Executive Summary

The world around us is witnessing a spate of changes. The forces of globalisation, internationalization of business, outsourcing and competition from alternate service providers/offerings have led firms to dispense with the age-old belief that clients should accept whatever product quality and service level that they provide. With a wide range of service providers to choose from, customers would seek to forge long term relationships with only those vendors who can customize their product/service offerings to meet their requirements. Customer Relationship Management (CRM) then emerges as a tool that becomes relevant for firms in such a scenario. Effective usage of this would enable the firm to provide excellent client service and also possibly develop new business. This article explores the intricacies involves in the process.

Introduction

Nurturing relationship with existing as well as prospective clients is one of the most critical constituents of a firm’s success strategy today. Customer Relationship Management (CRM) as a concept has been in vogue for quite some time. As per the latest enterprise software forecast from Gartner, the CRM industry globally is a $ 20.6 billion industry today and is likely to grow @ 15% to $ 36.5 billion by the year 2017. The leading players are Microsoft CRM, SAP AG, Salesforce.com Inc, Oracle etc

CRM perse is designed to maximize sales and increase customer satisfaction. It allows companies to track all the previous interactions with a customer and deliver the integrated information to the staff handling the client. This ensures that the customer’s core expectations are fully met in course of the interaction and also the firm gets a chance to potentially drive revenue by getting the client to buy complementary services and products.

However, CRM has not been implemented in a structured manner across most accounting and auditing firms in India. In other words, audit practitioners are in the business of relationships but have not taken CRM seriously. Since the business essentially hovers around ‘people profitability’, it is imperative that firms concentrate on this crucial dimension. This also assumes importance in wake of the new regulatory framework in India where the concept of ‘firm rotation’ will make acquisition of new clients a strategic compulsion for accounting and auditing firms.

CRM essentially would hinge on three concepts that are applicable to a firm as it is to every other business owner:

a) It is cheaper to retain existing customers as against the cost of acquiring new ones.

b) The Pareto Rule: 80% of a firm’s business comes from 20 % of its customer base.

c) The most effective way to grow the firm’s revenues is through the referral route.

Through Customer Relationship Management (CRM), firms can nurture ‘smarter’ relationships with customers, learn about their preferences and develop trust. With every interaction with the customer, the firm can record information and learn. In other words, CRM revolves around the concept that the lifetime value of a customer is much greater than the single transaction. If the firm can learn from each transaction and interaction with its customer, it would be in a position to render superior service. Thus the form gets an opportunity to differentiate itself from competitors, secures a unique competitive advantage and thus is in a position to proactively manage, track, and leverage client and prospect communications.

How to get started

CRM can be defined as the firm’s digital nervous system. If the CRM system is properly designed, it can be integrated with the other components of the firm’s software systems such as time recording and billing, document management, and email management.

The firm’s managing partners can take advantage of CRM features in common desktop programs such as e-mail calendar alerts and Excel name and address lists or they can make use of a variety of CRM software packages. One could start off with something as traditional as a birthday calendar.

There is a common perception that CRM is an Information Technology (IT) tool. It needs to be clarified that IT is merely a necessary, but not sufficient, condition for achieving effective use of CRM. IT perse contributes little to creating better relationships with customers. Hence it acts as a mere facilitator. Rather, a firm can emerge with superior customer-relating capability depending on how it is able to build and manage its organization.

The firm adopts a mindset that its topmost priority is Customer Retention. Its employees adopt flexible and nimble solutions to meet accord customized solutions to clients. Information is the final component: relevant and detailed information about customers is available through Information Technology systems in all parts of the company.

Execution Strategy

In order to strengthen the bond with clients, the audit firm can use the Internet to reach out to its clients. Some of the possible steps it could follow are:

a) Using hard copy surveys or online sites such as Google forms or www.surveymonkey.com to get clients’ opinions on ways & means where it could improve its service offering

The firm could get itself rated from clients on the following parameters on a scale of 1 to 10 and use the feedback.

· How does the client perceive the firm’s performance to be?

· How easy is it to do business with the firm

· Does the audit team exhibit a friendly/strong rapport

· Do the team members adopt an innovative approach and solve problems on the client’s turf, for e.g. how constructive is the firm’s approach when it comes to solving real time accounting issues that have emerged in a particular client

· What is the quality of the firm’s documentation? Often, it the documentation is of a high quality and easy to retrieve, the client may bank on the firm to trace some specific documents in course of a tax assessment.

· How does the client rate the technical expertise of the partners, managers as well as the junior team members? Are the seniors in the team Subject Matter Experts (SMEs)? Does the client feel that sensitive matters are handled adequately well? Is there someone in the team who is an expert on the particular business/industry, say, the telecom sector?

· Does the client perceive the fees to be high in relation to the value offered?

· Will the client reconsider the firm’s credentials for future business?

· Will the client recommend the firm to someone in his/her social circle?

Doing this would also make the client feel that the relationship is being viewed seriously by the firm and the ego appeasement always helps.

b) Set up an online system that facilitates online access to the financial accounts that the clients have with the firm and others.

This can be a great source of succor to the clients when urgent data retrieval needs emerge. This could be a situation where accounts in a particular branch of the client have got destroyed by fire and the client can retrieve key financials from this online system of the audit firm

c) Publish a permission-based e-mail newsletter.

