INTRODUCTION

While there may be no single universally accepted definition of Corporate Social Responsibility (CSR), each definition that currently exists underpins the impact that businesses have on society at large and the societal expectations of them. Although the roots of CSR lie in philanthropic activities (such as donations, charity, relief work, etc.) of corporations, globally, the concept of CSR has evolved and now encompasses all related concepts such as triple bottom line, corporate citizenship, philanthropy, strategic philanthropy, shared value, corporate sustainability and business responsibility.

CSR in India has traditionally been seen as a philanthropic activity. And in keeping with the Indian tradition, it was an activity that was performed but not deliberated. As a result, there is limited documentation on specific activities related to this concept. However, what was clearly evident that much of this had a national character encapsulated within it, whether it was endowing institutions to actively participating in India’s freedom movement, and embedded in the idea of trusteeship.

As some observers have pointed out, the practice of CSR in India still remains within the philanthropic space, but has moved from institutional building (educational, research and cultural) to community development through various projects. Also, with global influences and with communities becoming more active and demanding, there appears to be a discernible trend, that while CSR remains largely restricted to community development, it is getting more strategic in nature (that is, getting linked with business) than philanthropic, and a large number of companies are reporting the activities they are undertaking in this space in their official websites, annual reports, sustainability reports and even publishing CSR reports.

India is the first country in the world to have a regulatory framework for CSR by law. The Companies Act, 2013 has introduced the idea of CSR to the forefront and through its disclose-or-explain mandate, is promoting greater transparency and disclosure. Schedule VII of the Act, which lists out the CSR activities, suggests communities to be the focal point. On the other hand, by discussing a company’s relationship to its stakeholders and integrating CSR into its core operations, the rules suggest that CSR needs to go beyond communities and beyond the concept of philanthropy.

CSR in India tends to focus on what is done with profits after they are made. On the other hand, sustainability is about factoring the social and environmental impacts of conducting business, that is, how profits are made. Hence, much of the Indian practice of CSR is an important component of sustainability or responsible business, which is a larger idea, a fact that is evident from various sustainability frameworks.

APPLICABILITY & COMPLIANCE REQUIREMENTS

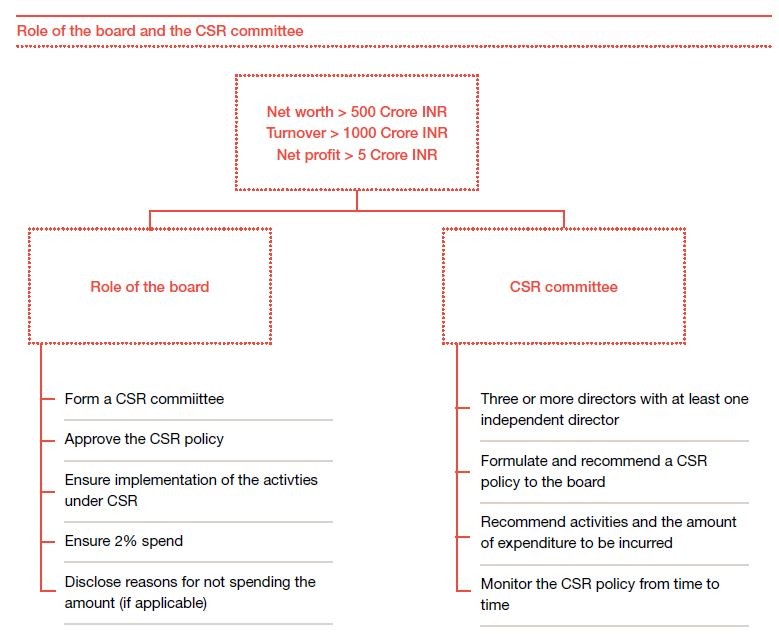

Every Company including its holding or subsidiary, and a foreign company (as defined under section 2(42) of the Act) having its branch office or project office in India, which fulfils the criteria specified under section 135(1) of the Act shall comply with the provisions of section 135 and the Rules.

Criteria given under section 135(1) of the Act, which provides, during any financial year, a company is either having:-

- Net worth of Rs. 500 Crores or more; or

- Turnover of Rs. 1,000 Crores or more; or

- Net profit of Rs. 5 Crores or more.

