Review of guidelines for Core Investment Companies

The Reserve Bank of India (‘RBI’) on 13 August 2020, notified the revised guidelines applicable to Core Investment Companies (‘CIC’) (‘the notification’)[1]. Consequently, the Master Direction - Core Investment Companies (Reserve Bank) Directions, 2016 (‘RBI CIC Directions’) stands amended.

The changes notified are primarily in relation to (a) the definition of adjusted net worth; (b) simplification of group structures where multiple CICs exist within a group; (c) constitution of a Group Risk Management Committee; (d) changes in corporate governance and disclosure requirements; (f) consolidation of financial statements; (g) exceptions to carrying other financial activity.

Background for the change

Working Group to Review the Regulatory and Supervisory Framework for Core Investment Companies (‘the Working Group’) identified six major issues that were required to be addressed and suggested measures to mitigate the related risks for the CICs, their groups as well as for the system as a whole.

These areas being:

- The complexity of group structures

- Multiple gearing and excessive leveraging

- Build up of high leverage and other risks at a group level

- Corporate governance

- Review of exempt category and registration

- Enhancing off-site surveillance and on-site supervision over CICs

Consequently, the Working Committee recommended a set of changes to the RBI CIC Directions.

An analysis of the changes made in the notification

Adjusted net worth

The adjusted net worth (ANW) of a CIC is an important parameter in the determination of compliance with capital requirements and leverage ratio for a CIC and directly impacts the ability of the CIC to leverage.

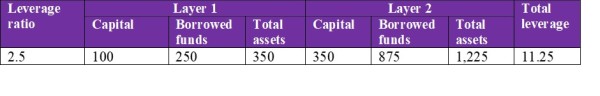

The notification amends the definition of ANW to reduce any direct or indirect capital contribution made by one CIC in another CIC, to the extent the amount exceeds ten percent of the CIC making the investment. This is applicable immediately for investments made after 13 August 2020 while for investments that are already in excess of the ten percent threshold, the CIC need not deduct the excess investment as on the date of this circular till 31 March 2023.

Accordingly, any reduction to the ANW effectively reduces the number of borrowings that the CIC can make and consequently the leverage at a group level

Effect of change in the definition of the net worth of ANW on group leverage

An analysis of the changes made in the notification

Simplification of group structure

The list of CIC on the RBI website states that there are 64 CICs as of 16 July 2020, there are more than 6 groups[1] that account for approximately 33%[2] of the CICs registered with the RBI. Out of the 63 CICs that was registered in August 2019, the top five CICs consist of around 60% of the asset size and 69% borrowings as of 31 March 2019, implying total leverage of 3.48 as against total leverage of 3.03 across the 63 CICs[3]

The 13 August 2020 notification states that the number of layers of CICs within a Group (including the parent CIC) shall be restricted to two, irrespective of the extent of direct or indirect holding/ control exercised by a CIC in the other CIC. Further, it also states that if a CIC makes any direct/ indirect equity investment in another CIC, it will be deemed as a layer for the investing CIC.

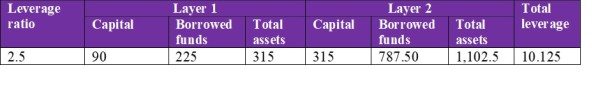

The group structure presented alongside is that of a group having interests in diverse businesses and has three ‘layers’ of CICs within the group. The notification does not permit such a group structure and CIC-Top Co will be required to reorganize the group and have only one more CIC in the group.

Consequently, the group will need to consider alternatives of either merging subsidiary 4 into subsidiary 2 or 3 or transferring CIC 2’s holding in Subsidiary 4 to CIC 1

In most cases, there will be significant operating challenges as well as challenges in financial reporting and taxation. In many cases, these could trigger accounting for business combinations or common control transactions, i.e. accounting using the pooling of interests method. The identity of the reserves shall be preserved and shall appear in the financial statements of the transferee in the same form in which they appeared in the financial statements of the transferor. This may also result in operational challenges such as identification and treatment of statutory reserves or any reserves created for loan losses and their utilization.

In the above example, CIC 2 may also need to transfer its holding in Associate 1 to CIC 1. This could require CIC 1 to undertake a purchase price allocation to determine goodwill on acquisition of Associate 1 and potentially impact consolidation procedures in the future for CIC- Top Co.

Given the time and effort required to implement this, the RBI’s move to provide CICs time until 31 March 2023 for the reorganization is welcome.

An analysis of the changes made in the notification

Corporate governance and disclosure requirements

The notification requires CICs to follow the Companies Act 2013 with respect to corporate governance. Further, it also lays down certain minimum disclosure requirements on the CIC’s website as well as in the annual financial statements.

