The Taxable Event under GST is Supply of Goods or Services or Both. GST Law, by Levying Tax on goods and/or services, departs from the Historical Concepts of 'Taxable Event' under State VAT laws, Excise Laws and the Service Tax Laws i.e. Sale, Manufacture and Service Respectively.

Some Important Definitions

Goods: Means every kind of movable property other than money and securities but includes actionable claims, growing crops, grass and things attached to or forming part of land which are agreed to be severed before supply or under contract of supply. (Sec 2(52) of the CGST Act)

Service: Means anything Other than Goods, Securities and Money but includes activities related to use of money or its conversion by cash or any other mode, from one form of currency or denomination to another form of currency or denomination for which a separate consideration is charged (Sec 2(102) of CGST Act)

"Business" includes -

|

(a) |

any trade, commerce, manufacture, profession, vocation, adventure, wager or any other similar activity, whether or not it is for a pecuniary benefit; |

|

(b) |

any activity or transaction in connection with or incidental or ancillary to sub-clause (a); |

|

(c) |

any activity or transaction in the nature of sub-clause (a),whether or not there is volume, frequency, continuity or regularity of such transaction; |

|

(d) |

supply or acquisition of goods including capital goods and services in connection with commencement or closure of business; |

|

(e) |

provision by a club, association, society, or any such body (for a subscription or any other consideration) of the facilities or benefits to its members; |

|

(f) |

admission, for a consideration, of persons to any premises; |

|

(g) |

services supplied by a person as the holder of an office which has been accepted by him in the course or furtherance of his trade, profession or vocation; |

|

(h) |

services provided by a race club by way of totalisator or a licence to book maker in such club; and |

|

(i) |

any activity or transaction undertaken by the Central Government, a State Government or any local authority in which they are engaged as public authorities(Sec 2(17) of the CGST Act 2017) |

"consideration" in relation to the supply of goods or services or both includes-

(a) any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government;

(b) the monetary value of any act or forbearance, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government:

Provided that a deposit given in respect of the supply of goods or services or both shall not be considered as payment made for such supply unless the supplier applies such deposit as consideration for the said supply(Sec 2(31) of CGST Act 2017)

"recipient" of supply of goods or services or both means-

(a) where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration;

(b) where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available; and

(c) where no consideration is payable for the supply of a service, the person to whom the service is rendered,

and any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods or services or both supplied

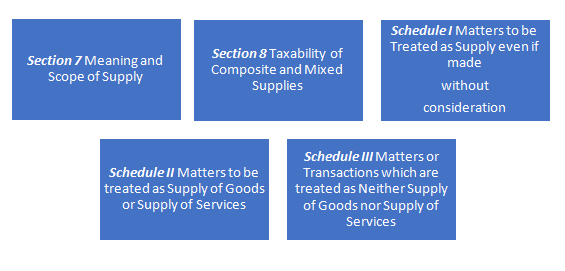

Concept of Supply {Section 7 of the CGST Act 2017}

(1) For the purposes of this Act, the expression "supply" includes-

(a)all forms of supply of goods or services or both such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

ANALYSIS-SECTION 7(1)(a)

1) Supply should be of Goods or Services to attract GST. Supply of anything else like money, securities etc. does not attract GST

2) Supply should be made for a Consideration. Activities carried out without consideration like Donations, gifts or charities are therefore outside the scope. Further Consideration may be Past, Present or future.

3) Supply should be in Course of Furtherance of Business

4) Supply should be made to a taxable person and should be a taxable supply

5) All forms of supplies made or agreed to be made shall be covered. It means advance received prior to supply of goods or services shall be leviable to Tax.

(b) Import of service for a consideration whether or not in course of furtherance of business

ANALYSIS-SECTION 7(1)(b)

The Import of service for consideration attracts GST. Thus, import of service without consideration or for non-monetary consideration does not attract GST. Import of service in course of furtherance of business is not essential. Thus, import of service for personal purpose shall fall within the scope of term ''supply'' and would attract GST.

