INTRODUCTION

An e-way bill is an electronic form of way bill. Way bill is a physical document to carry the supply of goods. Under the past tax regime i.e. VAT consignment used to accompany by DELIVERY NOTE also known as way bill which was to be obtained from authorities which was a cumbersome process. So to remove this electronic e-way bill is passed. In this new system before moving the goods to recipient details of the transaction are given to tax authorities so that it can be tracked and verified easily.

Procedure to register for the e-way bill for registered persons

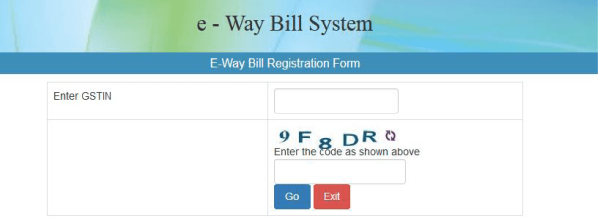

1. The user need to open the site http://ewaybill.nic.in and need to know the mobile number registered and GSTIN issued by department. After the screen appears click on E-WAY BILL REGISTRATION.

2. Then e-way bill registration form will open where GSTIN will be asked. Enter GSTIN and click GO. Other details like applicant name, trade name, address, mobile number will come automatically. Click on SEND OTP to get OTP on registered mobile. Enter the OTP and verify it.

3. Now to work on system applicant need to create unique USERNAME & PASSWORD of his choice. Username should be of 8-15 characters which should be alphanumeric and also contain special characters. The password should also be of at least 8 characters.

DISCLAIMER: The procedure for registration is as applicable to 3 states on which already GST EWAY BILL is implemented. It can further vary from state to state.

Procedure to register for the e-way bill for unregistered transporters

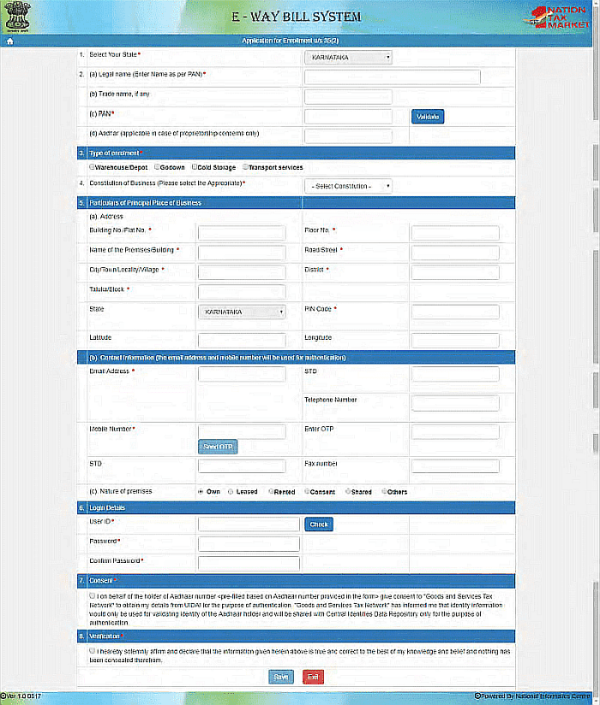

1. Un-registered transporter can't use the above method. He needs to use his business details. After that 15 characters transport id is made. He needs to provide PAN details, business type, business place, Aadhar.

2. Open e-way bill portal and select ENROLLMENT FOR TRANSPORTS option.

3. Enter the details as asked and create user id and password to which system generates TRANS ID which can be provided to clients to enter in e-way bill.

Rules relating to e-way bill are as follows:-

Information to be furnish before moving of goods

Every registered person who sends goods of value exceeding Rs. 50,000

• in relation to supply i.e. sale on consideration

• other than supply i.e. branch transfer or under barter system

• purchase from unregistered person

Shall before moving such goods furnish information online in part A of form GST EWB-01.

• If goods are supplied by principal to job worker as interstate then e-way bill need to be furnished by principal even if value is less than Rs. 50,000.

• If handcrafted goods even of less than Rs. 50,000 are send to other state by the person who is exempted from registration need to file e-way bill.

• Where goods are transported by registered person by consignor or the recipient of supply as consignee whether registered or not via own conveyance, hired, rail, air, vessel i.e. not by any transport company then details in part b of form GST EWB-01 need to furnished.

• Where goods are transported through the transporter by road then the registered person will furnish information in part b of form GST EWB-01 and e-way bill shall be generated by transporter on basis of part b information in part a of form GST EWB-01.

• E-Way bill can be generated even if consignment is less than Rs. 50,000.

• If goods are transported for distance of less than 10 km within state from place of business of consignor to place of business of the transporter for further transportation then supplier or transporter may not furnish details of conveyance in part B of form GST EWB-01.

