Clause - 17 Where any land or building or both is transferred during the previous year for a consideration less than value adopted or assessed or assessable by any authority of a State Government referred to in section 43CA or 50C, please furnish:

|

Details of property |

Consideration received or accrued |

Value adopted or assessed |

SECTION 50C: Special provision for full value of consideration in certain cases.

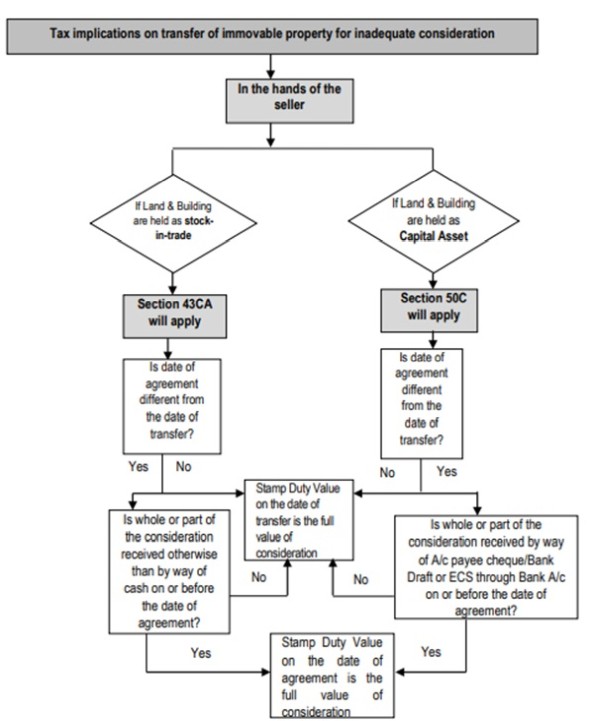

Section 50C of the Income Tax Act, 1961 was introduced by Finance Act, 2002 w.e.f 1.4.2003 which prescribes similar provisions in the case of transfer of land or building or both held in the nature of “capital asset”.

Section 50C is applicable where the assessee has transferred a capital asset being land or building or both and the value of such an asset is less than the value adopted or assessed or assessable by any State Government authority for the purpose of payment of stamp duty. In such a case, for purpose of section 48, the value so adopted or assessed or assessable by stamp duty authority shall be deemed to be the full value of consideration.

SECTION 43CA: Special provision for full value of consideration for transfer of assets other than capital assets in certain cases.

Finance Act, 2013 has inserted a new section 43CA under the Income Tax Act, 1961 which is applicable from Financial Year 2013-14, introducing the provisions for taxability of transfer of immovable property (land or building or both) held in the nature of stock in trade, on the same lines which are applicable for immovable property held in the nature of “capital asset” under section 50C of the Act.

Section 43CA is applicable where the assessee has transferred an asset (other than a capital asset) being land or building or both and the value of such an asset is less than the value adopted or assessed or assessable by any State Government authority for the purpose of payment of stamp duty. In such a case for purpose of computing profit & gains from such transfer, the value so adopted or assessed or assessable shall be deemed to be the full value of consideration.

Following proviso shall be inserted in sub-section (1) of section 43CA&sub-section (1) of section 50C by the Finance Act, 2018, w.e.f. 1-4-2019 :

Provided that where the value adopted or assessed or assessable by the authority for the purpose of payment of stamp duty does not exceed one hundred and five per cent of the consideration received or accruing as a result of the transfer, the consideration so received or accruing as a result of the transfer shall, for the purposes of computing profits and gains from transfer of such asset, be deemed to be the full value of the consideration.

Section 43CA deals with the computation for developers and Section 50C deals with this situation where the immovable property is a capital asset. Both the provisions provide that where the value of apparent consideration is lower than the value adopted for the stamp duty payment, the difference between the value as declared in the agreement and value assessed becomes taxable in the hands of the seller. If it is a business asset, the same becomes taxable as business income and if its capital asset it becomes taxable as capital gains.

In order to reduce the litigation and hardship to both, the seller and buyers, in case of minor difference between the value assessed and apparent consideration, the finance minister has proposed that the provisions of Section 43CA and 50C shall not be applicable, in case the difference between these two values does not exceed five per cent. Likewise, the buyer will also not be required to pay any tax under Section 56(2), if the difference does not exceed five per cent. Even in case the difference between both these values is higher than five per cent but does not exceed 50,000, the buyer will not be required to pay any tax on such difference.

Since Section 50C uses the word 'capital asset', its provisions can be invoked only if the land or buildings sold during the year is a capital asset. Stock in trade has been excluded from the definition of capital asset by sec. 2(14). As a result, the flats/building constructed and sold by builders and developers which are their business activity, and their 'stock-in-trade', could not be brought into Sec. 50C. Therefore the valuation done by stamp valuation authorities could not be substituted for apparent sale consideration in case of the transfer of flats/buildings even if such valuation by stamp valuation authorities was more than apparent sale consideration. In order to cover this apparent source of investment of unaccounted money, the new provision has been introduced to bring the transfer of land or building or both (being stock in trade) at par with section 50C and now the valuation done by stamp valuation authorities could be substituted for apparent sale consideration.

