There is always a lot of discussion regarding loans given by a company to its director, but seldom we talk about directors giving loans to companies and the plethora of legal compliances they entail. To avoid confusion, we will discuss the issue as per latest amended law.

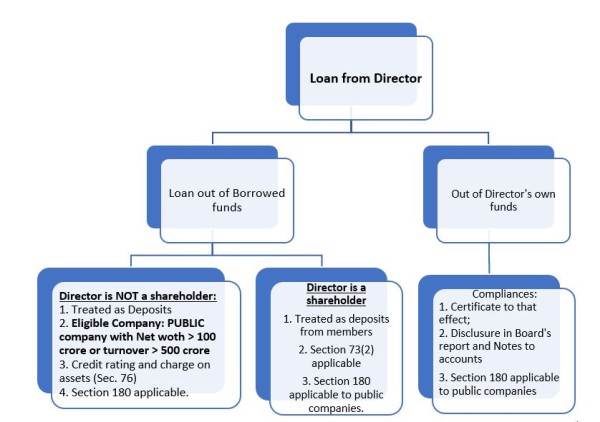

The issue at hand is how to classify the amount received from the director between a Loan and a Deposit. If treated as a Deposit, the transaction would entail compliance with provisions of Section 73(2) or Section 76, as the case may be, read with Company (Acceptance of Deposits) Rules 2014. Loans from directors can be broadly classified into two categories viz. Amounts received out of Director’s own funds and amounts received out of borrowed funds. To keep things simple, a detailed discussion of the treatment of 'Deposits' will be discussed in a separate article.

Amount received from directors out of their own funds, whether he is also a shareholder or not, are treated as loans and do not require compliance with section 73(2) or Section 76. However, to avail this relief the director must furnish to the company at the time of giving the money, a declaration in writing, that the amount is not being given out of funds gathered or collected by borrowing or accepting loans or deposits from others. However, information regarding the loan should be disclosed in the Director’s Report as well as the notes to accounts of the Financial statements of the company. Section 180 (discussed below) is also applicable in the given case.

Amount received out of funds borrowed by the director

Director is not a shareholder: In this scenario, funds received are treated as Deposits and attract Section 76 read with Companies (Acceptance of Deposits) Rules 2014. In such a case, these deposits can only be accepted by a PUBLIC company having either a Net worth of Rs. 100 crores or a Turnover of Rs. 500 crores (i.e. Private limited companies and ineligible Public companies cannot receive loans/deposits from director’s borrowed funds). Section 76 requires such public company to obtain credit rating every year and to create a charge on its assets in favour of the deposit holders for an amount not less than the amount of Deposits accepted. Section 180 is also attracted in this case (Discussed below).

Director is also a Shareholder: In this case, funds received from directors are also treated as deposits, however, they are treated as deposits from a member and attract provisions of Section 73(2) read with Companies (Acceptance of Deposits) Rules 2014. Section 180 is also attracted in this case (Discussed below).

Section 180 of Companies Act, 2013 provides for the board to take consent of the company by a special resolution (and file such SR in Form MGT-14) to borrow money, where the money to be borrowed, together with the money already borrowed by the company will exceed aggregate of its paid-up share capital, free reserves and securities premium, apart from temporary loans obtained from the company’s bankers in the ordinary course of business. However pursuant to notification dated 05.06.2015, section 180 is not applicable to private companies. Hence private companies can borrow or accept deposits, wherever eligible, without the need to pass a special resolution under section 180. However, all the public companies will have to comply with section 180 along with requirements discussed above.

The author is a practising Chartered Accountant in New Delhi and can be reached at ca.apuravgarg@gmail.com

CAclubindia

CAclubindia