What is a Credit Rating?

I am sure we come across this term more often than we think we do. Little do we know what this really means and what does it stand for.

So to put it in simple words, Credit rating is an opinion that is based on an assessment of credit-risk (credit risk is the risk of failure on part of the borrower to repay the loan). Credit rating is always for specific debt security or obligation, as on a specific date. It estimates the ability and the willingness of the obligator (the borrower) to repay the principal and the interest on the debt security in a timely manner. The entity that assigns the credit rating is called a Credit rating Agency.

Now it is important to understand that credit rating is a continuous process and as new information comes, an earlier rating may be revised. In general, a credit rating is usually for a specific instrument, however, some credit rating agencies undertake credit assessment of borrowers as a whole, for use by banks and financial institutions.

Why Credit Rating?

We can say that obtaining a credit rating serves a variety of purposes, firstly credit rating is required for many debt securities as per SEBI guidelines, and secondly, credit rating is also considered by prospective investors which may help the borrower to raise further capital in the future. For mutual funds and institutional investors, credit rating is a valuable input for their investment decisions. Credit rating is aimed to create confidence in the minds of the investors and develop the overall environment of investments in debt securities. Credit rating agencies also provide information about a country’s sovereign debt.

Different types of Credit rating can be listed down as follows

1. Banks and Financial Institutions ratings

2. IPO Grading

3. Issuer rating

4. Insurance/ CPA ratings

5. Infrastructure ratings

6. Sub-sovereign ratings

7. Fund credit Quality rating.

Any given risk assessment and quality assigned to debt security primarily depends on the following 3 factors

1. The issuer’s ability to pay,

2. The strength of the security owner’s claim on the issue, and

3. The economic significance of the industry and the market of the issuer

CREDIT RATING PROCESS

a. Request from the borrower and analysis: Whenever an issuer of debt security approaches the rating agency, a team of analysts interact with the management of the issuer and obtain relevant information for the credit rating process, namely historical performance, competitive position, business risk profile, strategies, financial policies, etc. Industry factors as well as the competitor's data are also considered for objective analysis.

b. Rating Committee: After a report is forwarded by the team of analysts, the Rating committee decides and allocates a credit rating as per its internal policies. Obviously, the issuer is nowhere involved in the assigning of the actual credit rating apart from providing useful information to the analysts.

c. Communication to management and appeal: The rating determined above is then shared along with the supporting date with the issuer. If the issuer does not agree with the rating, an opportunity of being heard is given to him and he may also be required to produce relevant additional data to support his case. The rating committee may review its decision although the rating may not change. The issuer may reject the credit rating assigned to the debt security and there is no requirement to disclose the rating to the public.

d. Pronouncement of the rating: If the rating decision is accepted by the issuer, the rating agency makes the public announcement of the rating.

e. Monitoring of the assigned credit rating: The rating agencies keep on monitoring the on-going performance of the issuer and the economic environment in which it operates. In cases where no change is required, the rating agencies carry out an annual review with the issuer for updating of the information required.

f. Rating watch: Based on the constant scrutiny, the agency may place rated security on a Rating Watch (possibility of movement in rating). If the rating is indicating a downgrade, then a full-scale review is carried out in order to confirm the change in rating.

g. Rating Scores: Comparative grades assigned for various levels of risk by some of the credit rating agencies in India is as follows:

|

---------------------- |

CRISIL |

ICRA |

CARE |

FITCH |

|

DEBENTURES |

||||

|

Highest Safety |

AAA |

LAAA |

CARE AAA (L) |

AAA (ind) |

|

High Safety |

AA |

LAA |

CARE AA (L) |

AA (ind) |

|

Adequate Safety |

A |

LA |

CARE A (L) |

A (ind) |

|

Moderate Safety |

BBB |

LBBB |

CARE BBB (L) |

BBB (ind) |

|

Inadequate Safety |

BB |

LBB |

CARE BB (L) |

BB (ind) |

|

High Risk |

B |

LB |

CARE B (L) |

B (ind) |

|

Substantial Risk |

C |

LV |

CARE C (L) |

C (ind) |

|

Default |

D |

LD |

CARE D (L) |

D (ind) |

|

FIXED DEPOSITS |

CRISIL |

ICRA |

CARE |

FITCH |

|

Highest Safety |

FAAA |

MAAA |

CARE AAA |

TAAA |

|

High Safety |

FAA |

MAA |

CARE AA |

TAA |

|

Adequate Safety |

FA |

MA |

CARE A |

TA |

(Above table only for illustration/ educational purposes and no advertisement is intended)

