In this article we will see the FAQ's related to the Final Return and how to file the GSTR-10 (Final Return) online step by step:

1. What is Form GSTR-10?

Ans. A taxable person whose GST registration is cancelled or surrendered has to file a return in Form GSTR-10 called as Final Return. This is statement of stocks held by such taxpayer on day immediately preceding the date from which cancellation is made effective. This return should be filed within three months of the date of cancellation or date of order of cancellation, whichever is later.

2. Who needs to file Form GSTR-10?

Ans. Form GSTR-10 is required to be filed by every taxpayer except:

(i) Input Service Distributor

(ii) Non-resident taxable persons

(iii) Persons required to deduct tax at source (TDS) under section 51

(iv) Persons paying tax under section 10 (Composition Taxpayer)

(v) Persons required to collect tax at source (TCS) under section 52

3. What is the difference between Final Return and Annual Return?

Ans. Annual return has to be filed by every registered person under GST. Annual return is to be filed once a year in Form GSTR-9.

Final return is required to be filed by the persons whose registration has been cancelled or surrendered in Form GSTR-10.

Online Procedure to File GSTR-10

1. Login > Services > Returns > Final Return

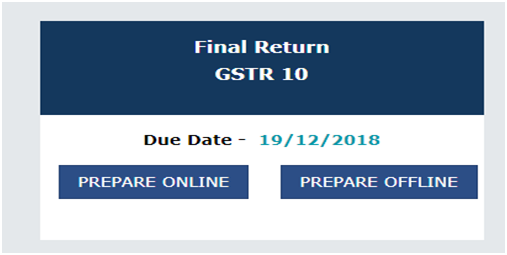

2. After clicking on Final Return, the below mentioned window will be appearing:

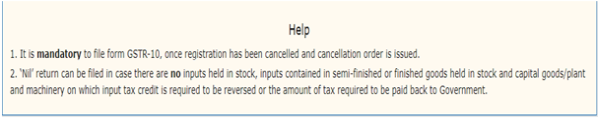

3. In the main window some help section is there:

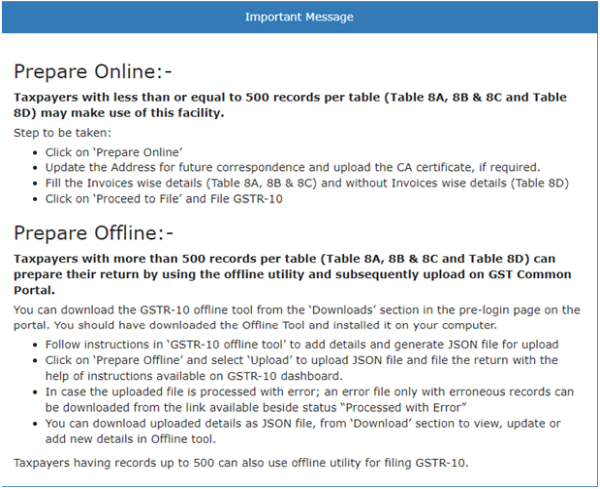

4. Some of the Important points are before filing the GSTR-10:

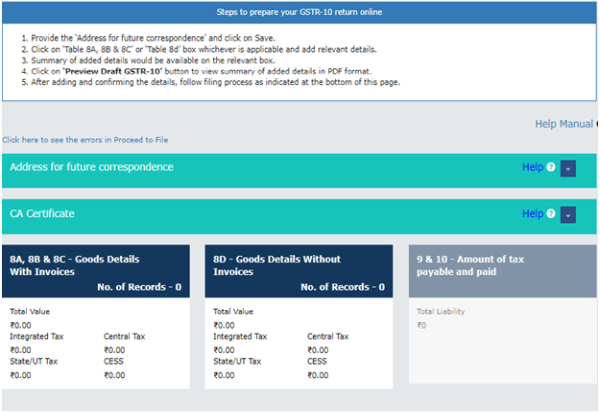

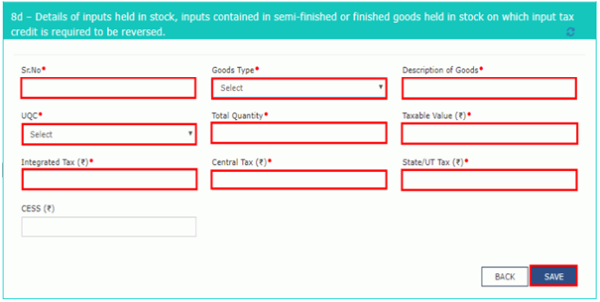

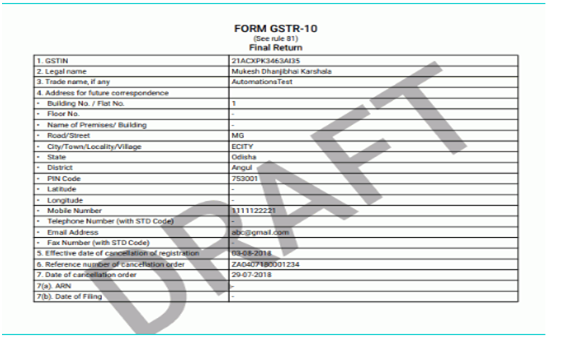

5. After clicking on Final Return > Prepare Online, the following window will appear:

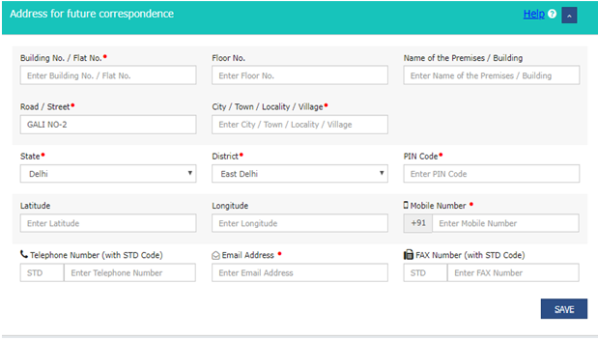

6. The following points to be remembered for “Address for future correspondence”.

I. The address for future correspondence would be auto-populated, if the same has been provided at the time of filing form REG-16.

II. The address would be in editable format, the same would be edited.

III. If the address details are not auto-populated, kindly provide the details as required. Click on ‘Save' after adding the required details.

