Abstract

Cryptocurrency, a groundbreaking financial innovation, has witnessed a global surge in popularity. This qualitative research paper delves into the evolution, types, and current position of cryptocurrencies in India. By examining historical developments, various types of cryptocurrencies, and the regulatory landscape in India, this paper seeks to provide a comprehensive understanding of the cryptocurrency ecosystem in the country.

INTRODUCTION

Cryptocurrency is a form of digital or virtual currency that relies on cryptographic techniques for security and operates on decentralized networks using blockchain technology. The blockchain is a distributed ledger that records transactions across a network of computers, ensuring transparency and security. Unlike traditional currencies, cryptocurrencies are not controlled by any central authority, instead relying on consensus mechanisms like mining or proof-of-stake. Cryptography plays a vital role in securing transactions, with users having a public key visible to others and a private key for transaction signing. Various types of cryptocurrencies, such as Bitcoin and Ethereum, use these principles and often incorporate smart contracts, self-executing agreements written in code. The market for cryptocurrencies is characterized by volatility, influenced by factors like market demand, regulatory developments, and technological advancements. Overall, cryptocurrencies have introduced a paradigm shift in finance, providing a decentralized and innovative approach to digital transactions and applications.

EVOLUTION OF CRYPTOCURRENCY

The evolution of cryptocurrency has been a remarkable journey marked by key milestones and technological advancements.

- Inception - Bitcoin (2009): The cryptocurrency story begins with the creation of Bitcoin in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto. Bitcoin introduced the concept of a decentralized, peer-to-peer electronic cash system based on blockchain technology. The groundbreaking feature of Bitcoin was its use of a proof-of-work consensus algorithm, allowing participants (miners) to validate transactions and secure the network.

- Altcoins and Variations (2011-2013): As the popularity of Bitcoin grew, alternative cryptocurrencies, often referred to as "altcoins," emerged. Litecoin, introduced in 2011 by Charlie Lee, was among the early altcoins, offering faster transaction confirmation times. Other altcoins like Namecoin and Peercoin introduced variations in blockchain technology, exploring new use cases and consensus mechanisms.

- Ethereum and Smart Contracts (2015): Ethereum, proposed by Vitalik Buterin in 2013 and launched in 2015, represented a significant evolution in the cryptocurrency space. Ethereum introduced the concept of "smart contracts," self-executing contracts with programmable conditions. This allowed developers to build decentralized applications (DApps) on the Ethereum blockchain, expanding the potential use cases beyond simple transactions.

- ICO Boom (2017): The Initial Coin Offering (ICO) boom in 2017 marked a period of fundraising for new cryptocurrency projects. Companies raised capital by issuing their own tokens on existing blockchain platforms, primarily Ethereum. While ICOs provided a novel way for startups to secure funding, it also led to concerns about regulatory compliance and the legitimacy of some projects.

- Rise of Decentralized Finance (DeFi) (2019-2020): Decentralized Finance, or DeFi, gained prominence as a movement aiming to recreate traditional financial instruments such as lending, borrowing, and trading on blockchain networks. DeFi platforms, often built on Ethereum, introduced protocols like decentralized exchanges (DEX), liquidity pools, and yield farming, enabling users to participate in financial activities without intermediaries.

- NFTs and Tokenization (2021-2022): Non-Fungible Tokens (NFTs) gained widespread attention, representing unique digital assets on the blockchain. NFTs are used to tokenize digital art, collectibles, and other unique items, providing provenance and ownership verification. The surge in NFT popularity highlighted the potential for blockchain technology beyond financial applications.

