Income Tax News

IT Department Issues Notices to Salaried Taxpayers Over 'Unrealistic' Exemption Claims in ITRs

25 April 2025 at 08:40The Income Tax Department has issued a wave of notices to salaried taxpayers since the beginning of the financial year, flagging "unrealistic" exemption claims made in their income tax returns (ITRs), according to official sources.

Luxury Items Over Rs 10 Lakh to Attract TCS - Key FAQs Issued

24 April 2025 at 09:07CBDT Notifies Luxury Items for TCS - FAQs on Section 206C(1F) Update

CBDT Rules Out Tax Relief for Penalty Settlements in SEBI, Competition Law Violations

24 April 2025 at 08:43CBDT has issued a crucial notification clarifying that any expenditure incurred by businesses to settle proceedings related to violations under key financial and competition laws will not qualify as deductible business expenses under the IT Act, 1961.

CBDT Amends Form 27EQ: TCS Now Applicable on Luxury Goods and Collectibles

23 April 2025 at 08:57In a move aimed at expanding the tax base and ensuring better traceability of high-value transactions, the Central Board of Direct Taxes (CBDT) has issued a notification amending the Income-tax Rules, 1962.

Form 10AB Filing Activated: Charitable Trusts Can Now Seek Section 12A Relief

21 April 2025 at 08:26In a significant relief to charitable and religious institutions, the Income Tax Department has now enabled the filing of condonation requests through Form 10AB on the e-filing portal.

Income Tax Dept Clarifies Tax Exemption Rules for DPIIT-Recognised Startups

21 April 2025 at 08:25In a significant clarification aimed at fostering ease of doing business, the Income Tax Department on Friday reiterated that DPIIT-recognised startups are eligible for multiple tax exemptions

Income Tax Dept Probes Startups on Foreign Funds from Singapore

19 April 2025 at 07:22In a significant move that could impact India's thriving startup ecosystem, the Income Tax Department has issued show cause notices to multiple startups regarding foreign investments routed through Singapore over the past five years.

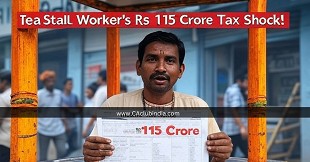

Tea Stall Worker in Gujarat Shocked After Receiving Rs 115 Crore Income Tax Notice

19 April 2025 at 07:22As the financial year nears its end and salaried professionals across India gear up for tax filings, an unusual and baffling incident has emerged from Gujarat. ..

Lok Sabha Panel Reviews Income Tax Bill 2025 Ahead of Monsoon Session

18 April 2025 at 08:41The Select Committee of the Lok Sabha on the proposed Income-Tax Bill, 2025 convened a crucial meeting today at Parliament House, New Delhi. Chaired by BJP Member of Parliament Baijayant Panda, the 31-member panel is actively reviewing the draft legi

Nagpur Man Slapped with Rs 314 Crore Tax Notice in Rs 560 Crore Hawala Scam Probe

18 April 2025 at 08:27In a bizarre twist of events, Chandrashekhar Kohad, a petty contractor originally from Nagpur and currently living in Multai, Madhya Pradesh, has been served a staggering Rs 314 crore income tax demand - an amount he says he cannot even comprehend.

Popular News

- CBDT to Replace Forms 3CA, 3CB & 3CD with Consolidated Form 26

- Exceptions for Cash Payments Above Rs 10,000 under Rule 26 of Draft IT Rules 2026

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

- Draft Income Tax Rules, 2026 Released: Major Changes in Capital Gains, Perquisites and Non-Resident Taxation

- CBDT Proposes New Form 130 for TDS on Salary, Pension and Interest Income Under IT Act

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia