(In context of appeals & application U/s.195(2) & 197)

Whether assessee can appeal for Intimation received under section 200A for TDS provision violation?

Whether is it mandatory to apply U/s. 195(2) or U/s.197 for no deduction certificate to pay without deduction?

Analysis provision & case laws of Income tax:

Whether assessee can appeal for Intimation received under section 200A for TDS provision violation?

Person being “any Assessee or any Deductor aggrieved” can appeal under section 246A the extract as below

a. An order passed by a Joint Commissioner under section 115VP(3)(ii) or an order against the assessee when the assessee denies his liability to be assessed under this Act r an intimation under section 143(1)/(1B) or Section 200A(1), where the assessee or the Dedcutor objects to the making of adjustments, or any order of assessment under section 143(3) (except an order passed in pursuance of the directions of dispute Resolution Panel) or section 144, to the income assessed, or to the amount of tax determined, or to the amount of loss computed, or to the status under which he is assessed;(as amended by Finance Act 2012)

Though the above provision doesn’t show any difference between resident or non-resident but the Income tax provision have separate provision under section 248 for Appeal by person denying liability to deduct tax under section 195.

The provision of section 248 as follows:

Where under an agreement or other arrangement, the tax deductible on any income, other than interest, under section 195 is to be borne by the person by whom the income is payable, and such person having paid such tax to the credit of Central Government, claims that no tax was required to be deducted on such income may appeal to the Commissioner (Appeals) for a declaration that no tax deductible on such income

Conclusion for the first question(whether appeal is possible for deductor):

Hence by the above two provision it is clear that if the deductor wish to Appeal is it possible to challenge the AO order even in appeal stage itself.

But the Controversy: whether the asseesee who is aggrieved with order passed by Department and wants to go for appeal who is required to deduct under section 195 will required to under gone to the provision for appeal under section 248 or 246A?

Which can be concluded by case law

In case of L.M.Textiles (Bombay High Court)

It is upheld that the “Specific provision will supersedes the General provision”

Hence accordingly the person required to deduct under section 195 wants to go for appeal he has to undergone the provisions under section 248 for appeal.

But the points required to note:

This section (i.e. Section 248) restricts the eligibility of filing an appeal only to cases where the tax is borne by the assessee.

It implies that, the following situation is outside the scope of section 248 and no appeal can be filed in such cases under section 248

- Where the tax is to be borne by the non-resident

- Where the tax is to be borne by the assessee but not deducted or paid due to the assessee is certain that the income is not chargeable to tax.

Here the question is if it is not chargeable to tax then how the question of tax is to be borne by the assessee will arise?

The AO in some cases can issue order (by reading clear provisions of the act alone) that since, without obtain the confirmation from AO on whether is chargeable to tax or not the assessee paid without tax deduction in this case the assessee decision is not sufficient they are require to follow the provision under income tax.

Accordingly, the final conclusion of Department (decided in some case laws), one person has to apply to AO for confirmation before decides to pay without tax deduction (i.e. the application 195(2) is mandatory to pay without deduction.)

Whether is it mandatory to apply U/s. 195(2) or U/s.197 for no deduction certificate to pay without deduction?

This can be clarified by the case law of Samsung Electronics Company Ltd. (Karnataka High Court):

Facts of the Case:

The Samsung Electronics Company Ltd.(herein after referred as “assessee”) imports standardized software from foreign Company being leading software developer(herein after referred as “Fr. Co”) who is not having PE in India and payment has been made without tax deduction U/s.195

Controversy between assessee and Department:

Contention of the assessee:

1. The Standardized software is copy righted article

2. Payment made is to purchase price for a copy righted article and not for service or software license fee

3. Hence, it is not Royalty but it is Business income

4. According to Article 7 of DTAA the payment is not taxable in the hands of Fr.Co accordingly the TDS is not required to deduct U/s.195.

Contention of Department:

The payment is not only the copy righted article, actually the assessee has paid for the software inside the article and not for that article. Therefore the payment paid to the software is to be treated as license fee (i.e.) it is chargeable to tax as Royalty:

- Hence in view of Section 9(1)(vi) Explanation 2(v) it is deemed to accrue or arise in India

- In view of section 5 it is Indian Income for non-resident

- Therefore according to section 4 it will be chargeable to tax in India

- The assessee is having obligation to deduct TDS u/s. 195 but not discharged

- Therefore the assessee is in default under section 201(1).

Action by the assessee and Department:

Then, the asessee has went to:

1. Appeal before CIT, but the CIT has supported the AO

2. The assessee challenged the decision before ITAT, the ITAT is supported the assessee.

3. Therefore the Department Challenged the ITAT decision in Karnataka High Court.

The Karnataka HC said the AO is justified as follows

- The assessee mandatorily should approach AO to decide whether is it chargeable to tax or not

- But the assessee has not approached the AO seeking no objection/clearance certificate under section 195(2) for making payment without tax deduction.

- So the Karnataka high court refused to interfere in this case

- Without analyzing whether is it taxable or not

- Just because the assesee is not approached AO before making payment, the Karnataka high court is supported the AO.

4. Assessee has challenged the Karnataka high court decision in Supreme Court

The Supreme court response as follows:

Note: While deciding the chargeability one has to refer following section:

- Section 4 – Chargeability Section

- Section 5 – Scope of Total Income

- Section 9 – Income deemed to accrue or arise in India

- Section 90 – Agreement with foreign country

- Section 91 – Country with no agreement exist

- and the Relevant DTAA

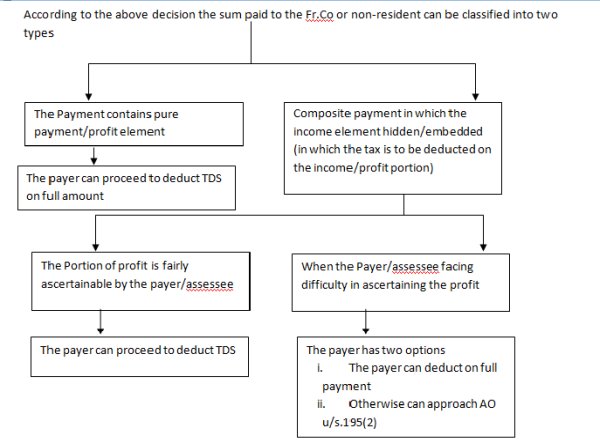

Conclusion/Summary of Decision:

1. The section 195(2) are intended to remove the hassles that may be caused on account of TDS violation. Hence at any situation the assessee is not in compulsory/statutory requirement to approach AO under section 195(2) and get clearance certificate

2. If the assessee is certain that the sum paid is not chargeable to tax in India, he need not approach AO under section 195(2) for confirmation.

3. Again it diverted and instructed Karnataka HC to analyse and provide decision on this

4. The Karnataka HC supported AO by

- The actual payment is not for article it is for the software embedded with the article so, the assessee intention is not to buy the article but to buy the software license

- Without that license it is not possible to use that software

- Accordingly it is treated as Royalty

- The AO was justified.

CAclubindia

CAclubindia