• If seller is unregistered and the buyer is registered then the buyer is liable to file e-way bill if buyer is known at the time of commencement of the movement of goods.

• Where goods are transported by rail/air/vessel then e-way bill will be filled by consignor or consignee.

Generation of e-way bill

• First of all user has to open the e-way bill portal and login. Then the main menu list will open which has number of options of left hand side.

- E-Way bill- It has sub-options to generate, update, cancel and print the e-way bill.

- Consolidated e-way bill- It has options to consolidate the bill, update and cancel it.

- Reject- It has option to reject the e-way bill created by others if it does not belong to you.

- Report- It has option to generate various kind of report.

- Masters- It has option to create masters of users like customers, supplier etc.

- User Management- It has option for users to create etc. sub users to his business.

- Registration- It has option to register for SMS facility.

• Then user will select the option from above generate e-way bill in which user will enter the details as asked.

- User must have the information handy like invoice/bill/challan details and information related to transporter through whom goods will be moved.

- User need to select carefully the outward or inward transaction i.e. outward is when we are selling the goods and inward is when we are purchasing the goods. Accordingly other fields will appear.

- For outward supply in FROM section the supplier details are auto populated yet we can edit it and in TO section details of consignee are to be entered.

- For inward supply in FROM section details need to be filled by the user and in TO section details of recipient are auto populated yet we can also edit it.

- Transportation details and item details are to be entered carefully.

• After filling the details the request for e-way bill is submitted, this is validated and if any error is there the message appears. After validation e-way bill in form EWB-01 will be shown along with unique 12 digits number i.e. EBN which is made available to the supplier, recipient and transporter and then print out can be taken.

• Any transporter transferring goods from one vehicle to other need to update the vehicle number under e-way bill option in form GST EWB-01.

- User will select any one option from e-way bill no. or generated date or generator GSTIN

- User need to fill the updated vehicle no. (If by rail/air/ship then need to fill document no.) and other details carefully and also need to fill the reason for change.

- When validated it will be aligned with the e-way bill.

• If goods are transported for a distance of less than 10 km within state from place of business of transporter to place of business of consignee then there is no need of updation.

• After generation of e-way bill where multiple consignments are to be transported in one conveyance then the serial number of e-way bill generated in each such consignment and the consolidated e-way bill in form GST EWB-02 may be generated by him.

• If consignor or consignee does not generate e-way bill then transporter will generate in form GST EWB-01.

• If goods are not moved or not moved as per details then e-way bill may be cancelled electronically directly or through centre notified by commissioner within 24 hours of generation. But if verified in transit then no need of cancellation.

• Select cancel option from e-way bill option. Fill EBN and give reason for cancellation.

• Once cancelled it becomes illegal to use it.

Validity of e-way bill generated

Distance Validity

Upto 100 km: For 1 day

For every 100 km thereafter or part: 1 additional day

• Commissioner may extend the period for certain category of goods as specified.

• If circumstances are of exceptional nature i.e. goods are not transported within valid period, the transporter may generate another e-way bill after updating details in part B of form GST EWB-01.

• One day will be counted from generation of e-way bill till completion of 24 hours.

• E-way bill generated in any state will be valid in every state or UT.

Acceptance of e-way bill generated

• Details of e-way bill generated shall be made available to the recipient if registered on common portal who will communicate his acceptance or rejection.

• If the acceptance or rejection is not communicated within 72 hours of the details being made available then it will be deemed to have been accepted.

Exemption from generation of e-way bill

• Goods transported are specified in annexure i.e. 154 items are notified like jewellery.

• Goods are being transported by non-motorized conveyance.

• Goods are transported from port, airport and air cargo complex and land custom station to an inland container depot or container freight station for clearance by custom.

• Goods are being moved to areas which are being notified by concerned state.

Documents & devices to be carried by a person in charge of a conveyance

• The person in charge of a conveyance shall carry

- Invoice or bill of supply or delivery challan and

- Copy of e-way bill or EBN physically or mapped to a radio frequency identification device embedded on to conveyance as notified by commissioner.

• Registered person may obtain an invoice reference number by uploading a tax invoice issued in form GST INV-1 & produce the same for verification in lieu of tax invoice and this shall be valid for 30 days from date of uploading.

• On the basis of above information, the information in form part A OF FORM GST EWB-01 will be auto populated.

Inspection and verification

• Physical verification of conveyance can be carried out by proper officer after approval from commissioner or an officer empowered by him.

• Summary report of every inspection of goods in transit need to be recorded online by the proper officer in part A of form GST EWB-03 within 24 hours of inspection and final report in part B of form GST EWB-03 within 3 days of inspection.

• Once physically verified further no verification will be done unless specific information relating to evasion of tax done after verification is obtained.

• Where vehicle is intercepted and detained for a period exceeding 30 minutes, transporter may upload the information in GST EWB-04.

CAclubindia

CAclubindia