accountant

45 Points

Joined August 2011

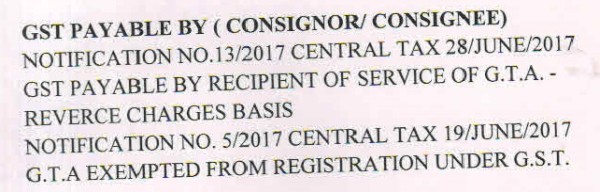

Sir I saw it later that he is an unregistered company (He claimed that he is supplying his service to the registered dealer only & not excessing the threshold limit - as i saw his notification no - 5/2017 central tax 19 June 2017) providing his transport service by providing vehicles on rent.

I am also getting his services that's why I asked my first query.

Practically he is just giving me 8 days bill on his letter head and attached summary with it. is it enough to fulfill the requirement of consignment note?

he is directly showing Rs 12000/- per day on his bill/letter head.