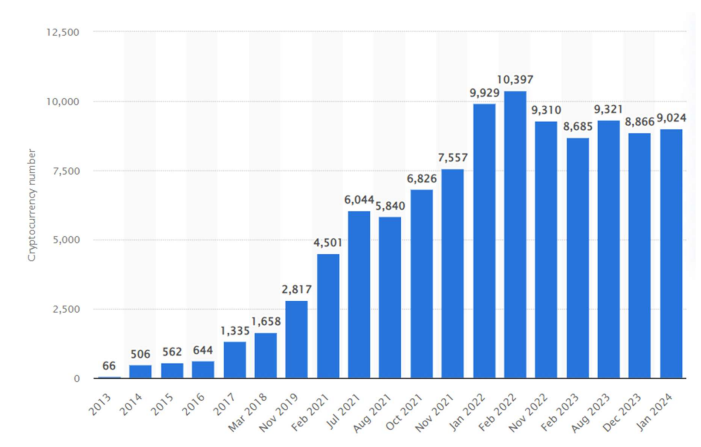

NUMBER OF CRYPTOCURRENCIES WORLDWIDE FROM 2013 TO JANUARY 2024

Best (2024) says that there were over 9,000 number of cryptocurrencies as of 2023, although there were many more digital coins in the early months of 2022. There are other estimates of roughly 20,000 cryptocurrencies being in existence, but most of these are either inactive or discontinued. Indeed, the top 20 cryptocurrencies make up nearly 90 percent of the total market.

