The GSTN has introduced the new RFD-01A form for Refund by Supplier of deemed export. In these article we will see the detailed analysis related to the Refund form, Rules and how to file the nil and not a nil refund form online.

Who can file a refund application in case of Deemed Exports supplies:

As per 3rd proviso to Rule 89(1) of CGST Rules, 2017, application for refund in case of deemed exports can either be filed by the recipient of deemed export supplies. Alternatively, the supplier of such deemed exports supplies can also file the refund application, in cases where the recipient does not avail of input tax credit on such supplies and furnishes an undertaking to the effect that the supplier may claim the refund.

Now we will see the online procedure to file the application through the portal.

I. In case of Nil Refund Form

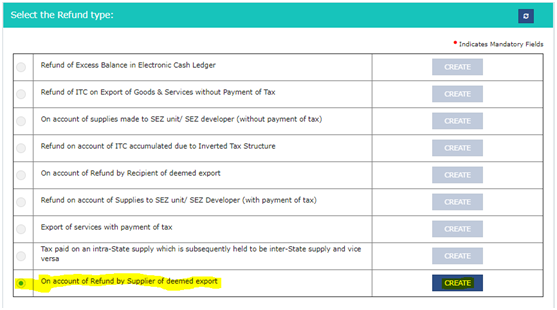

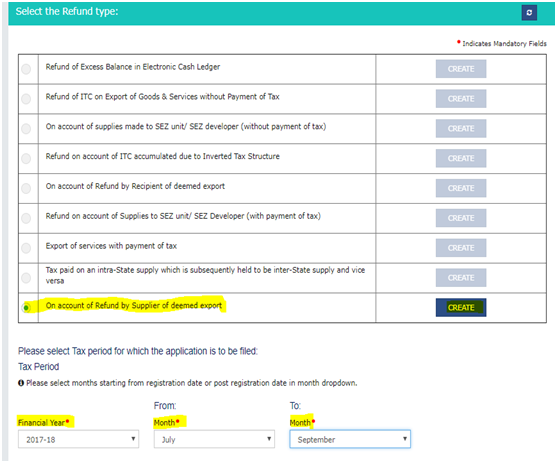

A. Login > Services > Refund > Application for refund type, then click on create tab and select the refund period month or quarter.