Some courts held that Section 50C being limitedly applicable to assessment of capital gains cannot apply to assessee holding land/building as his stock-in-trade. By insertion of new provision Section 43CA, all such decisions will be overruled.

In certain cases in the past, the tax authorities tried to extend the applicability of the provision of Section 50C to cover cases of transfer of such immovable property held as stock in trade, i.e. for real estate developers and builders etc. However, Allahabad High Court in the case of CIT vs. Kan Construction And Colonizers P Ltd. 70 DTR 169 (All) and Madras High Court in the case of CIT vs. Thiruvengadam Investments P Ltd. 320 ITR 345 (Mad) held that Section 50C has limited applicability to capital gains' assessment and can not apply to assessee holding land or building as trader (stock in trade) and assessed for the same under the head “Income from business”. As per new section 43CA, it is apparent that the intent of the provision of Section 50C applicable in the case of “capital asset” has been extended to real estate developer/ builder holding land or building as stock in trade.

Case Law:

Pradhan Housing Private Limited vs. Department Of Income Tax on 29 April, 2016

Brief Facts:

Assessee company is engaged in the business of construction , During the course of assessment proceedings, AO noticed that ITA No 1599 of 2014 Pradhan Housing P Ltd Hyderabad the assessee has sold a property admeasuring 8214.19 sq. yards together with 3 years old RCC building consisting of ground and 1st floors situated at Mindi Village within the limits of Greater Visakhapatnam Municipal Corporation area. He observed that the assessee has shown the market value of the property at Rs.3,78,00,000 in the sale deed and accordingly the stamp duty of Rs.35,92,250 was levied by the Sub Registrar on the chargeable value of Rs.3,78,10,500. He observed that the assessee has shown the value of the property at Rs.2.00 crores only in the computation of income and since there is a variation in the value of the income as shown by the assessee to the extent of Rs.1,78,00,000 (i.e. 3,78,00,000 - Rs.2,00,00,000), the AO held that this amount of Rs.1.78 crores is liable to be added as deemed business income as according to him the assessee suppressed the real value of the property sold. He accordingly brought the sum of Rs.1,78,00,000 and treated the same as business income of the assessee for the year under consideration. Aggrieved by the said addition, assessee preferred an appeal before the CIT (A).

Held:

Hon'ble Allahabad High Court in the case of Kan Construction & Colonizers Pvt. LTd (cited Supra) held that 50C gives rise to deeming fiction and that such deeming fiction is to be applied in case of computation of capital gain u/s 48 only. It is not in dispute that the assessee is in construction activity and the AO has treated the income from sale of the landed property as "business income". While computing the business income, the AO has invoked the provisions of section 50C to bring to tax, the difference between the value shown by the assessee for registration purposes and the value shown in its computation of his business income.

Therefore, it is clear that the deeming provisions of section 50C cannot be applied to income other than capital gains. The AO has applied 50C provision to the income computed under the head business income which is not sustainable and therefore, the deeming ITA No 1599 of 2014 Pradhan Housing P Ltd Hyderabad provisions cannot be applied

LIABILITY OF AUDITOR TO FURNISH DETAILS IN CLAUSE 17 OF FORM 3CD :

Where any land or building or both is transferred during the previous year for a consideration less than value adopted or assessed or assessable by any authority of a State Government referred to in section 43CA or 50C, the auditor is required to furnish the following details:

a. Details of property

b. Consideration received or accrued

c. Value adopted or assessed or assessable

If the assessee has transferred more than one property, the detail of all such properties is required to be mentioned. The auditor should obtain a list of all properties transferred by the assessee during the previous year. He may also verify the same from the statement of profit and loss or balance sheet, as the case may be.

For reporting the value adopted or assessed or assessable, the auditor should obtain:

- A copy of registered sale deed , in case, the property is registered

- In case the property is not registered, the auditor may verify relevant documents from relevant authorities or obtain third party expert like lawyer, solicitor representation to satisfy the compliance of section 43CA/ section 50C.

- In exceptional cases where the auditor is not able to obtain relevant documents, he may state the same through an observation in his report 3CA/CB.

- Auditor would have to apply professional judgment as to what constitutes land or building for e.g. whether leasehold right / development rights would fall under this provisions or not, would require to be evaluated based on facts & circumstances of transactions.

Source:

1. Income Tax Act ,1961

2. ICAI Guidance notes on tax audit

3. ICAI Final Study Material

CAclubindia

CAclubindia