Source: https://www.statista.com/statistics/863917/number-crypto-coins-tokens/

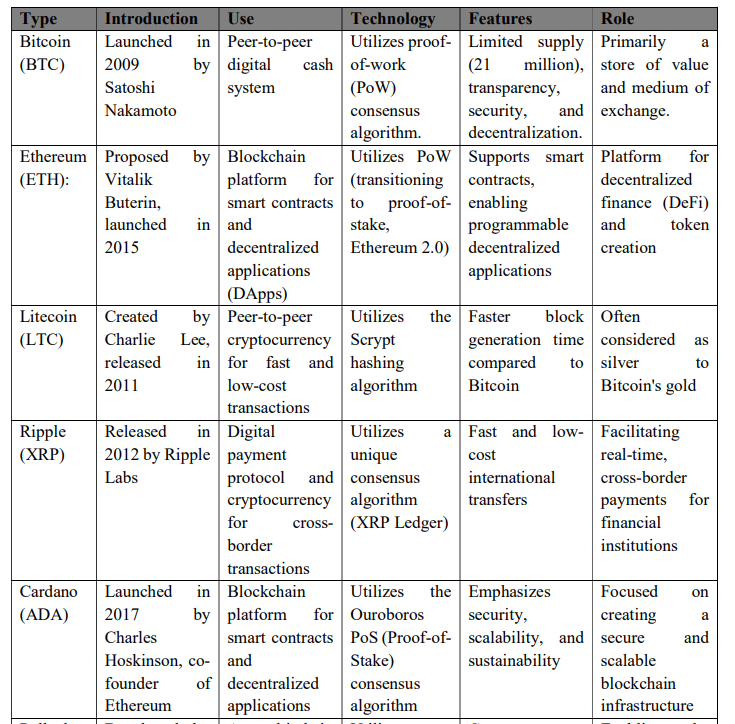

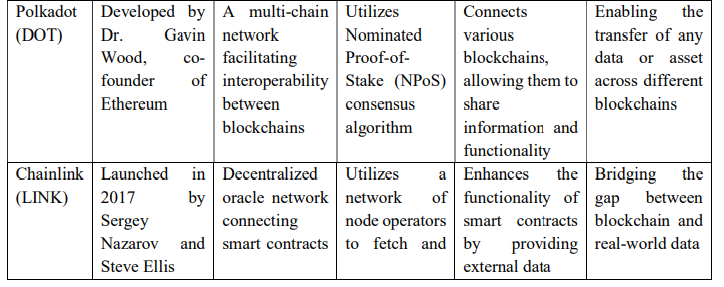

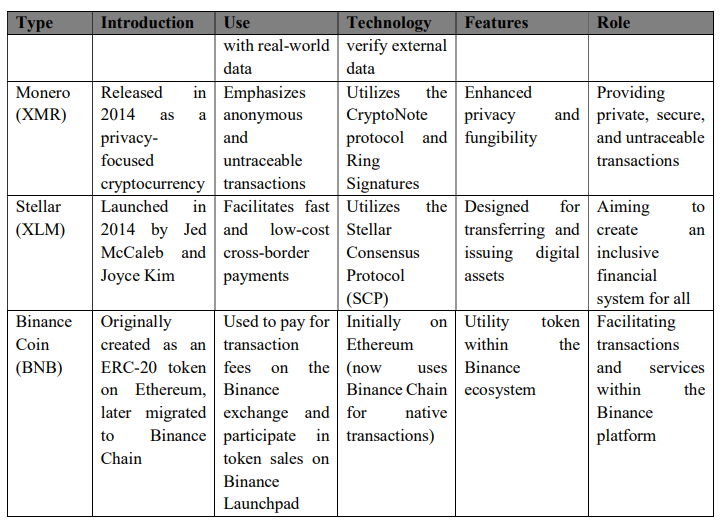

TYPES OF CRYPTOCURRENCIES

Table 1: Various Types of Cryptocurrencies

Table 1: Various Types of Cryptocurrencies

REGULATORY LANDSCAPE IN INDIA

The regulatory landscape for cryptocurrencies in India has been subject to ongoing developments and discussions.

Initial Caution (2013-2017)

During this period, Indian authorities expressed concerns about the potential risks associated with cryptocurrencies, including money laundering and fraud. The Reserve Bank of India (RBI) issued advisories, cautioning users about the risks of trading in virtual currencies.

RBI's Circular (2018)

In April 2018, the RBI issued a circular that prohibited banks and financial institutions from providing services related to virtual currencies. This circular adversely affected the cryptocurrency ecosystem in India, leading to the closure of several cryptocurrency exchanges or their relocation to more favorable jurisdictions.

Inter-Ministerial Committee (2019)

In 2019, an inter-ministerial committee, headed by Subhash Chandra Garg, submitted a draft bill to regulate cryptocurrencies.

The draft bill, titled "Banning of Cryptocurrency and Regulation of Official Digital Currency Bill," proposed a complete ban on the use of cryptocurrencies in India while allowing the creation of a central bank-backed digital currency.

Supreme Court Lifts Ban (2020)

In March 2020, the Supreme Court of India lifted the banking ban imposed by the RBI, deeming it unconstitutional. This decision provided a significant boost to the cryptocurrency industry in India, allowing exchanges to resume operations with the support of traditional banking services.

Regulatory Uncertainty (2020-2021)

Despite the Supreme Court's decision, regulatory uncertainty persisted as the government delayed the introduction of cryptocurrency regulations. Reports suggested that the government was considering a more balanced approach, exploring the potential for regulating cryptocurrencies rather than enforcing an outright ban. In 2021, there were indications that the Indian government was considering consultations with stakeholders, including industry participants and experts, to form a comprehensive regulatory framework. Several discussions and webinars took place to gather inputs from the cryptocurrency community and address concerns.

Crypto Bill Developments (2022)

The narrative took another turn in 2022 when the government announced a 30% tax on gains from cryptocurrencies and a 1% Tax Deducted at Source (TDS) on all cryptocurrency transactions during the Union Budget. This move signaled the government's intent to regulate, rather than prohibit, cryptocurrencies.

In early 2022, reports suggested that the Indian government was actively working on a new cryptocurrency bill. The bill seeks to create a favorable structure for the creation of the official digital currency that will be issued by the Reserve Bank of India (RBI). As of February 2022, the

cryptocurrency bill has not been approved by Lok Sabha, India's parliament, meaning the legislative status of cryptocurrencies in the country remains unclear. The proposal of this bill, however, indicates a shift in the government's approach towards cryptocurrencies – from viewing them with skepticism to considering them as part of the financial ecosystem that needs regulation.