Every company which falls under the criteria mentioned under section 135(1) shall:-

- Constitute a Corporate Social Responsibility Committee of the Board (CSR Committee);

- Formulate Corporate Social Responsibility Policy (CSR Policy);

- Spend, in every financial year, at least two percent of the ‘Average Net Profits’ of the company made during the three immediately preceding financial years, in pursuance of its CSR Policy;

- Include in Board’s Report (pertaining to financial year commencing on or after 1st April 2014) an Annual Report on CSR, containing particulars specified under the Rules (In case of foreign company, the balance sheet shall contain an annexure regarding report on CSR) .

- Display the contents of CSR Policy in Board’s Report and also place on company’s website, if any.

The company shall give preference to the local area and areas around which it operates, for spending the amount earmarked for the CSR Activities.

CSR Committee of Board shall consist of three or more directors, out of which at least one director shall be an independent director. However, there are following exemptions:

- An unlisted company or private company [not required to appoint an independent director pursuant to section 149(4)] shall have CSR Committee without such director.

- A private company having only two directors shall constitute CSR Committee with two such directors.

- CSR Committee of a foreign company shall comprise of at least two persons of which one shall be a person authorised to accept any notice or other documents from Registrar and another person nominated by the foreign company.

CSR: PLANNING AND STRATEGISING

Clause 135 of the Companies Act, 2013 requires a CSR committee to be constituted by the board of directors. This is an excellent starting point for any company new to CSR.

Functions of Committee:

- Formulate and recommend to the Board CSR Policy indicating activities to be undertaken (as specified under Schedule VII to the Act).

- Recommend amount of expenditure to be incurred on CSR projects, programs or activities (CSR Activity).

- Monitor CSR Policy from time to time.

- To ensure that all the income accrued to the company by way of CSR activities is credited back to the CSR corpus.

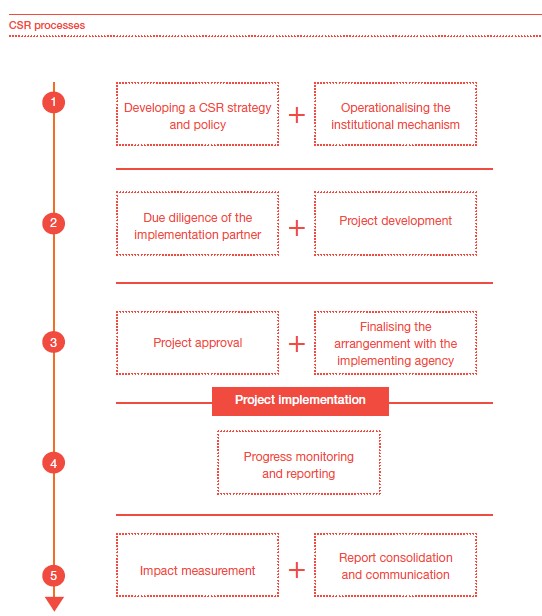

For effective implementation, the CSR committee must also oversee the systematic development of a set of processes and guidelines for CSR to deliver its proposed value to the company, including:

1. one-time processes such as developing the CSR strategy and operationalizing the institutional mechanism

2. repetitive processes such as the annual CSR policy, due diligence of the implementation partner, project development, project approval, contracting, budgeting and payments, monitoring, impact measurement and reporting and communication

CSR Policy shall inter alia, include the following:

- CSR Activity which company plans to undertake specifying modalities of execution and implementation schedules

- Monitoring process for CSR Activities

- Declaration that any surplus arising out of the CSR Activity shall not form part of the business profit of the Company

Provided that, (i) CSR Activity does not include the activities undertaken in pursuance of normal course of business of company; and (ii) the Board shall ensure that CSR Activities are related to the activities included in Schedule VII to the Act.