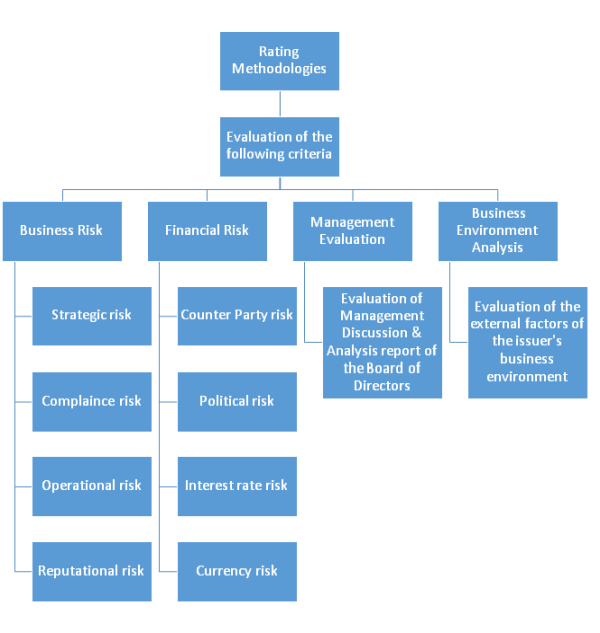

Credit rating methods involve the analysis of various data and information as given in the chart below:

Revision of Credit Rating

It is already clear that credit rating is a continuous process and it is always subject to certain amendments as and when relevant information comes to the issuer and the credit rating agencies.

SEBI has mandated all the rating agencies to continuously monitor the instruments rated by them throughout the life of those instruments, in order to protect the interests of the investors. In its circulars, SEBI has instructed the rating agencies to disclose the probability of default of a borrower in terms of various maturity periods, viz. 1 year, 2 year, 3 year maturities.

E.g if a bond is already redeemed by the company, there is no requirement of the credit rating for the bond and rightly so, the rating is withdrawn.

Limitations of Credit Rating

- In case there is a change in credit rating by the agency and investors are informed after a substantial period of time, the purpose of obtaining the rating is defeated.

- Since the rating agency receives its fees from the entity it rates, there is always a possibility of a conflict of business. This is because the rating market is competitive in nature and there is every possibility of a conflict of interest while entering into the rating system.

- There might also be situations where a rating agency receives a majority of its business from a particular group of companies which might affect the independence and the objectivity of the agency and the rating process.

- Transparency is also required with respect to the methods and assumptions and the methodologies by the rating agencies for an instrument.

Case Study: Credit rating agencies and the US Sub-prime crisis

Credit rating agencies have been highly criticized for understating the risk involved with new and complex securities like mortgage-backed securities (MBS) and collateralized debt obligations (CDO) that fueled the US housing bubble.

Between 2002 and 2007 an estimated $3.2 trillion in loans were made to homeowners with bad credit and undocumented incomes, such loans are called subprime mortgages. These mortgages were bundled into MBO and CDO securities that received high ratings and in turn, could be sold to global investors. Higher credit ratings were justified with over-collateralization (over and above the amount of loans given), credit default insurance (CDS), etc. Critics claim that the rating agencies were the parties who performed the magic that converted these securities from F-rated to A-rated. The banks could not have done what they did without the help of the rating agencies. Without AAA ratings, the demand for such securities would have been considerably less. Banks had to suffer losses to the extent of $523 billion.

The rating of such complex instruments was a lucrative business for rating agencies and therefore such companies enjoyed record profits and share prices. Rating agencies also competed with each other to rate particular MBS and CDO securities issued by investment banks which may have contributed to the lower credit rating standards and practices.

CAclubindia

CAclubindia