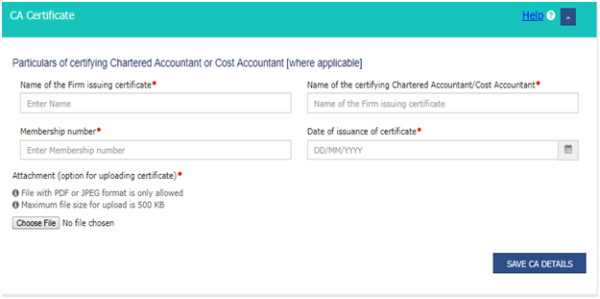

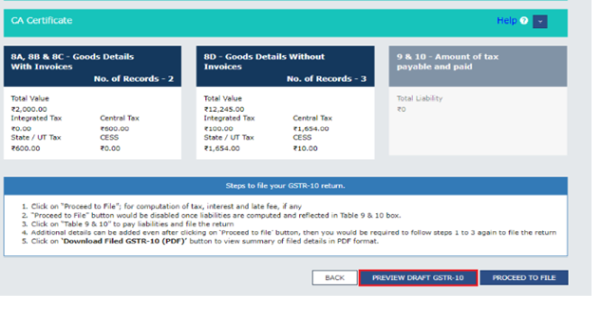

7. The following points to be remembered for “CA Certificate”.

I. Certificate from Chartered Accountant or Cost Accountant needs to be uploaded if details are uploaded in table 8d.

II. Provide the mandatory details as required.

III. Only one file can be uploaded in PDF/JPEG format.

IV. After uploading the certificate, click on �SAVE CA DETAILS'.

V. The details relating to CA certificate can be amended before filing.

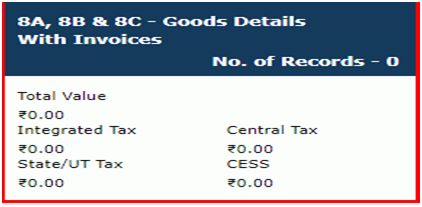

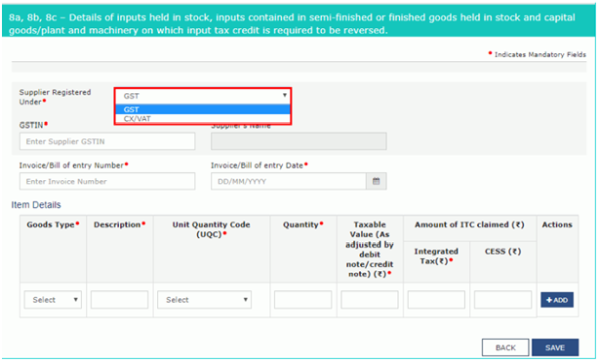

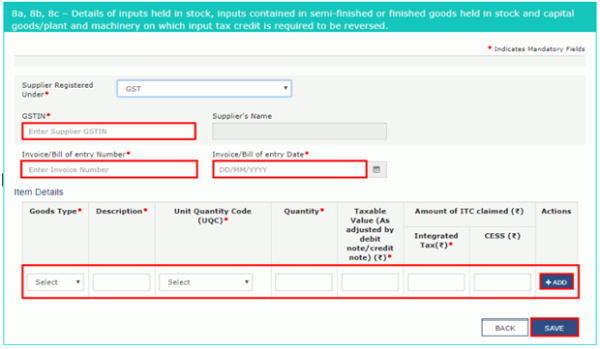

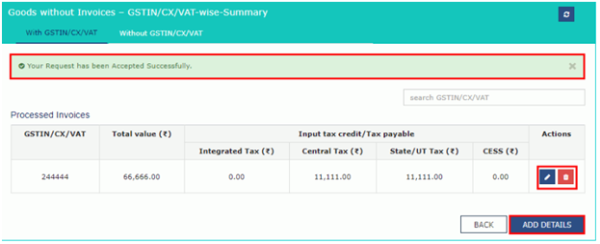

8. Enter the details in 8A, 8B & 8C - Goods Details With Invoices column.