A set of such enabling processes, their inter-relationships and the sequence in which they need to be developed have been identified below:

PERMISSIBLE CSR ACTIVITIES AS PER SCHEDULE VII OF THE ACT:

CSR Activities would mean any one or more of the following areas, as specified under Schedule VII to the Act, which are to be pursued/undertaken by the Company:

1. eradicating hunger, poverty and malnutrition, promoting preventive health care and sanitation including contribution to the Swach Bharat Kosh set-up by the Central Government for the promotion of sanitation and making available safe drinking water;

2. promoting education, including special education and employment enhancing vocational skills especially among children, women, elderly, and the differently abled and livelihood enhancement projects;

3. promoting gender equality, empowering women, setting up homes and hotels for women and orphans; setting up old age homes, day care centers and such other facilities for senior citizens and measures for reducing inequalities faced by socially and economically backward groups;

4.ensuring environmental sustainability, ecological balance, protection of flora and fauna, animal welfare, agroforestry, conservation of natural resources and maintaining quality of soil, air and water including contribution to the Clean Ganga Fund set-up by the Central Government for rejuvenation of river Ganga;

5. protection of national heritage, art and culture including restoration of buildings and sites of historical importance and works of art; setting up public libraries; promotion and development of traditional arts and handicrafts;

6. measures for the benefit of armed forces veterans, war widows and their dependents;

7. training to promote rural sports, nationally recognized sports, Paralympic sports and Olympic sports;

8. contribution to Prime Minister’s National Relief Fund or any other fund set up by the Central Government for socio-economic development and relief and welfare of the Schedule Castes, the Scheduled Tribes, other backward classes, minorities and women;

9. contributions or funds provided to technology incubators located within academic institutions which are approved by the Central Government;

10. rural development projects.

The companies may pursue CSR Activity by taking into account the following:

a. the activities undertaken in pursuance of normal course of business shall not be treated as CSR Activity.

b. the company may undertake CSR Activities through a registered trust or society or company, established by the company or its holding or subsidiary or associate company. Provided that, if trust, society or company is not established by company or its holding or subsidiary or associate company, it shall have an established track record of three years in undertaking similar programs or projects.

c. the company shall specify project or programs to be undertaken through said entities and also the modalities of utilization of funds and have system of monitoring and reporting the same.

d. collaborate with other companies for undertaking CSR Activities in such manner that the CSR Committee of respective companies can report separately on CSR Activities.

e. the programs or activities undertaken in India only shall amount to CSR expenditure.

f. the projects, programs or activities that benefit only the employees of the company and their families shall not be considered CSR Activity.

g. contribution of any amount directly or indirectly to any political party shall not be considered as CSR Activity.

h. companies may build CSR capacities of their own personnel as well as those of their implementing agencies through Institutions with established track records of at least three financial years but such expenditure shall not exceed five percent of total CSR expenditure in one financial year.

i. In case of foreign owned and controlled companies, CSR contribution can be made only to those trust/NGO’s, etc. who hold FCRA license. It also pertinent to note that such restriction has been proposed to be removed retrospectively in the Union Budget of 2016 but we need to wait and watch till the same is being effectively notified and comply with the currently effective provisions.

CERTAIN CLARIFICATIONS ON REGULATORY FRAMEWORK OF CSR

1. It is further clarified that CSR activities should be undertaken by the companies in project/ programme mode [as referred in Rule 4 (1) of Companies CSR Rules, 2014]. One-off events such as marathons/ awards/ charitable contribution/ advertisement/ sponsorships of TV programmes etc. would not be qualified as part of CSR expenditure.

2. Expenses incurred by companies for the fulfilment of any Act/ Statute of regulations (such as Labour Laws, Land Acquisition Act etc.) would not count as CSR expenditure under the Companies Act.

3. Salaries paid by the companies to regular CSR staff as well as to volunteers of the companies (in proportion to company’s time/hours spent specifically on CSR) can be factored into CSR project cost as part of the CSR expenditure.

4. “Any financial year” referred under Sub-Section (1) of Section 135 of the Act read with Rule 3(2) of Companies CSR Rule, 2014, implies ‘any of the three preceding financial years’.

5. Expenditure incurred by Foreign Holding Company for CSR activities in India will qualify as CSR spend of the Indian subsidiary if, the CSR expenditures are routed through Indian subsidiaries and if the Indian subsidiary is required to do so as per section 135 of the Act.

6. ‘Registered Trust’ (as referred in Rule 4(2) of the Companies CSR Rules, 2014) would include Trusts registered under Income Tax Act 1956, for those States where registration of Trust is not mandatory.

