We were told by history that before the advent of cash there was a concept of a barter system. Though the barter system, where there was no currency - "no cash", and things were exchanged according to needs, the society realized that the barter system has its own series of advantages and disadvantages, and the need to leave it behind arose. Various personalities, kings, and governments introduced new coins and currency made from time to time making impressions of their choice on such coins.

The various stages of the evolution of money can be seen in the following table:

|

1. COMMODITY MONEY OR BARTER SYSTEM |

When different commodities were used as a medium of exchange |

|

2. METALIC MONEY |

The first coins were made of an alloy of silver and gold. In China, gold coins were first standardized during the Qin dynasty (221-207 BCE) |

|

3. PAPER MONEY |

Paper money was first used by the Chinese, who started carrying folding money during the Tang Dynasty (A.D. 618- 907) |

|

4. CREDIT MONEY |

Credit money is any future monetary claim against an individual that can be used to buy goods and services |

|

5. ELECTRONIC MONEY |

Digital currency is a type of currency available in digital form. |

It is to be noted that currency in the form of coins was in circulation in our pre-independence period. These coins were left behind after independence and the baton was passed onto a new series of coins and currency Its advantages were so overwhelming that disadvantages penetrated into the economy deeply and the crisp and clean notes soon turned into "BLACK MONEY". Many schemes were introduced to dig out black money and many factors were responsible for the widening of its feet in every nook and corner of the system.

The question is ― Why is Black Money so bad? There is a proverb which goes like, "A thief leaves behind some sort of evidence after theft" but cash is wittier than this thief as it does not leave behind any trail of its source of origination. Whether it comes from a legal source or not, or whether taxes have been paid on it or not, etc. The thrust of the government is to curb cash transaction practices and to have a cashless economy.

A cashless economy is not possible since cash to the economy is like what blood is to the human body. It will stand still. The government can introduce various ways to restrict its usage, thus reducing the after-effects of cash transactions, but it cannot pull it out of the system and throw away in an instant.

Moving further let us understand what is a Cash Transaction? In layman language, a financial transaction with the immediate exchange involving physical money and not soft money is a cash transaction.

For instance, I went to a Showroom and bought a watch for Rs.50000/- and paid through a debit card. It is not a cash transaction since it involved payment through a banking channel, but if I had paid through hard physical money, the cash element has come into the picture, and thus the transaction is a cash transaction. Since it was not a cash transaction, the legal consequences follow, that my information will be sent to Income Tax Department or not depending on the size of the transaction or whether I will have to give my PAN to the seller, etc.

Flaws in Cash Transactions - Black Money and Corruption

In India, black money is funds earned on the black market, on which income and other taxes have not been paid. Also, the unaccounted money that is concealed from the tax administrator is called black money. The black money is accumulated by the criminals, smugglers, hoarders, tax-evaders, and other antisocial elements of the society.

In Other Words - Black money is that quantum of income that was not disclosed to the government and hence, no tax was paid, although the source is legal. Black money becomes white and legal if tax and penalty at the prevalent rate is paid. Corrupt money is the money obtained by bribes. The source is also illegal and it can't become legitimate by paying tax.

Impact of Cashless Transactions on Corruption

- No corruption, No Black Money: Through cashless transactions, details of every transaction is maintained. Payments done by every individual can be easily traced.

- No fake Money: One of the biggest advantages would be totally eliminating fake currency.

- Ensures Payment of taxes: As every single penny you own is counted, so it will be difficult to evade taxes.

Advantages of Cashless Transactions

1. The first and foremost advantage of a cashless economy is that an individual does not need to carry cash with him or her everywhere, which in turn reduces the chances of theft from the wallet, inconvenience due to carrying cash, gives freedom from the problem of change when the transaction is of an odd amount and assures no risk of receiving counterfeit currency and so on.

2. Another benefit of a cashless economy is that it is easier to track black money and illegal transactions because if cash is used directly for doing transactions then it is not easy to track the transactions as the money does not come into the banking system. However, in the case of digital transactions, it is easy to track the transaction as all records are there with the banks which results in a more transparent transaction, which in turn leads to a fall in corruption in the economy of the country.

3. Another advantage of a cashless economy is that since all transactions will be done through an organized channel i.e. through banks and financial institutions, it results in an increase in tax revenue for the government, as all cash transactions which were done illegally come into the banking system, which in turn helps the government in tracking all transactions and levying tax on them. This can be used by the government for the betterment of the economy of the country.

In a bid to curb black money as well as to limit the number and amount of cash transactions, the government has come out with some new provisions and related rules and prohibited some types of cash payments in the Finance Acts. For Example, sec 269ST has been inserted by Finance Act, 2017 which aims to restrict cash transactions of Rs. 2 Lakhs or above.

It is irrelevant whether the person receiving the specified sum in cash is assessed to income tax or not. It is also irrelevant as to what is his source of income e.g. salary, rent, business, agricultural income, or any exempt income. The restrictions would apply to the receipt of fees by educational institutions, hospitals, and to donations by temples, etc.

It would apply to transactions between two related persons or between such persons - where both the payer and the payee are exempt from payment of tax. In a lighter vein, it may be stated that even if a husband pays a specified amount of cash to his wife for household expenses, the receipt in the hands of the wife would be covered by the impugned restrictive provision.

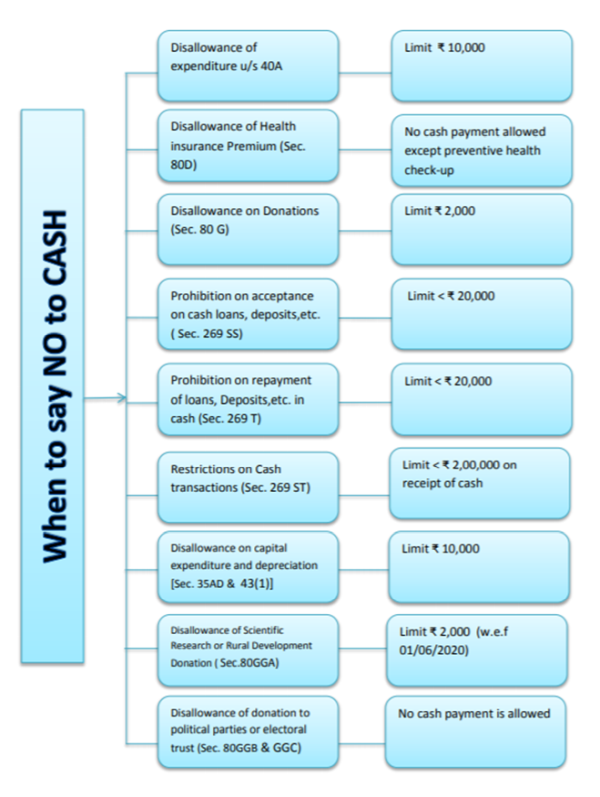

The effects of other restrictions under the provisions of the Income Tax Act are as follows:

1. Restrict cash transactions which results in disallowances of expenses or deduction under chapter VIA of the Income Tax Act in computation of taxable income and allowing deduction to provide an incentive for better compliance.

2. Penalizing cash transactions above the threshold limit to create effective deterrence.

We can explain the restrictions on cash payment and deductions with the help of the following pictorial representation:

Needless to say, cashless transactions are the future of the country, and rightly so. The need for a cashless economy has been increasing with each passing day and it is time that we all move forward with implementing the same. What are your thoughts on the same? Let us know in the comments sections below.

CAclubindia

CAclubindia