(c) the activities specified in schedule I, made or agreed to be made without a consideration

ANALYSIS-SECTION 7(1)(c)

ACTIVITIES TO BE TREATED AS SUPPLY EVEN IF

MADE WITHOUT CONSIDERATION

SCHEDULE I

1. Permanent transfer or disposal of business assets where input tax credit has been availed on such assets.

Analysis

a) Business asset is a piece of property or equipment purchased exclusively for the business purpose

b) In case a business entity donates its business assets on which ITC has been availed, then also it will be a supply and entity need to reverse credit

2. Supply of goods or services or both between related persons or between distinct persons as specified in section 25, when made in the course or furtherance of business:

Analysis

persons shall be deemed to be "related persons" if-

(i) such persons are officers or directors of one

another's businesses;

(ii) such persons are legally recognized partners in business;

(iii) such persons are employer and employee;

(iv) any person directly or indirectly owns, controls or holds twenty-five per cent

or more of the outstanding voting stock or shares of both of them;

(v) one of them directly or indirectly controls the other;

(vi) both of them are directly or indirectly controlled by a third person;

(vii) together they directly or indirectly control a third person; or

(viii) they are the members of the same family

Deemed Distinct Persons in Case of Multiple Registrations- Section 25(4)

A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act

Deemed Establishments of Distinct Persons in case of Multiple Registration in Different States- Section 25(5)

Where a person who has obtained or is required to obtain registration in a State or Union territory in respect of an establishment, has an establishment in another State or Union territory, then such establishments shall be treated as establishments of distinct persons for the purposes of this Act.

Analysis of Sec 25(4)/ (5)

In the View of the aforesaid discussion, the transaction between different locations (with separate GST registration) of same legal entity (eg. Stock transfers or branch transfers) will qualify as ''supply'' which is in contrast to the earlier regime.

By virtue of the definition of the related person given above, employer and employee are related person and activity between them would be treated as ''Supply'' even if made without consideration by virtue of Sec 7(1) (c) read with Schedule I. However, services provided by employer to employee in course of or in relation to his employment are not treated as supply of service {Schedule III of the CGST Act, 2017}.

3. Supply of Goods by a Principal to his Agent or Vice Versa:

Supply of Goods by Principal to his agent where agent undertakes to supply such goods on behalf of the principal; or by an agent to his principal where agent undertakes to receive such goods on behalf of the principal shall be treated as Supply even if such supplies are made without consideration.

4. Importation of Services in the course or furtherance of Business

Importation of services by a taxable person from a related person or from any of his other establishments outside India, in the course or furtherance of business shall be treated as a Supply of Service even if it is made without consideration.

(d) the activities to be treated as supply of goods or supply of services as referred to in Schedule II.

Analysis of Sec 7(1)(d)

SCHEDULE II

ACTIVITIES TO BE TREATED AS SUPPLY OF GOODS OR SUPPLY OF SERVICES

1. Transfer

(a) Any transfer of the title in goods is a supply of goods:

Analysis

This entry shall cover permanent transfer of title in goods as against the Temporary

transfer of right to use goods. The aforesaid proposition Holds good in the Pre-GST

regime as well. Thus, there is no change of the Treatment of the matter of the transfer

of title in goods in the GST Regime.

(b) any transfer of right in goods or of undivided share in goods without the transfer of title thereof, is a supply of services:

Analysis

In the aforesaid case, goods shall be transferred from one person to Another for

a specified period for a consideration. However, there is no Transfer of the Title

of the goods i.e. transfer of the ownership from one Person to another.

Position under Pre-GST Regime

Activity of Transfer of goods by way of Hiring, Leasing, Licensing or in any Other manner without transfer of right to use goods has been included In the definition of the Declared service under Sec 66-E(f) of the Finance Act 1994.Right to use is Deemed Sale under Article 366(29A) of the Constitution of the India

(c)any transfer of title in goods under an agreement which stipulates that property in goods shall pass at a future date upon payment of full consideration as agreed, is a supply of goods.

This matter deals with 'Agreement to Sell' wherein the property in Goods will pass at a future date as agreed between parties to an Agreement

2. Land and Building

(a)any lease, tenancy, easement, license to occupy

land is a supply of service;

(b)any lease or letting out of the building including a commercial, industrial or

residential complex for business or commerce, either wholly or partly, is a supply

of services.

