There are literally thousands of companies listed on exchanges in India but there are few companies which are stable when it comes to finances and other financial aspects.

Usually, long-term investors look out for stable companies so that their investments don’t become sour. Companies which can satiate such investors are popularly known as the Blue chip Companies

The name "blue chip" came about from the game of poker in which the blue chips have the highest value. In 1923, Blue Chips was first used to describe high priced stocks but today, blue chip stocks don’t necessarily refer to stocks with a high price tag, but more accurately to stocks of high-quality companies that have withstood with the test of time.

Blue chip Stocks generally cost high, as they have a good reputation and are often market leaders in their respective industries. The stocks are highly liquid since they are frequently traded in the market by individual and institutional investors alike.

Therefore, an investor who needs cash on a whim can confidently create a sell order for his stock knowing that there will always be a buyer on the other end of the transaction. Conservative Investor with a low-risk profile or nearing retirement will usually go for blue-chip stocks. These stocks are great for capital preservation and their consistent dividend payments not only provide income but also protect the portfolio against inflation.

Blue chip stocks are seen as less volatile investments than owning shares in companies without blue chip status because blue chips have an institutional status in the economy.

Blue chip Company is very strong financially, with a solid track record of producing earnings and only a moderate amount of debt. It also has a strong name in its industry with dominant products or services.

Typically, these companies are large (international) corporations that have been in business for many years and are considered to be very stable.

There is no formal requirement for being a blue chip company. Blue chip companies are also characterized as companies having little to no debt, large market capitalization, stable debt-to-equity ratio, and high Return on Equity (ROE) and Return on Assets (ROA). The solid balance sheet fundamentals aligned with high liquidity have earned all blue-chip stocks the investment grade bond ratings.

In his book The Intelligent Investor, Benjamin Graham points out that conservative investors should look for companies that have consistently paid dividends for 20 years or more.

Blue chip Index is an indicator used to measure and report value changes in representative stock groupings. It is often price-weighted; it means that stocks with the highest prices will have the most influence and those with the lowest, the least influence. An investor can track the performance of blue chip stocks through a blue-chip index, which can also be used as an indicator of industry or economy performance and that’s exactly what SENSEX does.

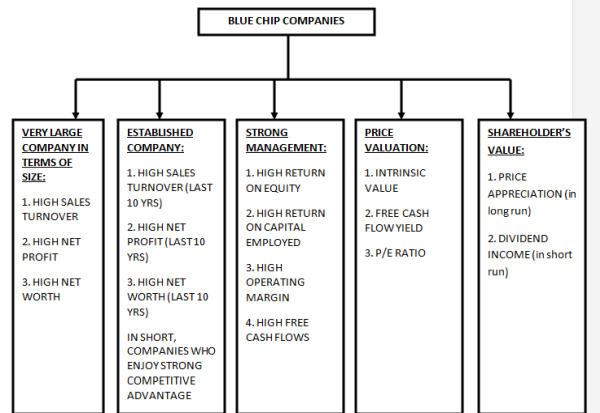

Conclusion: According to my knowledge I have framed 5 parameters through which we can categorize a company into Blue chip Company.

CAclubindia

CAclubindia