CENTRAL BANK DIGITAL CURRENCY (CBDC)

RBI has been a consistent proponent of creating India's CBDC called the e-Rupee, a vision now realized with the successful initiation of the Rupee CBDC pilot. This endeavor is bolstered by an enabling legal framework, achieved through amendments to the Reserve Bank of India Act, 1934. It has broadened the definition of "bank note" to encompass bank notes issued by RBI in both physical and digital forms, paving the way for RBI to issue its own CBDC.

Currently, 10 banks are participating in the wholesale CBDC pilot, and 13 banks are part of the retail pilot. Both of these initiatives have demonstrated promising results, allowing for the testing of various technical architectures, design choices, and use cases. As of 30th June 2023, the retail pilot had exceeded 1 million users and more than 262,000 merchants, underscoring the potential of this digital form of currency to spur innovation and efficiency.

CHALLENGES

The major challenges and their impact on economy is underlined as below in Table 2. Table 2: Major Challenges and their Impact

|

Basis |

Challenge |

Impact |

|

Regulatory Uncertainty |

Many countries, including India, have faced regulatory uncertainty around cryptocurrencies. Lack of clear guidelines and varying regulatory approaches can hinder mainstream adoption and create an uncertain business environment. |

Businesses and investors may face difficulties navigating the legal landscape, leading to reluctance in embracing cryptocurrency. |

|

Security Concerns |

Cryptocurrency exchanges and wallets are vulnerable to hacking and security breaches. High-profile incidents have resulted in significant financial losses and damaged the reputation of the industry. |

Users may be hesitant to adopt cryptocurrencies due to concerns about the safety of their funds and personal information. |

|

Volatility |

Cryptocurrency prices are highly volatile, leading to potential rapid gains but also substantial losses. This volatility can be a barrier for risk-averse investors and may limit the use of cryptocurrencies as a stable medium of exchange. |

Merchants may be hesitant to accept cryptocurrencies for goods and services due to concerns about price fluctuations. |

|

Perception and Awareness |

Cryptocurrencies are often associated with illicit activities, and there is a lack of understanding among the general public about how they work. Negative perceptions can lead to regulatory scrutiny and public distrust. |

Widespread adoption may be hindered as potential users and businesses remain cautious about engaging with cryptocurrencies. |

|

Scalability |

Some blockchain networks face scalability issues, resulting in slow transaction speeds and high fees during periods of high demand. This can limit the efficiency of certain cryptocurrencies for everyday transactions. |

Cryptocurrencies may struggle to compete with traditional payment systems that offer faster and more scalable solutions. |

OPPORTUNITIES

The major opportunities and their impact on economy is underlined as below in Table 3. Table 3: Major Opportunities and their Impact

|

Basis |

Opportunity |

Impact |

|

Financial Inclusion |

Cryptocurrencies have the potential to provide financial services to the unbanked and underbanked populations. Decentralized finance (DeFi) platforms can offer services such as lending, borrowing, and earning interest without traditional intermediaries. |

Increased financial inclusion can empower individuals who lack access to traditional banking services. |

|

Innovation and Decentralization |

Blockchain technology enables innovative applications beyond cryptocurrencies, including smart contracts, decentralized applications (DApps), and non-fungible tokens (NFTs). These technologies have the potential to revolutionize various industries. |

Increased innovation can lead to the creation of more efficient and transparent systems, disrupting traditional business models. |

|

Global Transactions |

Cryptocurrencies facilitate borderless transactions, enabling individuals and businesses to engage in international trade without the need for traditional financial intermediaries. This can reduce costs and enhance efficiency. |

Streamlined cross-border transactions can benefit global commerce and financial inclusion. |

|

Ownership and Control |

Cryptocurrencies provide individuals with greater control and ownership of their assets. Private keys and self-custody solutions empower users to manage their funds independently. |

