Today I am going to write on careers after passing C.A. exam. Passing C.A. is very daunting task but choosing appropriate career after passing C.A. is also very difficult yet very important. So, friends which career you may choose after passing C.A. exam.

Before speaking about option of career which you may choose, let's find what are options which you choose. Broadly there are two options which any CA may choose.

- Opting for job

- Establishing practice

Now coming back to the first option i.e. opting for job, which many of you may choose

1. Working with CA Firm: Working as a full-time employee with CA firm is a great option as there are multiple benefits which you may achieve. Here I am presuming that you are working with a firm which is mid-sized firm.

Variety is spice of the life. Yes, friends I as I mentioned you will get exposure to different area's such as

- Accounts writing

- Direct tax (Filling Income tax return, working in the field International taxation and corporate taxation

- GST-Indirect tax practice

- Internal audit, statutory audit, bank audit. In short in the audit

- Costing

- ERP implementation

There are following benefits of working in the CA firm.

1. You will be in the touch with accounting standards, you will remain updated on the existing as well on the new area.

2. You will develop your networking. Friends many times you will have to represent your firm and will have to go to client place, whether it is manufacturing industry, service industry or you are conducting audit of trusts, hospitals, banks. Here you will learn best practices followed by your clients and you will also learn gaps in their process. You must pick best practices followed in the industry and by doing good work you may built your networking. Here I do not want to restrict you to interpret “building networking” for switching job but here I also meant for exchanging good practices followed in the industries.

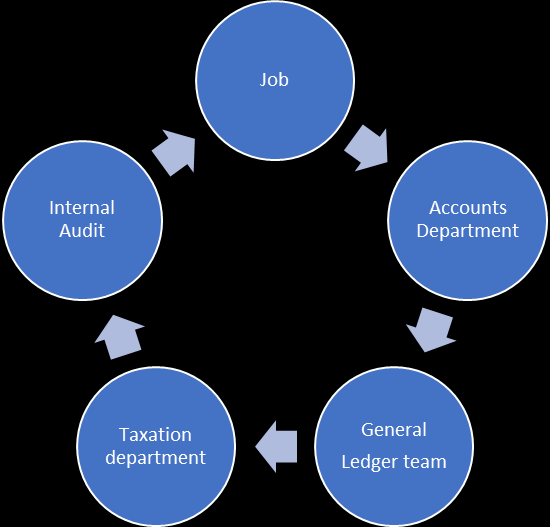

3. Working in the company: Although this looks simple as working in the company or doing job,

But job in which area. Again, as I mentioned previously there are multiple job opportunity for CA, yet you need to be very careful while choosing area of job. Typically, student gets trapped and confused in this. Many times, student seeks job in the MNC or company whose turn over is more than 1000 crores. But right approach is to choose company which is small or mid -sized company as in the small or mid-sized company you will get an opportunity to work in all areas and you may find your exact passion and you will understand area where you are fit. You need to work in such company at least for 2 or 2.5 years to understand various areas such as right from accounts payable(Bill passing, parking TDS, GST and input credit entries), accounts receivable, TDS, Payroll, direct and Indirect taxation, G&L, planning and budging and flow of accounting entries in ledger in the ERP systems.

In addition to this you should also think company policy, company customers, pricing strategies, Investment policies, working capital requirement, (credit given by the company to customer and vendor's credit period, how vendor is selected. company's contribution to the society. This will give holistic approach and you will be transformed from crude newly passed CA to professional and seasoned CA.

This 2- and 2.5-years working experience will give you right vision what is your passion and you can choose an appropriate career.

4. Working in the Capital Market: Working in the capital market is another good opportunity. Those who have passion about finance may join NSE, BSE, equity research companies, Credit rating companies or starting career in the forex, derivative and commodity markets.

5. Coaching classes: Those who are interested in the academics may start their own classes or may join CA/CS/CMA profession classes.

6. Functional consultants: This is good area where there are lot of opportunities and good money yet as far as my knowledge you need to get into this area or you may opt this as a career only after holding good and enriched experience in the field of accounts, taxation and person should be well versed with ERP. ERP such as SAP, Oracle, Navision.

7. Actuarial Science: Actuarial science is also one of the hot areas where leave encashment, gratuity, superannuation and other long benefits given by the employer is calculated. Here one needs to have strong background of mathematics and statistics. Mathematics up to 12th standard is compulsory.

2. Starting own practice: Although this is area where there is ample scope for any individual, yet one needs to build strong network to start his/her own practice. One should not restrict himself/ herself into specific area. As initial period is gestation period where one needs to have learning mind and should apply your studies into the practice.

CAclubindia

CAclubindia