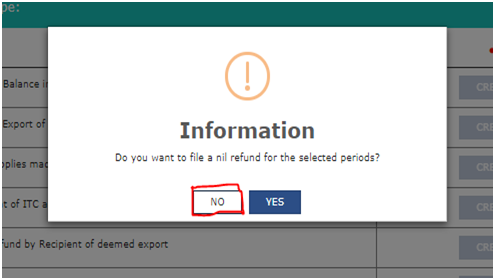

B. After clicking on create tab following screen is visible:

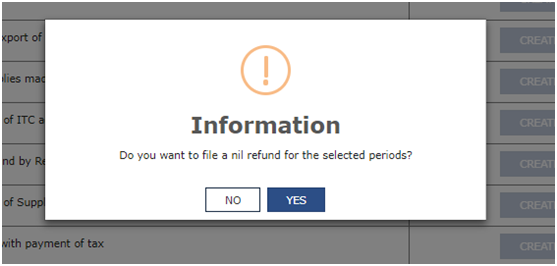

C. After clicking on Yes Button, the following screen is visible:

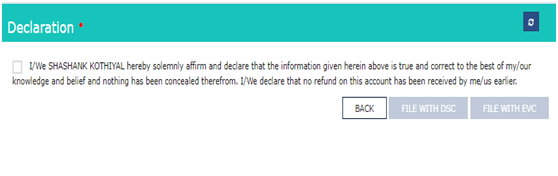

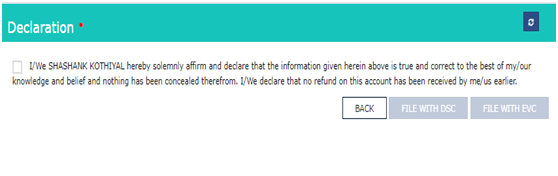

D. Click on the check box and file the Nil Refund form with DSC or EVC.

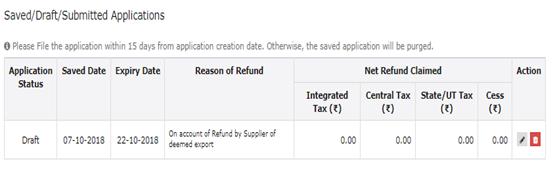

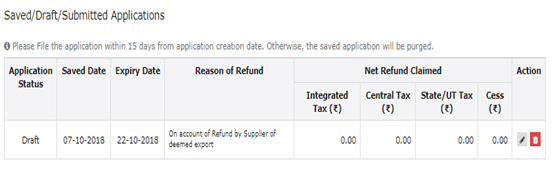

E. After successful filing of Nil Refund Form, the filed refund application can be viewed in Saved/Filed Applications tab:

II. In case of Not a Nil Refund Form

A. Login > Services > Refund > Application for refund type, then click on create tab and select the refund period month or quarter.

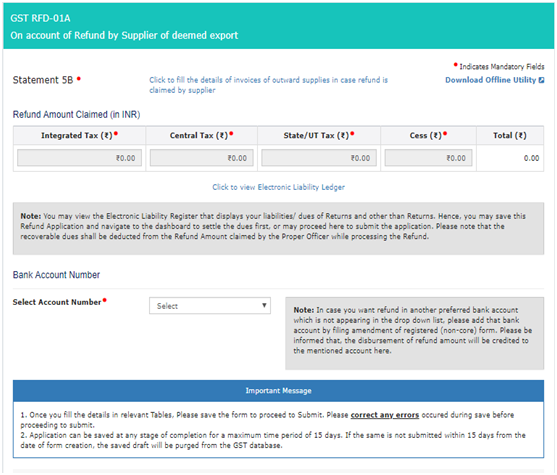

B. Click on create tab, then selecting No the following screen is visible.

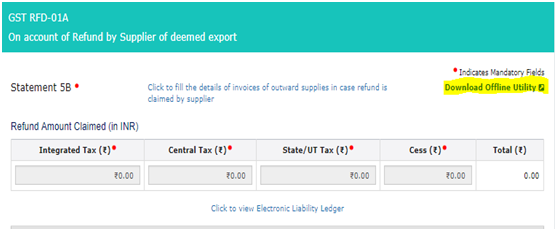

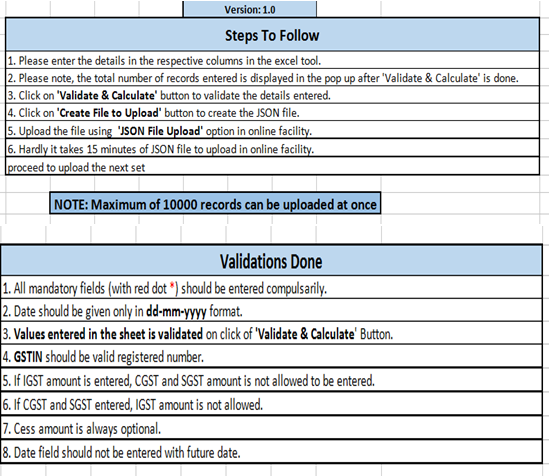

C. Then download the offline utility of Statement-5B.

Then fill the mandatory field in excel utility like:

I. GSTIN.

II. From Return Period & To Return Period.

III. "Details of invoices of outward supplies in case refund is claimed by supplier":

- Invoice No.