Increased ownership and control can attract users who value financial autonomy and privacy. |

|

Technological Advancements |

Ongoing advancements in blockchain technology, such as Ethereum 2.0, aim to address scalability issues and improve the overall efficiency of blockchain networks. |

Enhanced technology can lead to more widespread adoption as cryptocurrencies become more practical for everyday use. |

FUTURE OUTLOOK

Predicting the future outlook of cryptocurrency in India involves considering ongoing developments, regulatory changes, technological advancements, and market trends. Following is an overview of potential trends in the future of cryptocurrency in India.

Regulatory Clarity

The future outlook may be significantly influenced by regulatory developments. If India establishes clear and supportive regulations for cryptocurrencies, it could lead to increased adoption, investor confidence, and the development of a robust crypto ecosystem.

Institutional Participation

Increased involvement of institutional players, such as banks, financial institutions, and large corporations, can bring legitimacy to the cryptocurrency market. Institutional adoption could result in more sophisticated financial products and services related to cryptocurrencies.

Digital Rupee or Central Bank Digital Currency (CBDC)

The Reserve Bank of India (RBI) has been exploring the possibility of introducing a digital rupee. The launch of a CBDC could provide a government-backed digital currency, potentially influencing the adoption of cryptocurrencies in the country.

Integration with Traditional Finance

Cryptocurrencies may become more integrated with traditional financial systems through partnerships and collaborations. This integration could lead to greater interoperability between fiat currencies and digital assets.

Blockchain Technology Applications

Beyond cryptocurrencies, the adoption of blockchain technology in various sectors, including supply chain, healthcare, and governance, may increase. Governments and businesses might explore blockchain solutions for improved transparency, efficiency, and security.

Increased Awareness and Education

As understanding of cryptocurrencies and blockchain technology improves, there may be a broader acceptance of these innovations. Increased awareness can contribute to a more favorable environment for adoption among both individuals and businesses.

Evolution of Decentralized Finance (DeFi)

The growth of DeFi protocols and applications could continue, providing alternative financial services such as lending, borrowing, and decentralized exchanges. The development of DeFi projects may contribute to the financial inclusion of previously underserved populations.

Technological Advancements

Continued advancements in blockchain technology, including scalability improvements and enhanced security measures, could address current challenges and make cryptocurrencies more user-friendly and efficient.

Global Trends Impacting India

Global trends, such as the acceptance of cryptocurrencies by major economies or international regulatory standards, could influence India's approach and impact the future adoption and use of cryptocurrencies.

Market Innovation and Diversification

Ongoing innovation in the crypto space, including the development of new tokens, decentralized applications, and financial instruments, could diversify the market and attract a wider range of users.

CONCLUSION

In conclusion, the evolution of cryptocurrency has witnessed remarkable milestones, transforming the financial landscape and introducing innovative paradigms. Cryptocurrencies, built on the foundation of blockchain technology, offer decentralized and secure transactions, challenging traditional financial systems. From the inception of Bitcoin in 2009 to the rise of decentralized finance (DeFi) and the emergence of non-fungible tokens (NFTs), the crypto space has constantly evolved. Despite challenges like regulatory uncertainty, security concerns, and market volatility, opportunities for financial inclusion, innovation, and global transactions have emerged.

The regulatory landscape in India has undergone significant shifts, reflecting the government's evolving stance. The recent developments, including the proposed cryptocurrency bill and the

initiation of the Central Bank Digital Currency (CBDC) pilot, indicate a nuanced approach toward regulation rather than an outright ban. Challenges such as regulatory uncertainty, security issues, and volatility must be addressed for widespread adoption. However, opportunities for financial inclusion, technological advancements, and global transactions can reshape the crypto ecosystem positively.