7. Contribution to Corpus of a Trust/ society/ section 8 companies etc. will qualify as CSR expenditure as long as (a) the Trust/ society/ section 8 companies etc. is created exclusively for undertaking CSR activities or (b) where the corpus is created exclusively for a purpose directly relatable to a subject covered in Schedule VII of the Act.

8. There is no specific exemption given to section 8 companies with regard to applicability of section 135, hence section 8 companies are required to follow CSR provisions in case such companies are falling in the criteria specified under Section 135(1) and the same has been clarified by MCA.

9. It has MCA has clarified that amount spent by co. towards CSR cannot be claimed as ‘business expenditure’;

10. With respect to ‘average net profit’ criteria u/s 135(5), MCA clarifies that computation of net profit is as per section 198, which is primarily ‘profit before tax’;

11. MCA states that no specific tax exemptions that has been extended to CSR expenditure per se, however clarifies that spending on certain activities prescribed in Schedule VII already enjoy exemptions under different provisions of Income Tax Act;

12. Clarifies on activities which would not qualify as CSR, which includes: (i) Projects only for employees’ benefit, (ii) one-off events, (iii) expenses incurred for compliance of any other Act / Regulation, (iv) Contribution to political party, etc.;

13. MCA States that if any excess CSR amount spent, same cannot be carried forward to subsequent years;

TAX BENEFITS FOR EXPENDITURE ON CSR

Tax benefits for expenditure on CSR Firms spending money on Corporate Social Responsibility (CSR), which has been made mandatory under the new Companies Act, have more reasons to cheer.

Though CSR provisions do not offer any great tax savings, companies can claim deductions specifically allowed under Sections 30 to 36 of the Income Tax (IT) Act, 1961.

1. Section 30 of the IT Act allows deductions against expenditure incurred on repairs and insurance in respect of machinery, plant and furniture used for CSR activities.

2. Rent, rates, taxes and repairs incurred on buildings or other assets taken on lease earmarked for CSR activity would also qualify for deductions.

3. Deduction towards depreciation on assets used for CSR purposes can be claimed.

4. Funds spent on Skill Development projects gives the assesse the benefit of claiming 150% deduction in their books.

5. Installing water filter in schools at various places allows to claim expenditure on repairs, maintenance, insurance, besides deduction towards depreciation if the asset is shown in its books of account.

These are enabling provisions to incentivise companies to spend on welfare activities.

The following chart tabulates the activities as prescribed under Schedule VII to the 2013 Act and the allowability of expenditure incurred on the said activities under the Act:

|

Sr. No. |

Specific CSR Activities referred under Schedule VII to the 2013 Act |

Expenditure allowed under the relevant provisions of the Income-tax Act, 1961 |

|

1 |

Activities concerning basic necessities of life - Eradication of poverty, hunger and malnutrition - Promoting Sanitation and health care and making available safe drinking water |

- Section 35AC read with Rule 11K(i)(f). - Section 35AC r/w Rules 11k(i)(a),(f),(j) |

|

2 |

Activities concerning Education - Promoting Education , including special education and employment enhancing vocational skills especially among children, women and elderly and the differently abled - Livelihood enhancement programs |

Section 35AC r/w 11K(i)(c),(i),(o),(p),(s) - Section 35AC r/w Rules 11K(i)(j),(s) |

|

3 |

Activities addressing inequality and gender discrimination - Promoting gender equality - Empowering women - Setting up of homes and hostels for women and orphans - Setting up old age homes, day care centre |

Section 35AC r.w. Rule 11K(i)(n),(i) of the 1962 Rules |

|

4 |

Activities concerning Care for environment - Ensuring environmental sustainability and ecological balance - Preservation of flora and fauna, animal welfare, agro forestry - Conservation of natural resources and maintaining quality of soil, air and water |

Section 35AC r/w Rules 11K(i)(d),(h),(l),(q),(r) |

|

5 |

Activities concerning protection of National Heritage, Art and Culture - Protection of national heritage, art and culture including restoration of building and sites of historical importance and works of art - Setting up public libraries - Promotion of traditional arts and handicrafts and its Development |