- Date (DD-MM-YYYY) Format

- Taxable Value

IV. Tax Paid

- CGST

- SGST

- IGST

- CESS

V. Then click on validate sheet, if any error comes will show in error column.

VI. After successful validation, click on “create file to upload” to create the .json file.

VII. Save the JSON file.

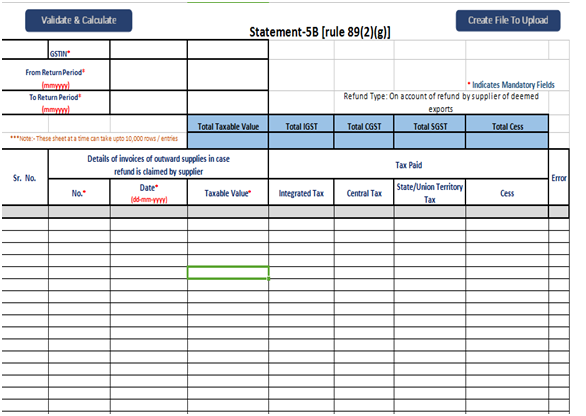

D. Click on “Click to fill the details of invoices of outward supplies in case refund is claimed by supplier” then the following screen is visible, after that click on “Click here to Upload” to upload the json file.

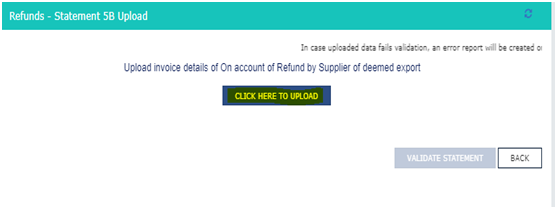

E. After successful uploading then click on “Validate Statement” to validate the sheet.

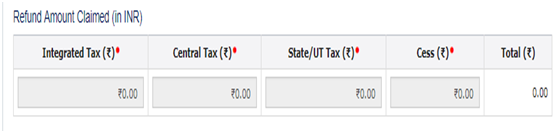

F. After successful validation of sheet, fill the amount in “Refund Amount Claimed (in INR)” under applicable head.

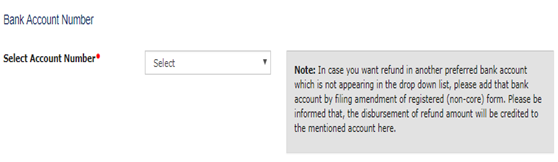

G. After entering the amount then select the “Bank Account No” to get the refund.

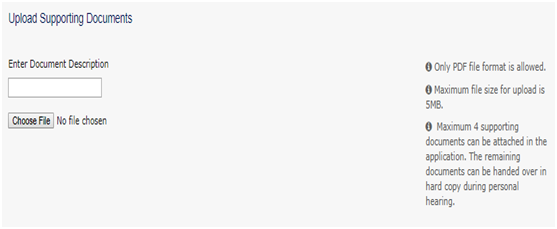

H. Then upload the documents, if any as per Rule 89(2) of CGST Rules,2017.

- Maximum 4 supporting documents can be attached.

- Maximum file size for upload is 5MB.

- If supporting documents is more than 4, then the remaining documents can be handed over in hard copy during personal hearing.

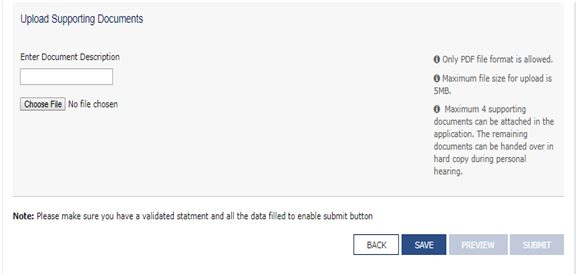

I. After successful uploading of documents, click on save button.

J. After click on save button, if statement is validated and all the data filed then submit button is enabled.

K. Click on Preview button.

L. After preview click on Submit button, the file the Refund form with DSC or EVC.

M. After successful filing of Refund Form, the filed refund application can be viewed in Saved/Filed Applications tab:

CAclubindia

CAclubindia