Looking ahead, the future outlook for cryptocurrency in India hinges on regulatory clarity, institutional participation, the integration of traditional finance, and advancements in blockchain technology. The potential launch of the digital rupee and increased awareness and education are factors that could shape the trajectory of cryptocurrency adoption. As the global landscape influences India's approach, ongoing market innovation and diversification may play a crucial role in determining the future of cryptocurrencies in the country. Overall, the dynamic nature of the crypto space suggests continued evolution and adaptation to meet the challenges and opportunities on the horizon.

REFERENCES

- Auer, R., Cornelli, G., and Frost, J. (2020), "Rise of the Central Bank Digital Currencies: Drivers, Approaches and Technologies", Available at: https://www.bis.org/publ/work880.pdf.

- Aysan A.F., Khan A.U.I., Topuz H. (2021), "Bitcoin and Altcoins Price Dependency: Resilience and Portfolio Allocation in COVID-19 Outbreak", Risks, 9(4):74. https://doi.org/10.3390/risks9040074

- Best, R. (2024), "Number of cryptocurrencies worldwide from 2013 to January 2024", Available at: https://www.statista.com/statistics/863917/number-crypto-coins-tokens/

- Collins, J. (2022), "Crypto, Crime and Control", Available at: https://globalinitiative.net/wp- content/uploads/2022/06/GITOC-Crypto-crime-and-control-Cryptocurrencies-as-an-enabler- of-organized-crime.pdf

- Grant, T. (2023), "Cryptocurrency", Available at: https://www.britannica.com/money/topic/cryptocurrency

- Jaikaran, C. (2018), "Beyond Bitcoin: Emerging Applications for Blockchain Technology", Available at: https://crsreports.congress.gov/product/pdf/TE/TE10025

- Kaur, J. (2023), "Central Bank Digital Currency - The Digital Rupee in India", Economic and Political Weekly, Vol. 58 (1), Available at: https://www.epw.in/engage/article/central-bank- digital-currency-%E2%80%98digital-rupee%E2%80%99

- Nakamoto, S. (2009), "Bitcoin: A Peer-to-Peer Electronic Cash System", Cryptography Mailing list at https://metzdowd.com.

- Press Release by Ministry of Finance, (2022), "Introduction of Central Bank Digital Currency 'Digital Rupee' Announced", Available at: https://pib.gov.in/PressReleasePage.aspx?PRID=1794160

- Rashmi (2023), "Metamorphosis of Money: Unveiling the Multi-Faceted Realm of Digital Currency" Chapter in ISBN edited book titled RESEARCH TRENDS IN MULTIDISCIPLINARY APPROACH – THE COLLECTIVE under Vaagdevi publishers, Hyderabad, ISBN: 978-81-966358-4-8.

- Weichbroth, P., Wereszko, K., Anacka, H., Kowal, J. (2023), "Security of Cryptocurrencies: A View on the State-of-the-Art Research and Current Developments", Sensors, 23, 3155. https://doi.org/10.3390/s23063155

- Wendl, M., Doan, M.H. and Sassen, R. (2023), " The Environmental Impact of Cryptocurrencies using Proof of Work and Proof of Stake Consensus Algorithms: A Systematic Review", Journal of Environmental Management, 326(A), 116530, https://doi.org/10.1016/j.jenvman.2022.116530

- Zetzsche, D.A., Arner, D.W., Buckley, R.P. (2020), "Decentralized Finance", Journal of Financial Regulation, 6(2), p.172-203. https://doi.org/10.1093/ifr/fjaa010

Websites:

- https://complyadvantage.com/insights/cryptocurrency-regulations-around-world/

- https://www.globallegalinsights.com/practice-areas/blockchain-laws-and-regulations/india

- https://www.imf.org/en/Publications/fandd/issues/2022/09/Regulating-crypto-Narain-Moretti

- https://1finance.co.in/blog/the-evolving-regulatory-framework-for-cryptocurrency/

CAclubindia

CAclubindia