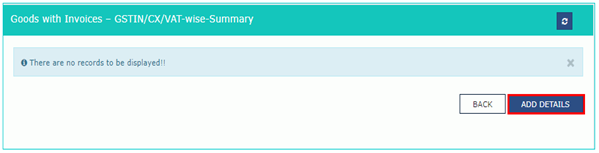

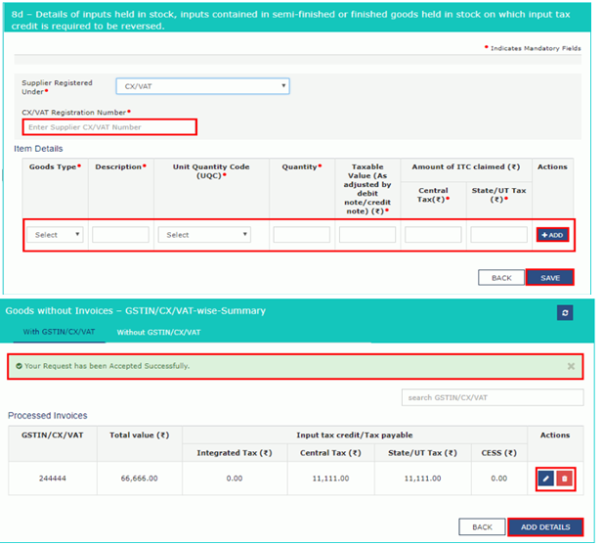

9. Click the ADD DETAILS button.

10. Select the Supplier's Registration, Registered Under (GST/CX/VAT) from the drop-down list.

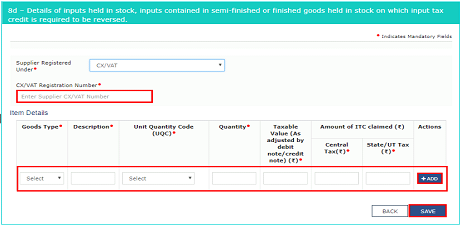

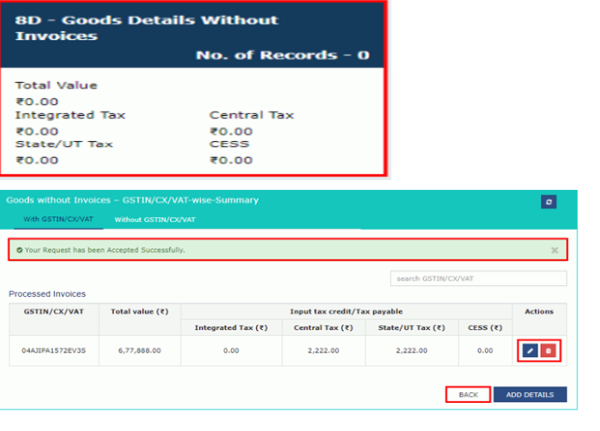

10.1 Enter the details In case of CX/VAT:

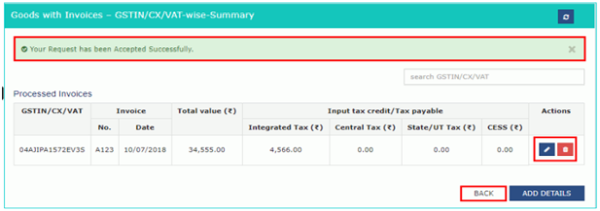

11. Enter the details in 8A, 8B & 8C - Goods Details With Invoices column.

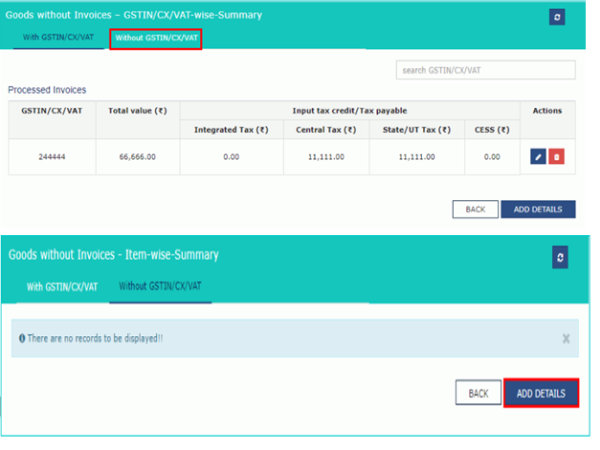

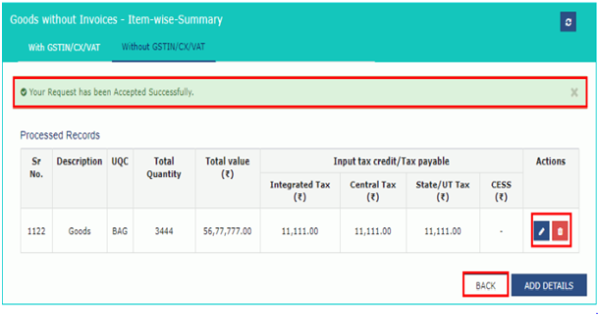

11.1 Enter the details Without GSTIN/CX/VAT Tab:

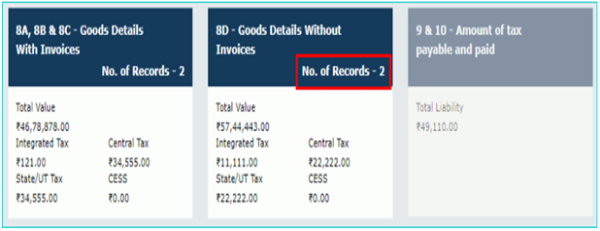

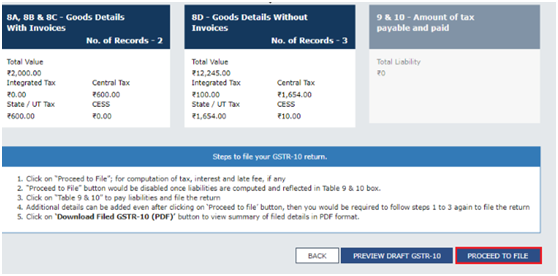

