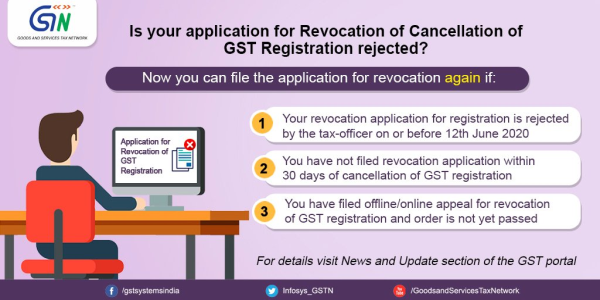

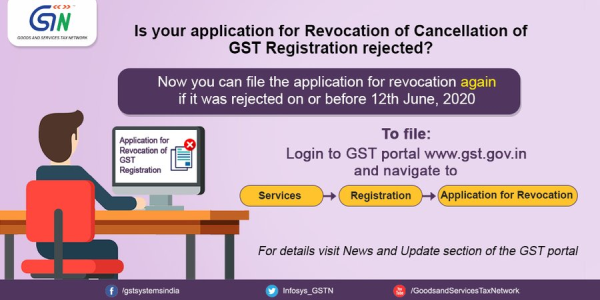

The GST Portal has notified that the functionality to file a revocation application for cancellation of GST Registration has now been made available on the GST Portal. If the tax officer had rejected your application on or before the 12th of June, 2020 the application can now be filed again on the portal. Here is the updated as hosted on the GST Portal.

Functionality to file Revocation Application under Removal of Difficulty

In view of the Removal of Difficulty Order No. 01/2020 dated 25.06.2020, the restriction on filing revocation application, in case it was rejected, has been removed. Aggrieved taxpayers can file application for revocation of cancellation of registration once again.

Further, those taxpayer who have filed Appeal against rejection of the Revocation Application and the decision is still pending, they may also file the Revocation of Cancellation.

Taxpayer is required to login and navigate to Services> Registration> Application for Revocation to file the application for revocation.

Also Read:

40 FAQs on filing GSTR-4 Annual Return using an offline utility

CAclubindia

CAclubindia