In a bid to have a Top-of-mind awareness (TOMA) of the firm’s brand, the firm could engage in sending newsletters which capture the latest developments in the regulatory domains such as IFRS, XBRL, Companies Act 2013 etc. This practice is already followed by the ‘Big Four’ accounting firm and certainly leads to enhancement of the brand perception. This could also highlight the upcoming due dates for filings such as TDS returns. Service Tax returns etc

d) Monitor news of their company or industry

Often bring out sectoral trends, such as analyzing the impact of the global recession on the client’s specific sector, in form of a customized report could go a great way in enhancing the strength of the relationship. For instance, a client in the steel sector, especially a Small & Medium Enterprise (SME), will greatly value a report sent by the firm which captured the global dynamics of the industry in the current crisis, trends and forecasts and key mitigation strategies to manage the risk. This report could also capture the key moves of competitors as well as their financial performance

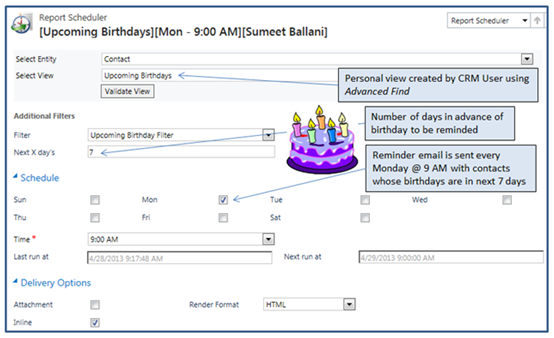

e) Birthday/Anniversary Reminders

(Source: Microsoft CRM)

Imagine a scenario of having a potential client. Sending a birthday greeting could be an effective mechanism to connect on the emotional front. Same holds good for a key existing relationship. Automated softwares and applications that are a core of a CRM package can help a firm immensely in these. The firm can take advantage of the scheduler packages to define the list of contacts to whom birthdays/anniversary needs to be sent, number of days in advance of the event for the reminder etc.

Some of the compelling benefits that can accrue to a firm from the CRM initiative are:

1) “One firm concept”

Normally it is a specific partner of an audit firm who services the client would be having an intimate knowledge of a client’s business needs, history and personal preferences. CRM would facilitate a transition in that anyone who works on that account can access information on everything pertaining to that client- from the client’s annual revenues to the names of the CEO’s children. This, therefore makes goodwill tangible, and thus emerges as a firm succession planning tool.

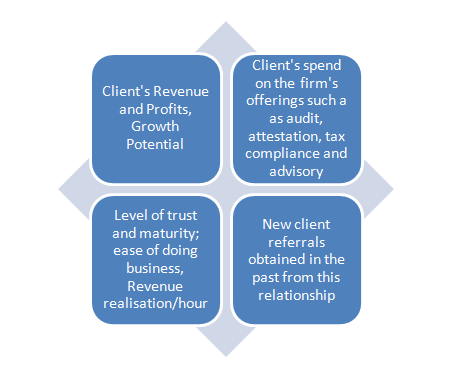

2) Measuring relationship capital & focused nurturing of relationships

The firm is able to analyse as to which are the key relationships to focus. The Pareto Rule is of utmost importance here. 80% of the firm’s revenues accrue from 20% of its clients. These are the crucial clients to focus. Once the clients are mapped on the relationship matrix, such a

If the firm adopts a ‘relationships-as-assets’ approach, it can priorities and focus on which clients it has to focus on. If the firm can make a realistic assessment of which clients are the true long-term assets, it will contribute to value creation.

Let us consider multiple scenarios

a) A client that offers large volumes and complex work becomes important right away. On the contrary, some clients are not interested in a long-term relationship.

b) A client may not want a long-term relationship or the firm would have to spend a disproportionately high amount of investment to get a mature relationship and thus it would be a futile exercise

c) A client may render high margins but its business model is risky, controls are always weak and thus the risk adjusted audit revenues may not be worth it.

d) A client may directly compete with other clients , say two major FMCG players and the firm has to choose who to partner with

Thus the detailed customer evaluation during the CRM exercise would really help in generating value for the firm.

3) Emergence as a one-stop solutions provider

The firm gets business on a repeated basis from the client as well as new lines of business. For instance, a client who is extremely satisfied with the Audit & Assurance function of a firm may also then also consider it favorably for Direct & Indirect taxation advisory services. Under the LLP concept, we will soon have multi-disciplinary firms where Chartered Accountants, Company Secretaries and LLs would work under the same roof. Promoting Customer Relationship Management

4) Client Referrals

Under Clause (6) of Part 1of the First Schedule of the Chartered Accountants Act, 1949, “Practising member prohibited from soliciting clients or professional by circular, advertisement, personal communication or interview or by any other means.”

Hence client testimonials and advocacy are one of the most effective ways to grow the practice, especially when audit firms cannot go for aggressive business development initiatives under the existing regulations of ICAI.

Conclusion

A carefully planned and consistently implemented CRM initiative in a firm’s practice can yield returns of upto 400% over the full life cycle. If CRM is implemented, the firm has the tools to get a 360 degree view of a customer and can deliver more robust solutions to the existing client base. Improved service quality leads to nurturing of strategic relationships that can go a long way in increasing revenues through cross-selling and referrals.

References

CRM Systems: Necessary but not sufficient. REAP the benefits of customer management,” Journal of Database Marketing, March 2002, page 267

Microsoft CRM, Retrieved from:

About the Author

CA Anurag Singal is the founder of CA Job Portal http://www.cajobportal.com/. He has authored a book titled “Auditing Mantras for CA IPCC” (http://www.auditingmantras.com/). He can be contacted at anurag@auditingmantras.com and contact@cajobportal.com

CAclubindia

CAclubindia