The Ministry of Corporate Affairs, via their announcement dated 15th October 2019, has released the Companies (Cost Records and Audit) Amendment Rules, 2019, due to the implementation of GST, other procedural changes and consequent revision of connected forms i.e. CRA-1 and CRA-3.

The Cost Audit represents the verification of cost accounts and a check on the adherence of Cost Accounting Standards.

The Companies Act, 2013 empowers the Central Government (CG) to make rules in the areas of maintenance of cost records by the companies engaged in specified industries, manufacturing of goods or providing services; and for getting such records audited under section 148 of Companies Act, 2013.

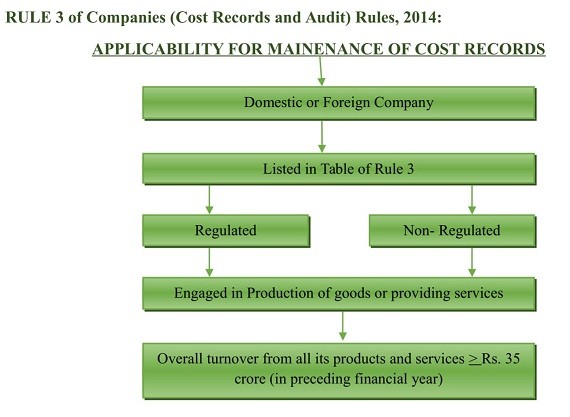

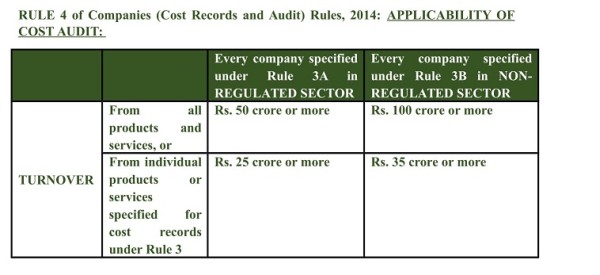

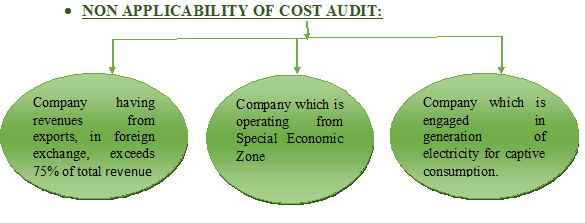

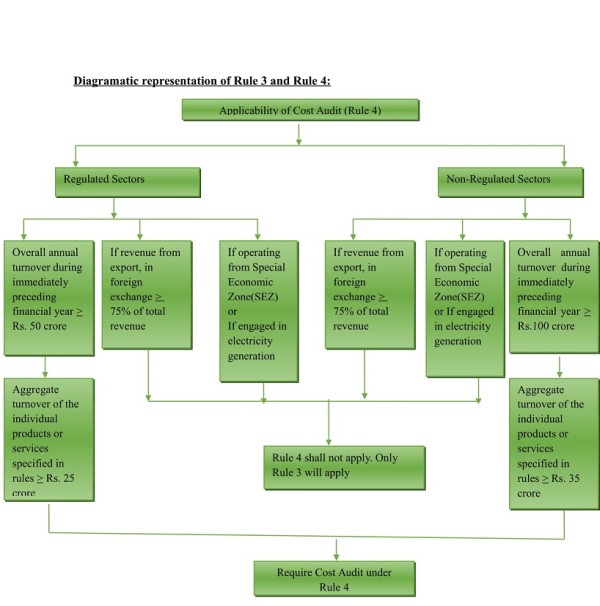

A brief diagrammatical analysis of provisions of Cost records and Cost Audit under Section 148 of the Companies Act, 2013 read with Companies (Audit and Auditors) Rules, 2014 and Companies (Cost Records and Audit) Rules, 2014 are as follows:

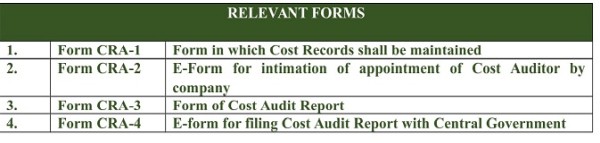

Cost Records [Section 148(1)]: The CG may direct to include the particulars of costs in books of accounts by the class of companies.(Rule 5 of Companies (Cost Records and Audit) Rules, 2014: Cost records shall be maintained in Form CRA-1).

Cost Audits [Sec.148(2)]: CG may direct to conduct audit of cost records of such class of companies having turnover or net worth as may be prescribed.

Cost Auditor[Section 148(3)]: Cost Audit shall be conducted by a Cost Accountant in practice who shall be appointed by the Board.

Auditor appointed under Sec.139 shall not be appointed for conducting cost audit.