Section 35AC r/w Rule 11K |

|

6 |

Activities concerning benefit to Armed Forces, veterans, war widows and their dependants - Measures for the benefit of armed forces, veterans, war widows and their dependents |

Section 80G(2)(a)(i) and 80G(2)(a)(iii)(h)(c) |

|

7 |

Activities concerning Sports - Training to promote rural sports, nationally recognised sports, Paralympics sports and Olympic sports |

Section 35AC r/w Rule 11K(i)(g) |

|

8 |

Activities concerning national relief and welfare of Economically backward class of Society - Contribution to PM National relief fund or any other fund - Relief and welfare of the Schedules Casts, Schedules Tribes/Other backward castes, minorities and women |

- Section 80G(2)(a) (iiia) - Section 35AC r/w Rules 11K(i)(b),(c) and 11K(ii). |

|

9 |

Activities concerning Technology incubators - Contributions or funds provided to technology incubators located within academic institutions which are approved by Central Government |

Section 35(2AA)/80G(2) (iihi) |

|

10 |

Activities concerning Rural Development (Projects) |

Section 35AC/35CCA |

Explanation II to sub-section (1) of Section 37 of Income Tax Act, 1961 says that any expenditure incurred by an assessee on the activities relating to corporate social responsibility referred to under

Section 135 of the Companies Act, 2013 shall not be deemed to be an expenditure incurred by the assesse for the purposes of the business or profession. This is effective from 1st April, 2015 and accordingly applies to the assessment year (AY) 2015-16 and subsequent years. In this scenario, resulting percentage spent by companies on CSR activities would be higher than the required 2% of the average three years’ net profits. It is understood that the aggregate corporate taxation is 33.9% (taking a surcharge of 10%). Since the CSR spend is not included while calculating the net profit, the actual CSR spending percentage can be derived from the following formula: 2% / 1 – 33.9%.

Thus the actual CSR spend of companies come to about 3.02% of the net profits, which is much higher than the required 2%.

It has been perceived by many industrialists that 2% of average net profit of the three preceding financial years is a huge spending for companies apart from other mandatory legal obligations. Corporates are already sharing the 30-35% of its net profit with government by corporate taxes as compared to the global average of 24%, so the government should not be diffident for allowing tax sops to CSR spending. If the present tax treatment of CSR continues, then it results in companies only inclined to give funds to those organizations under sections 35 or 80 where they get maximum tax benefit.

CONSEQUENCES OF DEFAULT IN CASE PRESCRIBED COMPANIES FAIL TO SPEND THE MANDATORY CSR AMOUNT AS PER THE ACT

The concept of CSR is based on the principle ‘comply or explain’. Section 135 of the Act does not lay down any penal provisions in case a company fails to spend the desired amount. Second proviso to sub-section (5) of section 135 provides that if the company fails to spend such amount, the Board shall in its report specify the reasons for not spending the amount.

However, sub-section 8 of section 134 relating to Board’s Report provides that in case the company contravenes the provisions of the section i.e. in case it does not disclose the reasons for not spending in the Board’s report, the company shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to twenty- five lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to three years or with fine which shall not be less than fifty thousand rupees but which may extend to five lakh rupees, or with both.

The CSR provisions were notified with clarity around the regulations that govern them, but the stakeholders continue to threadbare discussions on its applicability, calculation of net profit and on the amount of CSR expenditure. What makes CSR provisions so significant amongst many other critical provisions of the Act? There is no one answer to this question. There are wide-ranging responses given by stakeholders and experts. Few believe that, it contributes to the overall growth of the country and few categorise it as a ‘return on the investment’—which may be in terms of land, manpower, resources (tangible or otherwise) used by the companies registered in India. However, the peculiarity of the provisions of section 135 are such that the Act mandates certain class of companies to comply with the provisions of the section, and on the other hand permits the companies violating the provisions to provide necessary explanations in its Boards report—making it a comply or explain concept. The explanations shield the company from the penal consequences, i.e., the defaulting companies and officers of the company need not pay any penalty and will not be charged for the default. Interestingly, in the recent past the ministry of corporate affairs (MCA) seems to have taken the CSR mantra very seriously and has directed all the Registrar of Companies (RoC) to send show cause notices, in their respective jurisdiction to those companies who fall under the ambit of the provisions of the section of the law.