3. Treatment or process

Any treatment or process which is applied to another person's goods is a supply

of services.

Analysis

A careful perusal of this entry reveals that any job work carried out by a job-worker.

On another person's goods shall be treated as Supply of services. Further, it is

Immaterial whether the Job work is carried out Job worker with or without material.

4. Transfer of business assets

(a)where goods forming part of the assets of a business are transferred or disposed of by or under the directions of the person carrying on the business so as no longer to form part of those assets, whether or not for a consideration, such transfer or disposal is a supply of goods by the person;

(b)where, by or under the direction of a person carrying on a business, goods held or used for the purposes of the business are put to any private use or are used, or made available to any person for use, for any purpose other than a purpose of the business, whether or not for a consideration, the usage or making available of such goods is a supply of services;

Analysis

Example: Mr. Anand deals in large home appliances like Washing

Machine, Refrigerators, Computers etc. He uses computers in his shops for keeping

track on Inventory and other business purposes. Out of the 2 PC's, Mr. X takes home

one PC to be used by his son. The aforesaid Private use of a Computer by Mr. X shall

be treated as 'Supply of Service'

(c)where any person ceases to be a taxable person, any goods forming part of the assets of any business carried on by him shall be deemed to be supplied by him in the course or furtherance of his business immediately before he ceases to be a taxable person, unless-

(i)the business is transferred as a going concern

to another person; or

(ii) the business is carried on by a personal representative who is deemed to be

a taxable person.

5. Supply of services

The following shall be treated as supply of services, namely: -

(a) renting of immovable property;

(b) construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier.

(c) temporary transfer or permitting the use or enjoyment of any intellectual property right;

(d) development, design, programming, customization, adaptation, upgradation, enhancement, implementation of information technology software;

(e) agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act; and

(f) transfer of the right to use any goods for any purpose (whether or not for a specified period) for cash, deferred payment or other valuable consideration.

6. Composite supply

The following composite supplies shall be treated as a supply of services, namely: -

(a)works contract as defined in clause (119) of section 2; and

(b)supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where such supply or service is for cash, deferred payment or other valuable consideration.

7. Supply of Goods

The following shall be treated as supply of goods, namely:-

Supply of goods by any unincorporated association or body of persons to a member thereof for cash, deferred payment or other valuable consideration.

Schedule III, Central Goods and Services Tax Act, 2017

SCHEDULE III

ACTIVITIES OR TRANSACTIONS WHICH SHALL BE TREATED NEITHER AS A SUPPLY OF GOODS NOR A SUPPLY OF SERVICES

1. Services by an employee to the employer in the course of or in relation to his employment.

2. Services by any court or Tribunal established under any law for the time being in force.

3. (a) The functions performed by the Members of Parliament, Members of State Legislature, Members of Panchayats, Members of Municipalities and Members of other local authorities;

(b) The duties performed by any person who holds any post in pursuance of the provisions of the Constitution in that capacity; or

(c) The duties performed by any person as a Chairperson or a Member or a Director in a body established by the Central Government or a State Government or local authority and who is not deemed as an employee before the commencement of this clause.

4. Services of funeral, burial, crematorium or mortuary including transportation of the deceased.

5. Sale of land and, subject to clause (b)of paragraph 5 of Schedule II, sale of building.

6. Actionable claims, other than lottery, betting and gambling.

Explanation.- For the purposes of paragraph 2, the term "court" includes District Court, High Court and Supreme Court.

Concept of Composite and Mixed Supply

Composite Supply means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

Illustration: Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply.

Mixed Supply means two or more individual

supplies of goods or services, or any combination thereof made in conjunction with

each other by a taxable person for a single price where such supply does not constitute

a composite supply

Illustration: A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drinks and fruit juices when supplied for a single price is a mixed supply. Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately.

Every effort has been made to avoid error or omissions in this Article. Inspite of this error would creep in. Any error, omission or discrepancy noticed may be brought to my notice. Also 'Analysis' has been inserted wherever considered necessary to make it self explanatory.

The author can also be reached at rohitkpr1992@gmail.com.

CAclubindia

CAclubindia