Others News

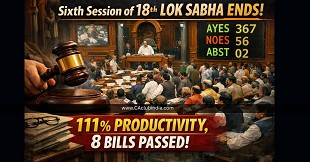

Sixth Session of 18th Lok Sabha Ends with 111% Productivity, 8 Bills Passed

23 December 2025 at 06:38Sixth Session of 18th Lok Sabha concludes with 111% productivity. 15 sittings, 8 bills passed, major debates on Vande Mataram and electoral reforms.

Parliament Enacts Health Security se National Security Cess Act to Fund Security, Public Health

19 December 2025 at 07:01Parliament has enacted the Health Security se National Security Cess Act, 2025, introducing a machine-based cess on specified goods to fund national security and public health.

MoCA directs IndiGo to clear refunds, regulates airfare amid operational disruption

08 December 2025 at 06:37The Ministry of Civil Aviation issues strict directives to IndiGo to clear all pending refunds, cap airfares, and protect passengers amid operational disruptions. Full details on refunds, fare regulation and passenger support.

RBI Cuts Penal Interest on CRR, SLR Shortfalls as Bank Rate Reduced to 5.50%

08 December 2025 at 06:37RBI's latest circular reduces penal interest on CRR and SLR shortfalls following a 25 bps cut in the Bank Rate to 5.50%. The revised rates now stand at 8.50% and 10.50%.

RBI Brings Repo Rate Down to 5.25% Amid Falling Inflation

08 December 2025 at 06:37RBI has cut the repo rate by 25 bps to 5.25% in the December 2025 MPC meeting, citing easing inflation and stable growth. The SDF stands at 5.00% and MSF/Bank Rate at 5.50%.

FDI Policy Under Ongoing Review to Enhance India's Global Investment Appeal

04 December 2025 at 06:59FDI Policy Under Continuous Review to Maintain India's Attractiveness as an Investment Destination

Centre Introduces Health Security Se National Security Cess Bill 2025

02 December 2025 at 06:45The Centre has introduced the Health Security & National Security Cess Bill, 2025 to fund emergency health and national safety measures. Learn key provisions, cess structure, exemptions, and expected impact.

President Droupadi Murmu Summons Winter Session of Parliament from December 1, 2025

12 November 2025 at 06:36President Droupadi Murmu has summoned both Houses of Parliament, Lok Sabha and Rajya Sabha, to convene for the Winter Session in New Delhi on December 1, 2025, at 11 AM, as per official Gazette notifications issued on November 8, 2025.

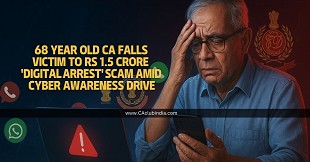

68 Year Old CA Falls Victim to Rs 1.5 Crore 'Digital Arrest' Scam Amid Cyber Awareness Drive

10 November 2025 at 06:33A 68-year-old Chartered Accountant in Odisha lost Rs 1.5 crore to cyber fraudsters posing as ED and CBI officers, keeping him under a 10-day "digital arrest."

CAT Cuttack Imposes Rs 20,000 Cost on CBIC Officer for Non-Compliance in Suspension Case

05 November 2025 at 06:30CAT, Cuttack, has imposed a Rs 20,000 cost on a CBIC officer for non-compliance in the suspension case of Deepak Niranjan Nath Pandit, directing submission of a full compliance report or personal appearance on December 11, 2025.

Popular News

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Draft Form 124 Proposes Mandatory Disclosure of Relationship With Landlord for HRA Claims

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

- MCA Launches Companies Compliance Facilitation Scheme 2026 with Major Relief on Late Filing Fees

- ICAI Reprimands CA for Filing Unsigned Financial Statements with MCA in AOC-4

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia