RELATED PARTY- As Per Section 2(76) of the Companies Act, 2013, Related Party means

a) A director

b) Relative of director

c) KMP

d) Relative of KMP

e) A Firm, in which a director, manager or his relative is a Partner

f) A Private Company in which a director or manager is a member or director

g) A Public Company in which a director or manager is a director and holds more than 2% of Paid-up Capital along with his relatives

h) Any Body Corporate whose BOD/ MD/ Manager accustomed to act in accordance with instructions of director/ manager

i) Any person whose advise director or manager is accustomed to act

j) A Holding Company [not applicable on Private Company]

k) A Subsidiary Company [not applicable on Private Company]

l) An Associate Company [not applicable on Private Company]

m) A Subsidiary of a holding company to which it is also a subsidiary [not applicable on Private Company]

n) Director of Holding Company

o) KMP of Holding Company

MAIN CONCEPT OF SECTION 188-

1) Board resolution

2) Prior Special Ordinary resolution (After amendment on 25th May, 2015)

3) Approval or omnibus approval of Audit Committee (if apply).

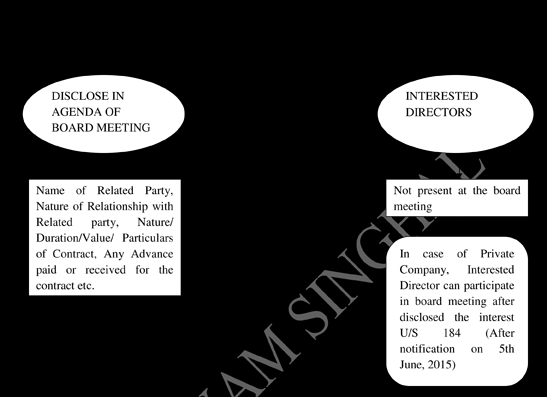

REQUIREMENT OF BOARD RESOLUTION

Company shall Pass Board Resolution in respect to any contract/ arrangement with a related party with respect to

a) Sale, Purchase or Supply of any goods/ materials.

b) Selling or Buying of property of any kind.

c) Leasing of property of any kind.

d) Avail or Render of any service.

e) Appoint any agent for Purchase or Sale of goods/ materials/ Services/ Property.

f) Appoint Related Party to any office or place of profit in the Company, its Subsidiary Company or Associate Company.

g) Underwriting the subscription of any securities of the Company.

REQUIREMENT OF ORDINARY RESOLUTION

The Company required to obtained prior Ordinary Resolution where the transactions exceeds the following limits-

Note- Turnover or Net Worth shall be computed on the basis of Audited Financial Statement of Preceding Year.

NOTE- Requirement of Ordinary resolution shall not be applicable for transactions entered between a Holding Company and its Subsidiary whose accounts are consolidated with the Holding Company.

NOTE- not required to comply with any aforesaid compliance, if any transaction entered by Company in its ordinary course of business except such transactions are not on arm’s length basis.

REQUIREMENT OF APPROVAL OF AUDIT COMMITTEE

If any Company required to constituting Audit Committee under Section 177 of the Companies Act, 2013, also required to get approval or omnibus approval of said Committee after passing board resolution.

Features of Omnibus Approval-

1. Omnibus approval shall not be made for transactions in respect of selling or disposing of the undertaking of the Company.

2. Omnibus approval shall be valid for a period not exceeding 1 financial year and shall require fresh approval after the expiry of such financial year.

3. Where Audit Committee not have requisite information about related party transactions, then the committee may make omnibus approval for such transactions subject to their value not exceeding Rs. 1 crore per transaction.

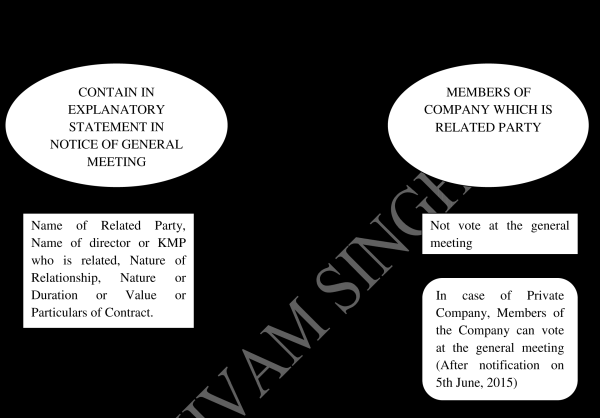

OTHER COMPLIANCE UNDER SECTION 188-

1) Every Contract with related party shall be referred in Board’s report in Form AOC-2.

2) If any Contract made by directors or employees of the Company without take Board resolution or Ordinary Resolution must ratified within 3 Months from the date of such Contract otherwise such contract shall be void.

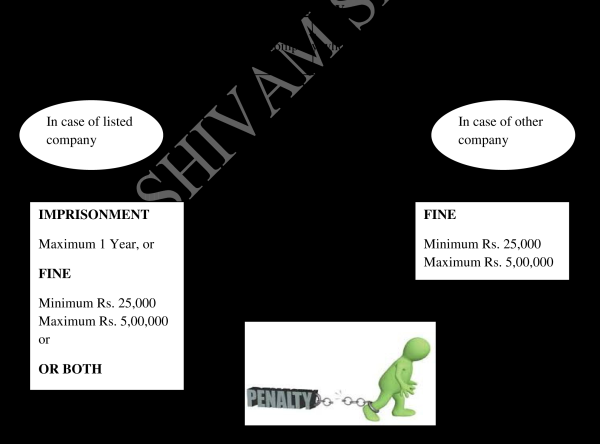

NOTE- Company can proceed against director or employees who entered into contract with related party in contravention of provision of Section 188.

CAclubindia

CAclubindia