CAclubindia News

GST Rationalisation to Boost MSMEs, Exports and Consumer Welfare

06 September 2025 at 09:34GST rationalisation lowers costs, eases refunds for low-value e-commerce exports, supports MSMEs, fixes inverted duty structures, and boosts competitiveness.

GST Reforms: Cigarettes to Cost More, But Bidi Prices Cut to Protect Industry

06 September 2025 at 09:28GST reforms make cigarettes costlier at 40% tax, while bidi GST cut to 18% aims to protect jobs of 70 lakh workers, sparking debate on health and politics.

CBIC Confident of Smooth Transition to Next-Gen GST by September 22, Says Chairman

06 September 2025 at 09:24CBIC Chairman says next-gen GST rollout from Sept 22 will be glitch-free, with lower tax slabs, ITC flexibility, and festive season boost to demand.

CBIC Refutes Reports of 18% GST on Caramel Popcorn

06 September 2025 at 09:20CBIC clarifies GST on popcorn: both salted and caramel varieties will attract 5% tax under new rates, refuting earlier reports of 18% GST on caramel popcorn.

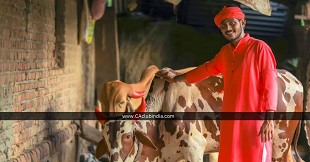

NextGen GST Reforms to Benefit Dairy Farmers and Rural Economy: PM

06 September 2025 at 09:10PM says NextGen GST reforms will empower dairy farmers, make products affordable, and boost rural economy by strengthening India’s dairy sector.

GST Rationalization Boosts Dairy Sector, Most Products Now at Nil or 5%

06 September 2025 at 09:02GST Council rationalizes rates for dairy sector; most products now taxed at Nil or 5%, boosting affordability, demand, and farmer income.

ICAI Confirms September 2025 CA Exams to Be Held as Scheduled

06 September 2025 at 08:53ICAI confirms CA Examinations September 2025 will be held as per notified schedule. Students must follow timetable and check updates on www.icai.org

GSTN Enables GST Payments via UPI and Debit/Credit Cards Across 24 States

05 September 2025 at 09:46GSTN introduces GST payment via UPI and Debit/Credit Cards across 24 States, including Delhi, Maharashtra and Mizoram, making tax compliance faster and easier.

GSTN Adds DBS Bank India as Authorized Partner for GST Payments

05 September 2025 at 09:42GSTN adds DBS Bank India as an authorized bank for GST payments, raising the total to 32. Taxpayers can now use DBS for Net Banking and OTC payments, boosting convenience and compliance.

CBDT Issues Corrigenda to Income Tax Act, 2025

05 September 2025 at 09:36The Ministry of Law & Justice issues corrigenda to the Income-tax Act, 2025, correcting typographical errors and replacing "previous year" with "tax year," ensuring accuracy ahead of its April 1, 2026 rollout.

Popular News

- Exceptions for Cash Payments Above Rs 10,000 under Rule 26 of Draft IT Rules 2026

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Provident Fund Contributions Above Threshold? Here's How Rule 277 Taxes Interest

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

- Draft Form 124 Proposes Mandatory Disclosure of Relationship With Landlord for HRA Claims

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia