The Central Government has issued the various Notifications on 13.09.2018 related to the Provisions of TDS, TCS and Form-9C. In this article we will see the detailed analysis of the Notification.

1. The Central Government has notified that the provisions relating to Tax Deduction at Source ( TDS ) and Tax Collection at Source ( TCS ) under the new Goods and Services Tax (GST) regime will be implemented from 1st October 2018 vide Notification No 50/2018 - Central Tax&51/2018 - Central Tax.

The registration for these provisions has already started in the GSTN portal from earlier this year. As per the Central Goods and Services Tax (CGST) Act, the notified entities are required to collect TDS at 1% on payments to suppliers of goods or services in excess of Rs 2.5 lakh.

2. The Central Government hereby appoints the 1st day of October, 2018, as the date on which the provisions of section 51 of the said Act shall come into force with respect to persons specified under clauses (a), (b) and (c) of sub-section (1) of section 51 of the said Act and the persons specified below under clause (d) of sub-section (1) of section 51 of the said Act, namely:-

(a) an authority or a board or any other body, -

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government, with fifty-one per cent. or more participation by way of equity or control, to carry out any function;

(b) Society established by the Central Government or the State Government or a Local Authority under the Societies Registration Act, 1860 (21 of 1860);

(c) public sector undertakings.

3. The Central Board of Indirect Taxes and Customs (CBIC) has notified the GST Audit Form ‘FORM GST-9C’ by amending the Central Goods and Services Tax Rules, 2017.

The Central Goods and Services Tax (Tenth Amendment) Rules, 2018 notified by the Board today specified that the amendment is applicable from 13th September 2018.

GSTR 9C should be filed by the taxpayers whose annual turnover exceeds Rs 2 crores during the financial year. All such taxpayers are also required to get their accounts audited and file a copy of audited annual accounts and reconciliation statement of tax already paid and tax payable as per audited accounts along with GSTR 9C.

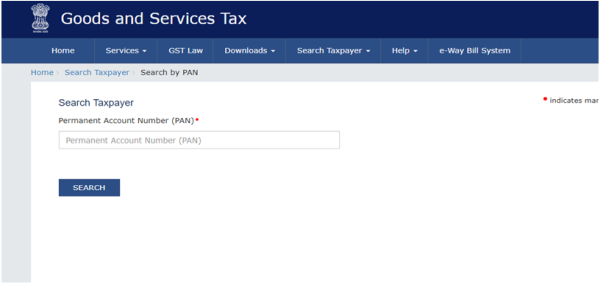

4. The new functionality has been introduced on the GST Portal, now taxpayer can search any person by the PAN by using “Search by PAN” option under “Search Taxpayer” Tab in pre login mode.

The link on the tab is https://services.gst.gov.in/services/searchtpbypan

The link of the Notifications are:

|

S.No |

Notification No |

Subject |

Link |

|

1. |

49/2018-Central Tax ,dt. 13-09-2018 |

Notification amending the CGST Rules, 2017 (Tenth Amendment Rules, 2018) |

|

|

2. |

50/2018-Central Tax ,dt. 13-09-2018 |

Seeks to bring section 51 of the CGST Act (provisions related to TDS) into force w.e.f 01.10.2018 |

|

|

3. |

51/2018-Central Tax ,dt. 13-09-2018 |

Seeks to bring section 52 of the CGST Act (provisions related to TCS) into force w.e.f 01.10.2018 |

CAclubindia

CAclubindia