INDEPTH SOURCE & COVERAGE ANALYSIS MAY 19 CA FINAL AUDIT (OLD SYLLABUS)

Hello everyone! As a professor it's very important to understand what material is being used for drafting papers, understand the trend so that I can make students hit bulls eye. So we worked for many hours to give you accurate and path breaking analysis. So this time ICAI has drafted much easier paper. Majority of the questions were either from the PM or the recent past papers or the MTPs/RTPs.

You will be surprised to see many of below facts. (Paper was of 118 marks of which 30 were covered by MCQs, So he have around 88 Marks descriptive questions)

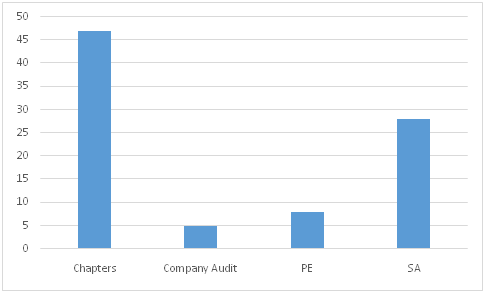

Coverage of Various Topics

1. Standards on Auditing covered 28 Marks. (32%)

2. Professional Ethics covered merely 8 Marks. (10%)

3. Company Audit covered just 5 Marks. (5%)

4. Other Chapters had the majority weightage of around 47 Marks. (53%)

Source of Paper

(Don't add up below marks there is overlapping of the source)

1. PM contributed to 31 Marks of the paper. (35%)

2. If we consider the recent past papers, it contributes around 40 Marks. (45%, 5 Years)

3. Considering the MTPs/RTPs, they contribute to around 33 Marks of the paper.(38%, 2 Years)

4. Around 34 Marks of the paper constituted of new questions which were not covered in the PM, Past papers or MTPs/RTPs. Such questions required conceptual clarity. Therefore, it is very important for the students to understand that depending solely on the question bank would not suffice.(39%)

5. Considering the Tax Audit Area, ICAI targeted the GST Audit area which covered 10 Marks. There were no questions on the Income Tax Audit.

6. SA 500 series held a lot of importance in this paper. It carried around 23 marks.

Strategy

1. Solely relying on Company Audit & PE was not a wise decision considering the current paper.(Only 13 marks in descriptive)

2. Descriptive & MCQs combined coverage of SAs is also good, its worth to spend more time on them.

3. There were some direct questions asked from the other chapters & hence was the easy scoring area.

4. Because of whooping 30 marks MCQs, importance conceptual clarity and coverage all concepts hasincreased many fold.

Curious Questions

Q2(c) - Question on Insolvency Professional was covered in Nov 18 RTP , It is allowed to use Insolvency Professional as it is title recognised by central government.

Q4(a) - Question on relative holding shares, Limit of 1,00,000 is for all relatives taken together. Daughter & her Husband are covered in definition of relative. Holding was reduced to zero after correction time was over. So auditor stands disqualified. Market Value is to be ignored.

Q4(c)-- This answer originally when provided by ICAI in suggested of NOV 18 (New) was not correct but later on Board of Studies changed the answer after discussion with the us.

Ultimate authority on consolidation is AS / Ind AS as prescribed by law and if they give some exemption it should be followed. If out of exemption some subsidiaries are not consolidated, then list should be disclosed in notes to accounts with reason.

ANALYSIS ON THE BASIS OF MARKS DISTRIBUTION:

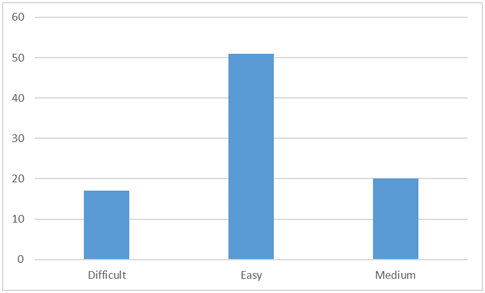

ANALYSIS ON THE BASIS OF DIFFICULTY:

To enroll CA Final Audit (Old Syllabus) subject of the author: Click here

To view / download CA Final Audit - Old Syllabus Question Paper - May'19: Click here

CAclubindia

CAclubindia