'Profit is fine, profiteering is not. Don't let someone profiteer at your expense.'

First of all let us discuss what is profiteering?

Profiteering as dictionary meaning suggests it is to make an excessive or unfair profit that too illegally. As the meaning is clear, so comes the anti-profiteering authority purpose becomes clear.

In actual any reduction in rate of tax under GST or benefit of input tax credit (ITC) should have been passed on to the buyer by reducing the prices i.e. ITC is available from the production stage to the final stage which will reduce the prices but this was not happening as the supplier was not passing on the benefit to consumer so was getting illegal profit.

Why is anti-profiteering authority important? As before implementing GST in India, many countries have adopted GST namely Singapore, Australia, Malaysia and many more.

Inflation in Australia was 1.9% before GST and rose to 5.3% after GST. Seeing past, Malaysia was able to come out with the reason and laid down an authority named anti-profiteering.

So the National Anti-profiteering authority is being made by the central government to check whether the ITC availed by any registered person or reduction in taxes have actually benefited the consumer or not. It is designed to know prices remain under check and business do not pocket all the gain from GST.

Duties of the authority

The duties of the authority will be as follows:-

• To determine and identify the registered person who has not passed the benefit of reduction in the rate of tax on any supply of goods or services to the receiver by way of reduction in prices. We can see from the below invoice where GST rate previously was 18% and then rate came to 5% but the final cost to the consumer was same as the company had increased the cost price of the item.

• To determine and identify the registered person who has not passed the benefit of input tax credit to the receiver by a reduction in prices.

The explanation to the above is as previously the retailers were not allowed to take credit on services and the service providers were not allowed to take credit on goods supplied so the prices were high but now under GST credit is allowed to both so there is a tax saving which will affect the final prices. This benefit is not passed on to the consumer so authority will keep an eye on this. Recently the case of Pyramid Infratech has come to notice under this provision.

• Further authority can order to:

- Reduce the prices

- Return to the receiver an amount equal to not passed due to red a ction in prices along with 18% interest from date of collection till date of return. If the eligible person does not claim return or is not identifiable then need to deposit the same in consumer welfare fund. Continuing the above example if need to return on 15-01-2018 then Rs. 15.643 + interest @ 18% from 15-11-17 to 15-01-18 to consumer or to fund.

- Impose the penalty.

- Cancel the registration.

Constitution of the Authority

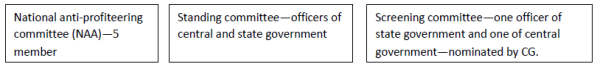

i. National Anti-profiteering Authority will be 5 member committee-consisting of:

- A Chairman who holds or held a post equivalent to secretary to Government of India

- 4 technical members who are or have been commissioners of state tax or central tax or have held equivalent post under existing law.

- The Additional Director General of safeguards under CBEC shall be Secretary to the authority.

- The Authority may determine the methodology and procedure to fulfill duties of the authority.

- Anti-profiteering Authority sunset clause is of 2 years.

ii. The council may constitute the standing committee on Anti-profiteering which consists of officers of the state and central government as nominated.

iii. A state level screening committee shall be constituted in each state by state govt. which consists of one officer of state govt. to be nominated by the commissioner & one officer of central govt. to be nominated by the chief commissioner.

Examination by Committees and Investigation

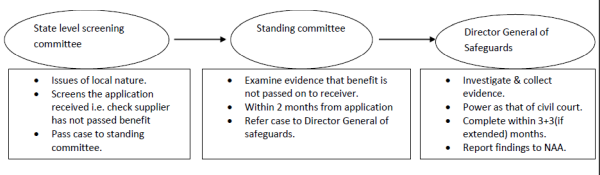

i. Issues of local nature-first examined by state level screening committee. If satisfied then recommendations to standing committee.

ii. Standing committee examines accuracy and adequacy of application within 2 months from date of receipt of written application from interested party or commissioner or any person.

- Interested party includes supplier or receiver of goods or services.

iii. Further if standing committee is satisfied then it shall refer the matter to the Director General of safeguards (DGS) for detailed investigation.

• DGS should collect necessary evidence to determine undue profiteering.

• Should issue a notice to interested parties containing information on

- Description of goods or services in respect of which proceedings are initiated.

- Summary of statement of facts on which allegations are based.

- Time to reply to above.

• DGS can seek opinion of any other agency or statutory authority in discharge of his duties.

• Will have the power to summon any person necessary either to give evidence or to produce document or any other thing.

• Will have the power as that of civil court.

• Every inquiry is deemed to be judicial proceedings.

• DGS shall complete the investigation within 3 months of receipt of reference from standing committee or extension allowed further of 3 months.

• When completed report to the authority along with relevant records.

• Information submitted by the DGS should be kept confidential.

Order of the Authority (NAA)

• Authority shall pass the order within 3 months from date of receipt of report from DGS.

• Opportunity of being heard should be given to the interested party.

• If authority comes to conclusion that registered person has not passed benefit to the receiver the authority will pass order by exercising the power given.

• If the members of the authority differ in opinion then majority will be considered.

• If order passed is not followed then the action will be taken to recover the amount as per GST act. The authority can order any authority of central, state or Union territory tax to monitor implementation of order passed.

Case studies

• As per the ET, currently notices are passed to 5 companies i.e. Honda dealer, Hard castle restaurants, McDonalds franchisees for west and south Delhi, Retailer lifestyle.

• Notice to Jaipur-based Sharma trading is also issued for charging 28% GST on Vaseline but the rate is 18%.

• Notice against Hard Castle Restaurants is issued on complain that price of cup of coffee was charged @ 18% instead of its rate at 5%.

• Notice issued to Pyramid Infratech has said that 36 buyers have accused the builder of not passing on the benefit of ITC to them which will lower the total consideration for flats booked under Haryana affordable housing scheme.

• A Bareilly based dealer of Honda cars India- Vrandavanhwaree Automotive ltd. Is charged of charging higher tax when car was booked in April and delivered on the implementation of GST in July.

• All complaints are with standing committee and are asked to submit documents and replies.

What we can do

If we go to buy something and supplier is charging higher rate and we know prices are less and supplier is saying due to GST we are charging higher rate we can file a complaint to the anti-profiteering committee.

CAclubindia

CAclubindia