12. Taxpayer will be directed to the GSTR-10 Dashboard page and the 8A, 8B & 8C - Goods Details With Invoices column,8D - Goods Details Without Invoices box in Form GSTR-10 will reflect the total number of records and value of goods.

13. Once the taxpayer entered all the details, click the PREVIEW DRAFT GSTR-10 button. This button will download the draft Summary page of Form GSTR-10 for review. It is recommended that download this Summary page and review the summary of entries made in different sections carefully. The PDF file generated would bear watermark of draft as the details are yet to be filed.

14. After that Click the PROCEED TO FILE button.

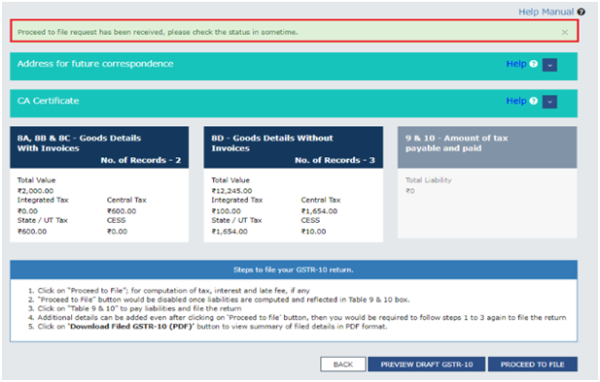

14.1 A message is displayed on top page of the screen that Proceed to file request has been received. Please check the status in sometime. Click the Refresh button.

