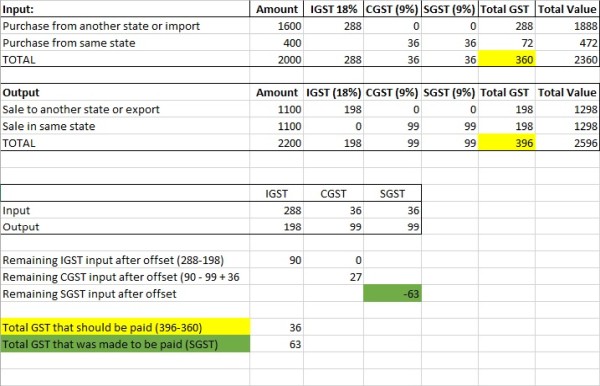

We have been facing this issue since past few months now and decided to seek some help from this forum. Our CGST input remains unutilized and we have to pay SGST every month. So basically we are paying surplus GST and as far as I know, there is no provision of refund of this amount. In the below attached example, the total GST that should be paid is 36 but we pay 63 and CGST of 27 is in our CGST ledger which we cannot use or claim. Can someone please suggest a solution? Thanks.

CAclubindia

CAclubindia