An Income tax return (ITR) is a form filed with the Income tax authority of India that reports about income, expenses, assets and liabilities in addition to other pertinent tax information. Tax returns allow taxpayers to calculate their tax liability, schedule tax payments, or request refunds for the over-payment of taxes. You have to file your income tax return (ITR) with utmost care because even a small mistake can land you in trouble with the income tax department. You could end up getting penalized or even be served a tax notice. As the deadline to file ITR is fast approaching it becomes all the more important that you take utmost care while filing ITR.

Filing an Income tax return (ITR) is complex process for assessees. Long documentation process, tracking various records and matching requirement lead the individuals bound to commit mistakes often. Many times, employees try to give wrong or ambiguous information to their employer in order to pay less TDS.

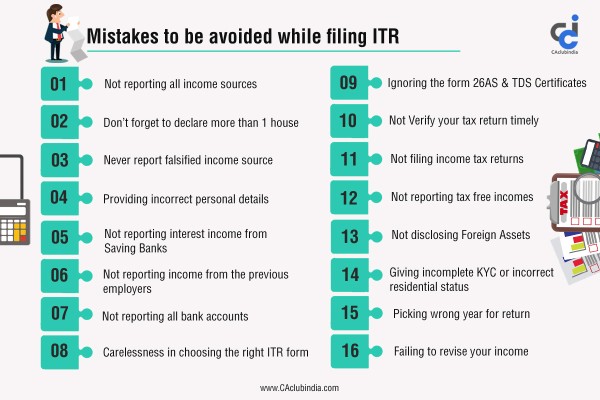

There are some mistakes which are to be taken care off while filing income tax return :

- Not reporting all income sources - If you do not report all your income sources while filing income tax return, then IT department is likely to treat it as concealment of income and may subject to tax and penalty.

- Don’t forget to declare more than 1 house – If you own more than one house, then you are liable to consider in computation of Income tax on it. Not declaring such properties is the second-most common mistakes people make while filing tax returns.

- Never report falsified income source - While this may not be classified as a mistake, many tax professionals try to move people into filing surge returns to earn more tax benefits.

- Providing incorrect personal details - Many people face issues with income tax returns filing due to wrong postal address, incorrect or invalid phone numbers and email address.

- Not reporting interest income from Saving Banks - One should report all the interest incomes received or accrued due to him in the previous financial year (for which the return is being filed) while filing his tax returns. Individuals generally forget to report interest earned from savings bank account, fixed deposits, recurring deposits, etc. under the head 'Income from other sources'. While interest received or accrued on fixed and recurring deposits are fully taxable.

- Not reporting income from the previous employers - If you have switched jobs in a financial year then income from your previous job must be reported while filing income tax return along with income from the current job. If any income (from previous job) is not reported, then a discrepancy is bound to reflect in your TDS certificates, Form 16 and Form 26AS. This is bound to bring you taxman to your door. Again the penalties are same as not clubbing of income.

- Not reporting all bank accounts - a taxpayer is required to report all the bank accounts held by him in previous year in his/her income tax return. Earlier you were only required to mention a single bank account in which you wished to receive credit of the income tax refund if any.

- Carelessness in choosing the right ITR form - As per tax laws, an individual is required to report all sources of income and file ITR using the correct form applicable to him. If he files it using the wrong form, then his filed return will be treated as 'defective' and he will be asked to file a revised ITR using the correct form. If the defect is not rectified within the time limit, then the assessing officer will treat it as an invalid return.

- Ignoring the form 26AS & TDS Certificates - The tax deducted or collected by an entity is reflected in Form 26AS of the respective PAN and this helps in identifying any discrepancy or error. One need to check and match such TDS credits with the income he is showing in ITR. He should also check the he got the correct tax credit in the form 26AS which is a consolidated tax statement (Form 26AS) and a proof of tax deducted on your behalf as well.

- Not Verify your tax return timely - After having successfully filed your income tax return, the next step is to verify it. The Income Tax Department starts processing your return, once it is verified. Refunds, if any, are processed for returns that have been submitted and verified. After successfully e-verifying your ITR via net banking, you don’t have to send the physical ITR-V. However, if you do not want to e-verify, you will have to send the physical ITR-V.

- Not filing income tax returns - Many people don't file their income tax returns who either do not have the income is below the tax-exempt income level or they have the exempted income eg. Agricultural income, dividend or capital gain. There are also sme cases where people have loss in business or stock market and do not file the ITR thinking that it is not required to file but they need to check the law carefully in each cases and also consider the benefits of filing the ITR even there is no income tax.

- Not reporting tax free incomes - As a taxpayer, you are duty bound to report all your income even if some is tax free. Interest earned from provident fund or/and tax-free bonds in a financial year must be reported in your ITR. However, you can claim exemption on these under various sections of the Income Tax Act. These exempt incomes are to be reported in the 'Exempt Income' schedule of the ITR.

- Not disclosing Foreign Assets - Government has been very strict on anti-money laundering measures and disclosure of all foreign assets falls under this. To avoid being on the wrong side of the law you need to make sure that you have updated all such details in your ITR.

- Giving incomplete KYC or incorrect residential status - For smooth processing your ITR and a timely refund, you should provide correct information about your name, address, bank account number, IFSC code, Aadhaar, PAN, and Assets details.

- Picking wrong year for return - People often get confused about the year of filing their returns. You have to be clear about the year for which you are filing ITR. The simple way is to consider the financial year of your income as the Previous Year. The following year in which your income is assessed and return is required to be filed is called as assessment year. In current context the Assessment Year is 2019-20 while the Previous Year is 2018-19.

- Failing to revise your income - If you have discovered any error once tax filing has been completed, then you must rectify your mistake. You must file the revised return to rectify your mistake. Current income tax laws allow you two years to file the revised returns.

Considering the recent changes in ITR form, one needs to file it carefully otherwise soon you may get the income tax notice which may turn in to tax demand if not replied suitably. Now a day, Income tax department is tech-savvy and running of automated software which has access with many authorities so income tax evaders are on its radar.

CAclubindia

CAclubindia