By virtue of section 206 of the law—power to call for information, inspect the books and conduct inquiries, the RoCs have been sending out notices to the companies seeking information on the (i) annual report for the financial year FY15; (ii) information pertaining to net profits, average net profits, of the three immediate preceding financial years; (iii) 2% of the prescribed CSR expenditure; (iv) complete information on the CSR expenditure, if any; (v) further details for not meeting the CSR requirements or on explanations provided in the Board’s report.

With the enthusiasm shown by the RoCs under the directions of the MCA, one can infer that the companies may expect to receive notices even for the financial year FY16. As there are no stringent penal provisions provided for non-compliance of section 135, numerous companies have not complied with provisions and the rules framed thereunder and have been claiming defence by providing necessary explanations in the Board’s report for not meeting the CSR requirements.

In view of such non-compliances, it is clear that the RoCs have been very enthusiastic in having right amount of checks and balances in CSR compliance by the companies who fall under the ambit of CSR and also to create a distress on the companies who fail to comply and take advantage of the shield of providing necessary explanations in the Board’s report.

On a separate note, there may be a possibility that, MCA may consider CSR compliance for a period of three years, i.e., from the date of notification of the CSR provisions, thereafter may decide to amend the provisions and the rules made thereunder, so as to fit in the necessary penal provisions for the companies and its officers for the non-compliance or partial compliance of section 135 of the Act. In which case, a diligent compliance of the CSR provisions, will replace the explanations in the Board’s report.

CONCLUSION

The business sector is faced with new responsibilities, new challenges and new opportunities to be explored in order to make poverty and squalor a thing of the past. Philanthropy among businesses has always existed. In India, all leading corporate houses are involved in programs covering areas like education, health, livelihood creation, skill development, and empowerment of weaker sections of society. CSR is the continuing commitment by business houses to behave ethically and contribute to economic development while improving the quality of life of the workforce.

Though there are published analysis which reveals that there is a positive relationship between CSR and financial performance and the descriptive measures shows that Corporate social expenditure depends upon the financial performance of the Company but at the same time, we can conclude that some of the top Indian companies are not spending the prescribed amount on part of their social responsibilities. 5 Out of 10 companies spent lesser amount on social projects than recommended, 3 companies spent more than the recommended budget. The country's top 75 companies spent more than Rs 4,000 crore towards corporate social responsibility in the last fiscal, i.e. the first year after the government mandated bigger companies to give away a part of their profits for social work.

Big CSR spenders include Reliance Industries with Rs 760 crore, ONGC with Rs 495 crore, Infosys with Rs 239 crore, NTPC with Rs 205 crore and TCS with Rs 220 crore. Wipro, ITC, Mahindra & Mahindra and Hindustan Unilever are among the 28 companies that met the mandatory CSR spending norm of at least 2% of their annual average net profits for the preceding three years. As per the data, health, education and skill development are the sectors that seem to have attracted large chunks under CSR. In a bid to invite corporate funds for the flagship schemes, like Swachh Bharat and Clean Ganga initiatives, the Government has decided that corporate contributions towards these two key initiatives will now be counted as CSR spend. Mahindra Finance is an example which spent a part of 2% of its profits in Swachh Bharat Kosh.

Tax deductibility of the CSR expenses is essential to encourage corporates to participate on a sustainable basis in government’s social sector initiative through the CSR regulations. In order to enable corporates to participate fully in the philanthropy space, the participation must start with a more inclusive management of CSR policies where government and industry work side by side.

All stake-holders also need to share experiences and try finding solutions with industry experts and stakeholders in relation to achieving inclusive growth in India.

“Good people do not need laws to tell them to act responsibly, while bad people will find a way around the laws.” - Plato

DISCLAIMER:

This write up is the personal property of the author to this article. If this write-up is circulated, content of this disclaimer and credit to CS Bhavik Gala shall be retained.

The content of this write up is purely academic and is intended to provide a general guide to the subject matter and not intended to be a professional advice and should not be relied upon for real life facts and the views are of personal opinion in nature. Specialist advice should be sought about your specific circumstances, if any.

CAclubindia

CAclubindia