The websites of the CICs are required to disclose basic corporate information and information of the group such as the annual report of the CIC, the Corporate Governance Report, Management Discussion & Analysis covering, inter alia, industry structure, and developments, risks, and concerns for the group and adequacy of internal controls and any other significant information.

The disclosures in financial statements include:

- Components of ANW, % of ANW to risk-weighted assets

- Leverage ratio

- Investment in CICs:

- The amount representing any direct or indirect capital contribution made by one CIC in another CIC

- Number of CICs with their names (both wherein the direct or indirect capital contribution exceeds 10% of Owned Funds or is less than 10% of Owned funds)

- Off-balance sheet- including a letter of comfort issued to any subsidiary

- Value of investments and related movement of provisions held

- Maturity pattern of assets and liabilities

- Business ratios

- Provisions and contingencies, the concentration of NPA

- Overseas assets

- Registrations/licenses obtained from other financial sector regulators

- Penalties imposed including strictures or directions on the basis of inspection reports or other adverse findings

- How the modified opinion of the auditors was dealt with in case such an opinion is issued

Risk management

The parent CIC or the CIC with the largest asset size, if there is no parent CIC, is required to constitute a Group Risk Management Committee (GRMC) with at least 2 out of the minimum 5 members shall be independent directors. The GRMC is charged with analyzing material risks to the group, Carry out a periodic independent formal review of the group structure and internal controls, articulate leverage of the group amongst others.

CICs are also required to submit a quarterly statement of deviation certified by the CEO / CFO indicating deviations in the use of proceeds of any funding obtained by the CIC from creditors and investors from the objects/ purpose stated in the offering documents. This is an important step in ensuring that the funds raised by the CICs are also deployed for the purpose for which they have been borrowed and not diverted for other entities/purposes.

CIC with an asset size of more than Rs 5,000 crore will also need to appoint a CRO in lines with the guidelines as applicable to other systemically important NBFCs.

Consolidated financial statements

CICs are required to prepare consolidated financial statements, however, in case there are entities that meet the definition of a group entity but are not covered in scope for consolidation, additional disclosures are required to be made in respect of those entities.

This information includes the name of the entity, the asset size, debt-equity ratio, profitability of the last two years, and for each such entity, the nature, and type of exposure to investments in equity, convertible instruments, bonds, debentures, etc. Further, in order to disclose information of the flow of funds, disclosure is also required for Investments by the loanee of the CIC in the shares of the parent company and group companies along with loans and advances to companies in which directors are interested

Other changes

The notification also makes certain other changes to the existing RBI CIC Directions. For example, with respect to the activities that can be carried out by a CIC, it is now clarified that CIC that invest in money market instruments, including mutual funds which make investments in money market instruments/debt instruments with a maturity of up to 1 year. This is primarily with the objective of improving the asset-liability position of a CIC as most of the assets held by CICs (investments in equity instruments) are generally long term in nature.

The registration requirements are also now simplified as CICs with assets of less than Rs 100 crore are exempt from registration while those with asset size of more than Rs 100 crore are only required to register with the RBI in case they access public funds. Further, a CIC which is not required to be registered will now be called as ‘Unregistered CIC’ as against the practice of calling them ‘exempted CIC’.

It is also clarified that CICs implementing Indian Accounting Standards shall adhere to the circular dated March 13, 2020, on Implementation of Indian Accounting Standards.

In summary, the notification makes significant changes to the CIC regulations, especially for those CICs that are a part of a complex group structure. The notification aims to simplify such group structures and at the same time through the changes helps to reduce leverage at a group level. Although these changes may fundamentally change group structures, a glide path of two years, i.e. up to 31 March 2023 is provided by the RBI for implementation. The notification also raises the bar on corporate governance, risk management, and utilization of funds for CICs. Additional disclosures are also now required to be made so as to provide relevant and timely information to stakeholders.

[1] Source: World of financial reporting analysis

[2] Source: World of financial reporting analysis

[3] Source: Report of the Working Group to Review the Regulatory and Supervisory Framework for Core Investment Companies (October 2019) and World of financial reporting analysis

[1] The text of the notification can be accessed at https://www.rbi.org.in/scripts/FS_Notification.aspx?Id=11949&fn=14&Mode=0

The author is a Chartered Accountant and an alumnus of the Indian Institute of Management Bangalore (IIM Bangalore) and has over a decade of experience in financial reporting and auditing. He is also the co-founder of World of financial reporting, a firm focused on financial reporting consulting and Ind AS / IFRS training. The author can be reached at prateekmankad@worldoffinrep.com

CAclubindia

CAclubindia