization.

- Liquidity Risk: Liquidity is the ability to convert asset into cash at fair price in short duration to meet its short-term obligations. If any company is unable to do so then is experiencing liquidity risk.

- Operational Risk: It refers to potential losses a company faces while conducting its day-to-day activities due to failure in internal control or human error or some external event. Operational risk is a company specific risk that it doesn't affect the entire industry as a whole.

What is Financial Risk Management?

Risk management is not a process of completely elimination risk rather it is a process of mitigating and reducing risk which helps the organization to decide which risk it wants to take, which risk to avoid and which risk to hedge. Financial Risk management is the process of protecting the value of the company by using various hedging strategies to manage risk exposures. Like general risk management, financial risk management requires identifying it source, measuring it and addressing them.

Why is Financial Risk Management Important?

Financial Risk management benefits organizes in many ways like:

- Protect the firm's ability to attend to its core business and achieve its strategic objectives.

- Helps encourage equity investors, creditors, managers, workers, suppliers, and customers to remain loyal to the business.

- Reduce earnings volatility, which helps to make financial statements and dividend announcements more relevant and reliable.

- Risk management may reduce the cost of capital, therefore raising the potential economic value added for a business.

- To prevent another Global crisis like "The Financial Crisis of 2007-08"

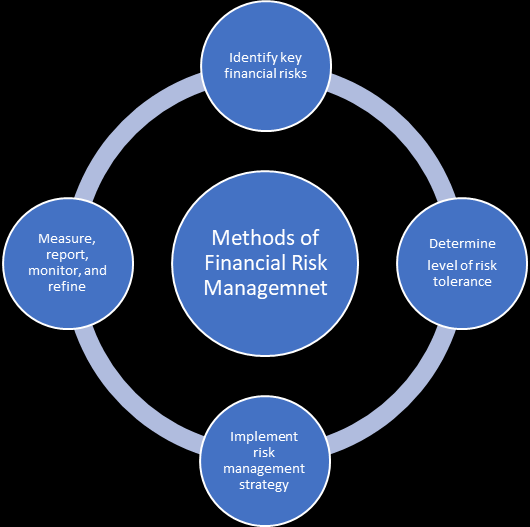

Methods of Financial Risk Management

Financial Risk Management is a continuous process as the market conditions are constantly changing which also affect the expectation of shareholders which affects the overall risk-taking capacity of the organization. Therefore, risk management process can be summarized as follow:

- Identify and prioritize key financial risks.

- Determine an appropriate level of risk tolerance.

- Implement risk management strategy in accordance with policy.

- Measure, report, monitor, and refine as needed.

Conclusion

Risk management is important in an organization because without it, a firm cannot define its objectives for the future. If a company defines objectives without taking the risks into consideration, chances are that they will lose direction once any of these risks hit home. The whole goal of risk management is to make sure that the company should only take the risks that will help it to achieve its primary objectives while keeping all other risks under control.

The author can also be reached at imsaloni22@gmail.com

CAclubindia

CAclubindia