Cost auditor shall comply with the cost accounting standards.

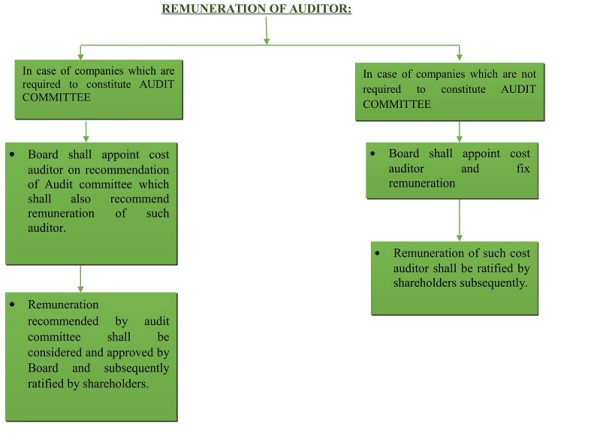

Rule 14 of Companies (Audit and Auditors) Rules, 2014:

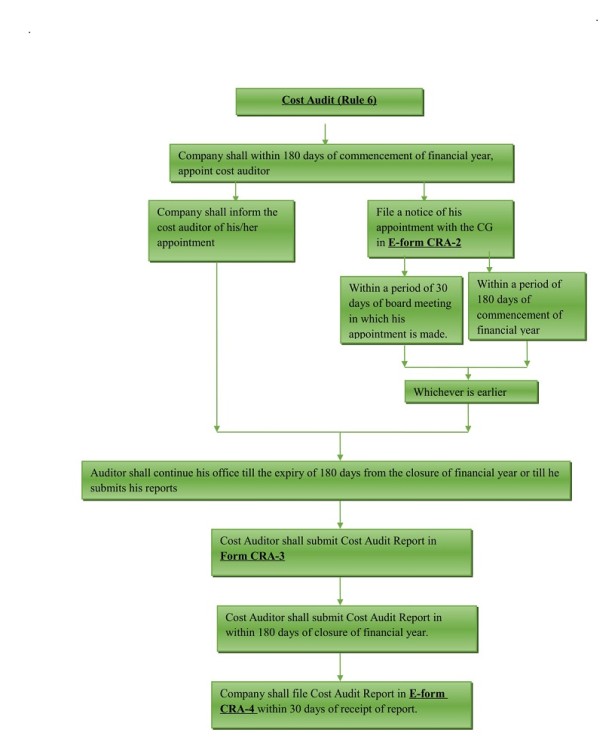

Rule 6 of the Companies (Cost Records and Audit) Rules, 2014: Cost Auditor shall submit a certificate as per Rule 6(1A).

- The company shall within 180 days of the commencement of every financial year , appoint cost auditor.

- The auditor shall be informed about his appointment and notice of his appointment shall be filed within 30 days of his appointment in Form CRA-2.

- Tenure of cost auditor: Every auditor shall continue his office till the expiry of 180 days from the closure of the financial year or till he submits his cost audit report.

- Removal of Cost Auditor: Cost Auditor may be removed before expiry of his term, through a board resolution after giving him reasonable opportunity of being heard.

- Casual Vacancy: Any casual vacancy of cost auditor whether due to resignation, death or removal, shall be filled by board of directors within 30 days of such occurrence and company shall inform CG in E-Form CRA-2 within 30 days of appointment of cost auditor.

- Signing of Cost Statements: Cost Statements to be annexed to the cost audit report, shall be approved by the Board of directors before signing on behalf of the board by any director, for submission to the cost auditor to report thereon.

- Cost Audit Report: Cost Audit Report shall be made in form CRA-3 and shall be forwarded to Board of Directors within a period of 180 days from the closure of the financial year.

- Filing with ROC: Cost Audit Report shall be filed in XBRL format within 30 days of receipt of report in E-Form CRA-4.

- Applicability of Sec.148(12): The provisions regarding disclosure of fraud by auditor in its Audit report under Sec.148(12) shall be applicable to Cost Auditor.

Section 148(4): Audit conducted under this section shall be in addition to the audit conducted under sec.143.

Qualification of Auditor [Section 148(5)]: Qualification, disqualification, rights and duties of applicable to auditor under this chapter shall be applicable to Cost auditor.

Cost Auditor shall submit its report to the board of directors of the company

ROC filing [Section 148(6)]: Company shall within 30 days of receipt of Cost Audit Report, shall furnish report with Central Government in E-form CRA-4.

Additional explanation [Section 148(7)]: After considering the cost audit report under this section, the CG may ask for further information and explanation from the company.

Penalty[Section 148(8)]: Penalty under this section shall be same as prescribed under Sec. 147.

CAclubindia

CAclubindia