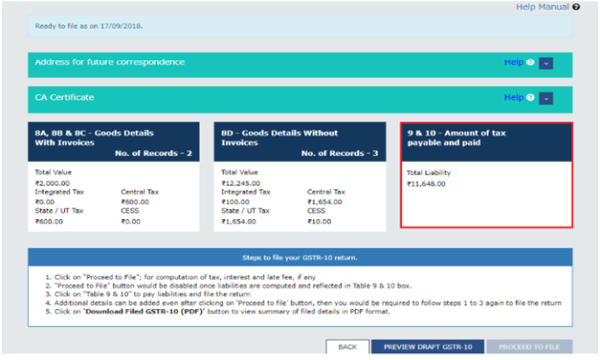

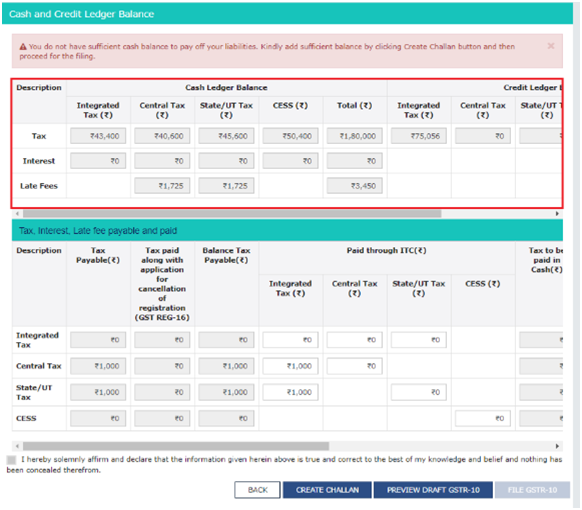

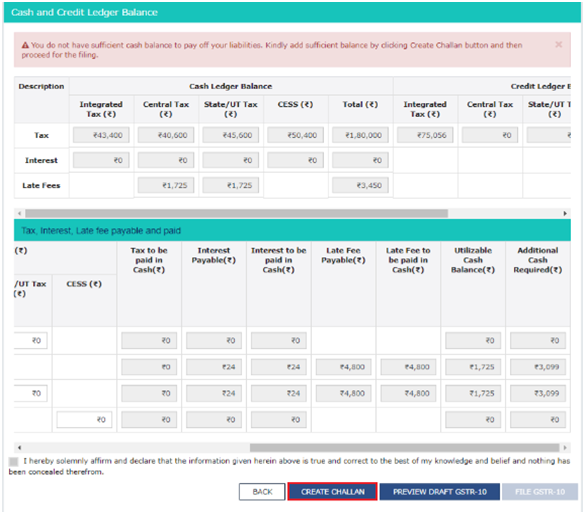

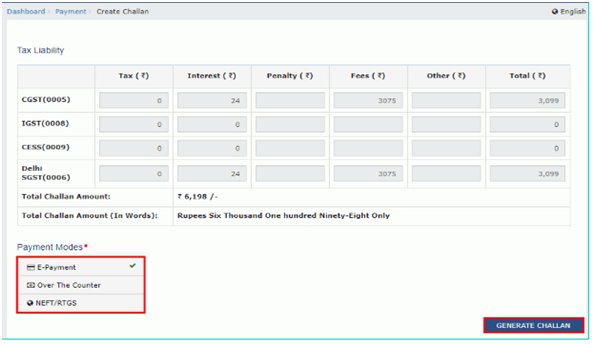

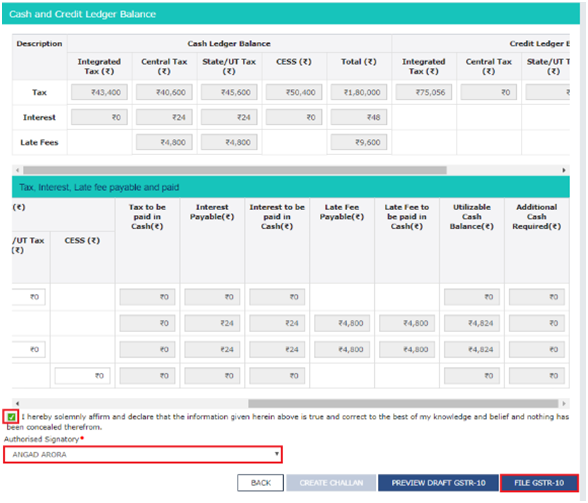

15. Once the status of Form GSTR-10 is Ready to File, 9 & 10 - Amount of tax payable and paid tile gets enabled. Click the 9 & 10 - Amount of tax payable and paid tile.

16. File Form GSTR-10 with DSC/ EVC

Please share your valuable comments and feedback.

The author can also be reached at shashank.kothiyal9@gmail.com.

CAclubindia

CAclubindia